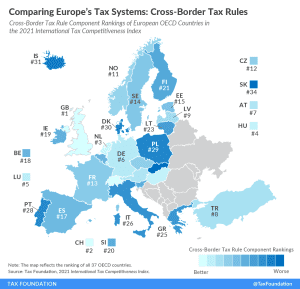

Comparing Europe’s Tax Systems: Cross-Border Tax Rules

Cross-border tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of each country’s tax code.

3 min read

Cross-border tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of each country’s tax code.

3 min read

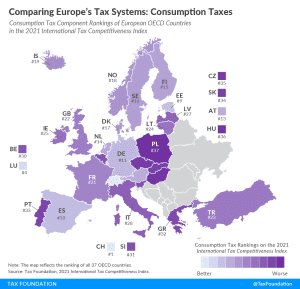

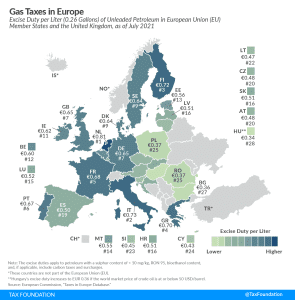

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

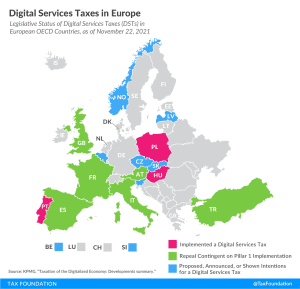

Despite ongoing multilateral negotiations in the OECD, about half of all European OECD countries have either announced, proposed, or implemented their own unilateral digital services tax.

7 min read

France’s individual income tax system is the least competitive of all OECD countries. It takes French businesses on average 80 hours annually to comply with the income tax.

3 min read

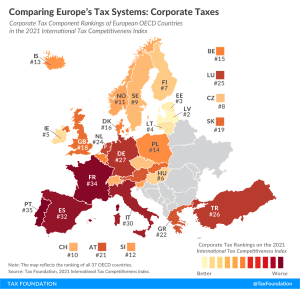

According to the corporate tax component of the 2021 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min read

Tax Foundation testimony on the diversity of tax systems within the EU, three important ways to consider reforms by Member States, and several recommendations for the EU Parliament’s Subcommittee on Tax Matters to consider.

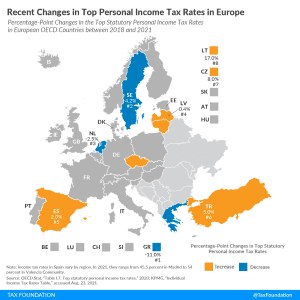

In the past three years, eight European OECD countries changed their top personal income tax rate, of which four of them cut their top personal income tax rates.

3 min read

Tax competition has proven to be key in keeping tax hikes under control in some regions of Spain as regional governments look to copy Madrid’s tax reforms.

6 min read

Rather than pursuing policies that have demonstrably reduced R&D and innovation elsewhere, and that would disincentivize R&D in the U.S., lawmakers should continue to ensure an ecosystem that encourages risk-taking and R&D.

4 min read

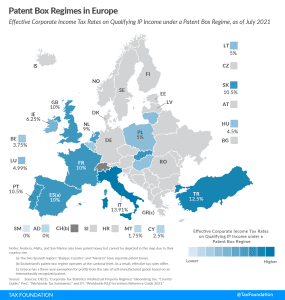

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP. Most commonly, eligible types of IP are patents and software copyrights. Currently, 14 of the 27 EU member states have a patent box regime.

4 min read

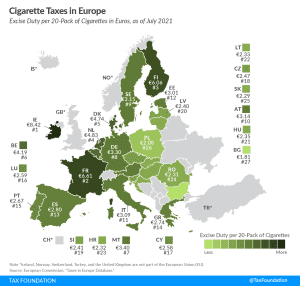

Ireland and France levy the highest excise duties on cigarettes in the EU, at €8.42 ($9.60) and €6.61 ($7.53) per 20-cigarette pack, respectively. This compares to an EU average of €3.34 ($3.80). Bulgaria (€1.81 or $2.06) and Poland (€2.08 or $2.37) levy the lowest excise duties.

3 min read

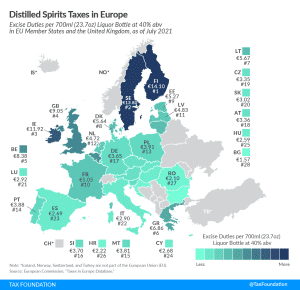

The highest excise duties are applied in Finland, Sweden, and Ireland, where the rates for a standard-size bottle of liquor are €14.10 ($16.08), €13.80 ($15.73), and €11.92 ($13.59), respectively.

3 min read

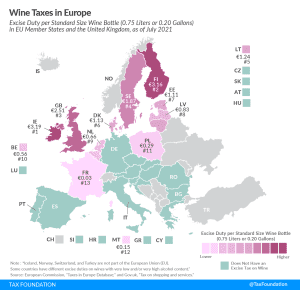

As one might expect, southern European countries that are well-known for their wines—such as France, Greece, Portugal, and Spain—either don’t tax it or do so at a very low rate. But travel north and you’ll see countries that tend to levy taxes on wine—and often hefty taxes.

3 min read

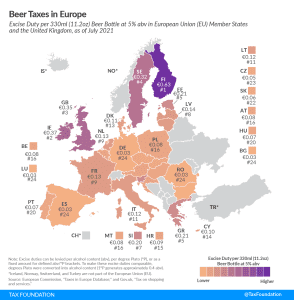

Finland has the highest excise tax on beer in Europe, followed by Ireland and the United Kingdom. Compare beer taxes in Europe this International Beer Day

3 min read

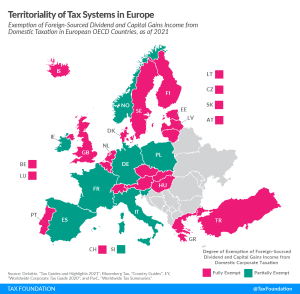

19 European OECD countries employ a fully territorial tax system, exempting all foreign-sourced dividend and capital gains income from domestic taxation. No European OECD country operates a worldwide tax system.

3 min read

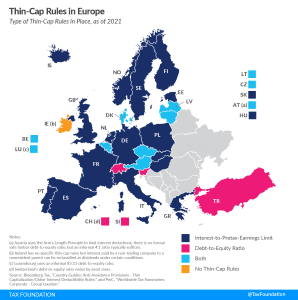

To discourage this form of international debt shifting, many countries have implemented so-called thin-capitalization rules (thin-cap rules), which limit the amount of interest a multinational business can deduct for tax purposes.

5 min read

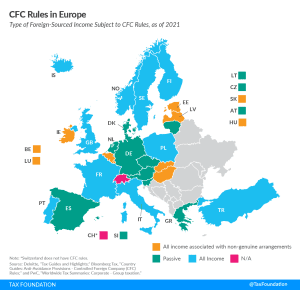

To prevent businesses from minimizing their tax liability by taking advantage of cross-country differences, countries have implemented various anti-tax avoidance measures, such as the so-called Controlled Foreign Corporation (CFC) rules.

5 min read