FAQ: The One Big Beautiful Bill Act Tax Changes

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min readOur dedicated excise tax experts, Adam Hoffer and Jacob Macumber-Rosin, provide leading tax policy research, analysis, and commentary of the latest proposals and trends related to excise taxes. Explore the vast and changing world of excise taxation.

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

The European Commission proposed new budget options for 2028 to 2034. It is worth zooming in on one new proposal for revenues that would support EU-level spending. The “Corporate Resource for Europe,” or CORE, provides a good opportunity to think through how best to raise revenue for the EU budget.

5 min read

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

38 min read

The One Big Beautiful Bill is now law—but what does it actually do? In this episode, we break down the new tax law’s key provisions, including who benefits, who doesn’t, and what it means for the economy, tax certainty, and the federal deficit.

The One Big Beautiful Bill Act makes many of the individual tax cuts and reforms of the TCJA permanent. It improves upon the TCJA by making expensing for R&D and equipment permanent. However, for the most part, it does not include further structural reforms, and instead introduces many new, narrow tax breaks to the code, adding complexity and raising revenue costs.

7 min read

While well-designed excise taxes can make society better off, some of the health taxes proposed by the WHO use a pretty façade to cover for policies that fail to deliver their promised benefits.

5 min read

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

16 min read

Tax Foundation Europe’s Sean Bray interviews Dr. Monika Köppl-Turyna, director of the EcoAustria Institute for Economic Research, about the future of the EU tax mix.

14 min read

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETSs), and carbon taxes.

4 min read

The American Revolution was a tax revolt over the power to tax, not over tax burdens. It serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

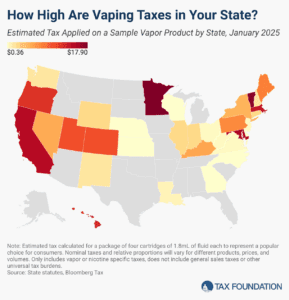

The vaping industry has grown rapidly in recent decades, becoming a well-established product category and a viable alternative to cigarettes for those trying to quit smoking. US states levy a variety of tax structures on vaping products.

7 min read

The House-passed reconciliation bill leaves out Trump’s promise to eliminate taxes on Social Security benefits, opting instead to expand the standard deduction for seniors.

The final House bill makes impressive cuts to the IRA green energy tax credits, but it does so in part by introducing more complexity.

5 min read

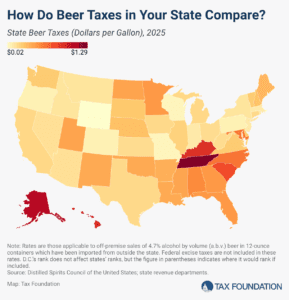

In the United States, taxes are the single most expensive ingredient in beer. The tax burden accounts for more of the final price of beer than labor and materials combined—the many different layers of applicable taxes combining to total as much as 40.8 percent of the retail price.

6 min read

The ongoing economic uncertainty from Russia’s war in Ukraine, economic recovery, supply chain disruptions, and rising interest rates have highlighted the importance of business investment.

30 min read

Our preliminary analysis finds the tax provisions increase long-run GDP by 0.8 percent and reduce federal tax revenue by $4.0 trillion from 2025 through 2034 on a conventional basis before added interest costs.

9 min read

The House-passed “One Big Beautiful Bill” includes a new 3.5 percent tax on remittances, or non-commercial transfers of money that people in the US send to people abroad.

7 min read