Sugar Taxes Back on the Menu

At least four states—Connecticut, Hawaii, New York, and Washington—are considering statewide excise taxes on sugary drinks this year.

4 min readOur dedicated excise tax experts, Adam Hoffer and Jacob Macumber-Rosin, provide leading tax policy research, analysis, and commentary of the latest proposals and trends related to excise taxes. Explore the vast and changing world of excise taxation.

At least four states—Connecticut, Hawaii, New York, and Washington—are considering statewide excise taxes on sugary drinks this year.

4 min read

West Virginians would face extraordinarily high taxes on vapor products in state if Senate Bill 68 becomes law. The bill would increase taxes on liquid used in vapor products from 7.5 cents per milliliter (ml) to $1 per ml—an increase of over 1,300 percent.

3 min read

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

Developed countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less distortionary effects than taxes on income.

16 min read

The potential override of Gov. Larry Hogan’s (R) veto of a digital advertising tax (HB732) looms large over the current legislative session in Maryland, though it is only one of many tax proposals under consideration in the state.

7 min read

Although this week’s Super Bowl festivities may be muted, states with legalized sports betting may have something to cheer: a tax revenue bump thanks to the accompanying excise taxes.

3 min read

The consultation on the EU’s digital levy provides an opportunity for policymakers and taxpayers to reflect on the underlying issues of digital taxation and potential consequences from a digital levy. Unless the EU digital levy is designed with an OECD agreement in mind, it is likely to cause more uncertainty in cross-border tax policy.

12 min read

Washington state lawmakers have proposed a bill that would make it the second state to ban all flavored tobacco and the first to impose a nicotine cap on vapor products, and would increase taxes on vapor to among the highest in the nation.

5 min read

Despite the potential of consumption taxes as a neutral and efficient source of tax revenues, many governments have implemented policies that are unduly complex and have poorly designed tax bases that exclude many goods or services from taxation, or tax them at reduced rates.

40 min read

The economy and climate change are two challenges the Biden administration has identified as priorities. One way to address both issues at the same time is to enact a carbon tax to discourage carbon emissions, and to use the resulting carbon tax revenue to lower—or in the case of the TCJA’s individual provisions, avoid increases of—other, more distortive, types of taxes. This would not only address the challenges of climate change but also support the economy.

3 min read

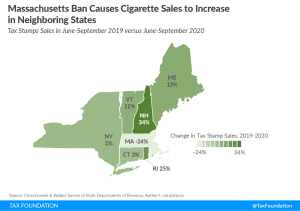

The Massachusetts flavored tobacco ban highlights the complications of contradictory tax and regulatory policy, the instability of excise taxes that go beyond pricing in the cost of externalities, and the public risks of driving consumers into the black market through excessive taxation or regulation.

5 min read

With most states experiencing reduced tax revenues due to the coronavirus pandemic, several are contemplating whether recreational marijuana legalization and taxation may be one avenue to raise new revenue. While states that have already legalized do raise meaningful revenue, lawmakers should remember that establishment of legal markets takes time.

5 min read

Expensing for capital investments is a powerful tax policy for economic growth. But expensing can also help shift the economy to a more sustainable future through increased investment in new, less carbon-intensive technology. Expensing for capital investment would eliminate a tax bias against energy efficiency improvements that reduce operating costs but involve high upfront investments. It could also serve to accelerate the existing trend of movement towards more green energy power sources.

28 min read

Over the last several years, policymakers in countries around the world have groped for new ways to tax e-commerce, social media, cloud-based, and other online businesses, in some cases stoking major international trade disputes in the process. In this episode of The Deduction, we explore the “digital services tax” (DST), one new and increasingly popular policy designed to address the digital economy.

Twenty-six states and the District of Columbia had notable tax changes take effect on January 1, 2021. Because most states’ legislative sessions were cut short in 2020 due to the COVID-19 pandemic, fewer tax changes were adopted in 2020 than in a typical year.

24 min read

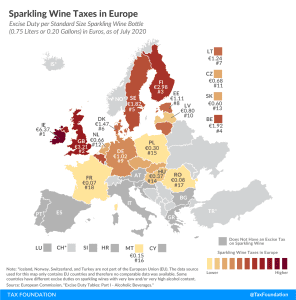

This week, people around the world will celebrate New Year’s Eve, with many opening a bottle of sparkling wine to wish farewell to—a rather consequential—2020 and offer a warm welcome to the—by many of us, long-awaited—new year 2021.

1 min read

Tax extenders are no stranger to hitching a last-minute ride on year-end legislation. This year they made another last-minute appearance, finding a hold in their own division of the 5,593-page bill to fund the government through the fiscal year and provide additional coronavirus relief through March.

2 min read

By the time marijuana is sold to a consumer, local taxes could be applied four different times—by one or more localities.

5 min read