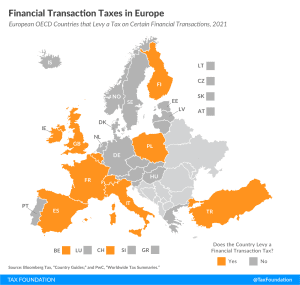

Financial Transaction Taxes in Europe

Belgium, Finland, France, Ireland, Italy, Poland, Spain, Switzerland, Turkey, and the United Kingdom currently levy a type of financial transaction tax

2 min read

Belgium, Finland, France, Ireland, Italy, Poland, Spain, Switzerland, Turkey, and the United Kingdom currently levy a type of financial transaction tax

2 min read

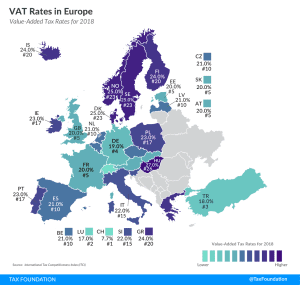

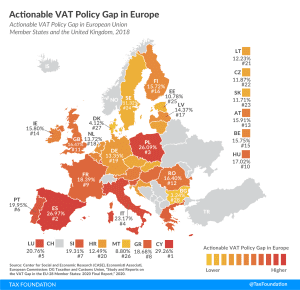

Value-added taxes (VAT) make up approximately one-fifth of total tax revenues in Europe. However, European countries differ significantly in how efficiently they raise VAT revenues. One way to measure a country’s VAT efficiency is the VAT Gap.

4 min read

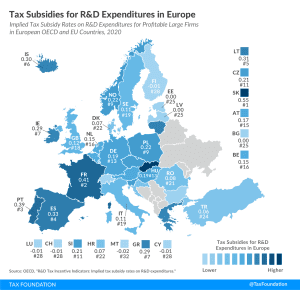

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offer R&D tax incentives.

4 min read

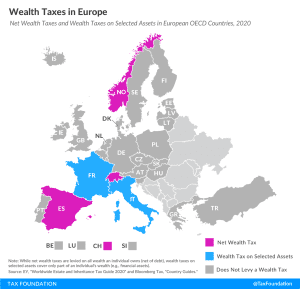

Net wealth taxes are recurrent taxes on an individual’s wealth, net of debt. The concept of a net wealth tax is similar to a real property tax. But instead of only taxing real estate, it covers all wealth an individual owns. As today’s map shows, only three European countries covered levy a net wealth tax, namely Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets but not on an individual’s net wealth per se.

3 min read

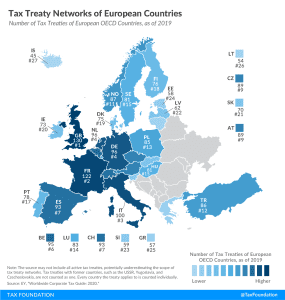

Tax treaties usually provide mechanisms to eliminate double taxation and can provide certainty and stability for taxpayers and encourage foreign investment and trade. A broad network of tax treaties contributes to the competitiveness of an economy.

1 min read

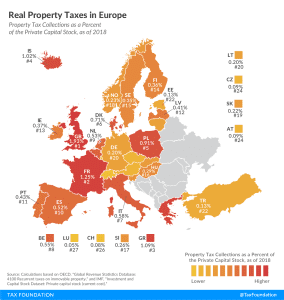

High property taxes levied not only on land but also on buildings and structures can discourage investment because they disincentivise investing in infrastructure, which businesses would have to pay additional tax on. For this reason, it may also influence business location decisions away from places with high property tax.

3 min read

The European Council recently agreed on a new multiannual budget and a recovery program, which sets EU budget levels for 2021-2027 totals €1 trillion (US $1.2 trillion). The lack of details on the various tax proposals and the eventual need for revenue sources to finance new EU debt mean there is a lot of work left for policymakers in Brussels to do.

4 min read

While much of Germany’s EU presidency agenda is focused on policies to ensure economic stability and recovery from the COVID-19 pandemic, there’s a pair of tax proposals that the country is planning to develop and move forward at the EU level: a financial transaction tax and a minimum effective tax.

5 min read

In the wake of the coronavirus crisis, some governments are seeking to cut bank taxes to enhance financial support to businesses and public investment projects.

2 min read

The European Commission announced new budget plans including loans, grants, and some revenue offsets. The proposals follow other support mechanisms for workers and businesses that were designed in response to the Covid-19 pandemic and economic shutdown.

5 min read

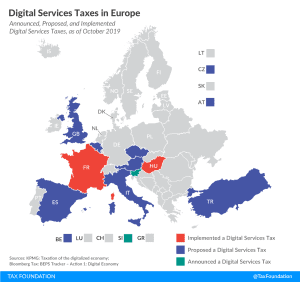

A digital services tax like the one implemented by France likely violates both the General Agreement on Trade in Services and a model U.S. free trade agreement. However, it is uncertain whether meaningful relief could be obtained under either regime.

26 min read

As policymakers consider ways to facilitate investment, effective average tax rates provide a valuable perspective on where burdens on those activities are high and where they are low.

16 min read