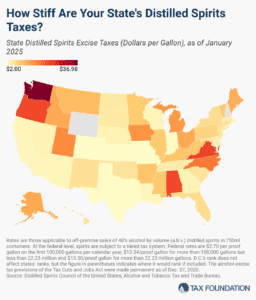

Distilled Spirits Taxes by State, 2025

The significant disparity in tax rates across states underscores the complex tax and regulatory environment governing distilled spirits.

6 min readOur dedicated excise tax experts, Adam Hoffer and Jacob Macumber-Rosin, provide leading tax policy research, analysis, and commentary of the latest proposals and trends related to excise taxes. Explore the vast and changing world of excise taxation.

The significant disparity in tax rates across states underscores the complex tax and regulatory environment governing distilled spirits.

6 min read

Sean Bray interviewed Professor of Business Accounting and Taxation at the University of Kiel, Jost Heckemeyer, about the future of the EU tax mix. The interview shows that there is a trade-off between stability and flexibility in European tax policymaking. It also shows that there ought to be a balance between fairness and competitiveness when thinking about improving tax policy.

16 min read

We break down the House GOP’s One, Big, Beautiful Bill—a sweeping tax package designed to extend key parts of the 2017 Tax Cuts and Jobs Act before they expire in 2026.

William McBride discussed how and why the budgetary cost of the IRA’s tax credits has grown, described who benefits from the tax credits, and recommended ways to reform the credits amid budget reconciliation.

As lawmakers continue to debate the “One Big Beautiful Bill,” they should abandon temporary and complex policy in favor of simplicity and stability.

4 min read

The unique complexities of tax design for sports betting excise taxes make optimal tax design particularly challenging. Any reforms to the federal sports betting tax should ensure that both bettors and operators find legal markets more attractive than illicit markets.

6 min read

Tax simplification has two aspects. The first is a code without a mess of targeted provisions for various social policy goals. The second is a code with provisions that are simple and easy to comply with. The bill succeeds at the first, but fails at the second.

7 min read

According to the latest economic data from the US Census Bureau, the average per capita state and local tax burden is $7,109. However, collections vary widely by state, reflecting differences in tax rates and bases, natural resource endowments, the scale and scope of taxable economic activity in each state, and residents’ political preferences.

5 min read

The Trump administration advocates an “energy dominance” agenda to boost US energy production and lower costs. Its tariff agenda runs directly counter to it.

5 min read

Hemp, intoxicating or otherwise, is a growing market that needs to be addressed with tax policy. A well-designed tax will generate tax revenues for states while improving public health by shifting consumers away from illicit markets.

5 min read

New leadership at the FDA will have the opportunity to revisit decisions that have shifted consumption to illicit products and discouraged harm reduction—policies that, however well intended, have come at a significant cost in lives.

7 min read

Among the many other tax proposals being considered in Washington this year, policymakers have proposed separate bills that would impose a carbon tax on cigarettes and implement a state-wide flavor ban on tobacco products.

3 min read

Congressional Republicans are looking for ways to pay for extending the tax cuts scheduled to expire at the end of the year. Repealing the green energy tax subsidies expanded or introduced in the Inflation Reduction Act is an appealing option.

Many states regulate and tax legal marijuana sales and consumption, despite the ongoing federal prohibition. Explore the data here.

8 min read

The empirical evidence thus far on sugar-sweetened beverage taxes fails to support claims that these taxes will create substantial health benefits. At the same time, their structural limitations make them ill-suited for generating stable, equitable revenue.

54 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

The Inflation Reduction Act (IRA) introduced a series of new targeted tax breaks, many of which seem to be much more expensive than originally forecasted. Understandably, repealing these subsidies is a key option for policymakers looking to pay to extend the expiring broader tax cuts passed in the Tax Cuts and Jobs Act (TCJA).

7 min read

An update to the EU’s Excise Tax Directive that embraces harm reduction principles would save lives and provide a steady stream of revenue to support public health expenditures.

22 min read

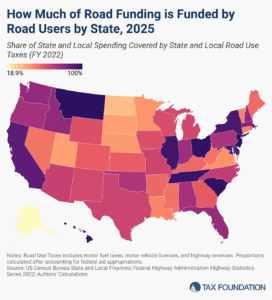

The amount of revenue states raise through roadway-related revenues varies significantly across the US. Only three states raise enough revenue to fully cover their highway spending.

5 min read

As we learned in the first trade war, retaliation will exact harm on US exporters by lowering their export sales—and the US-imposed tariffs will directly harm exporters too. US-imposed tariffs can burden exporters by increasing input costs, which acts like a tax on exports.

4 min read