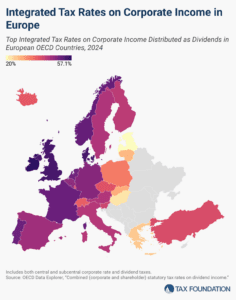

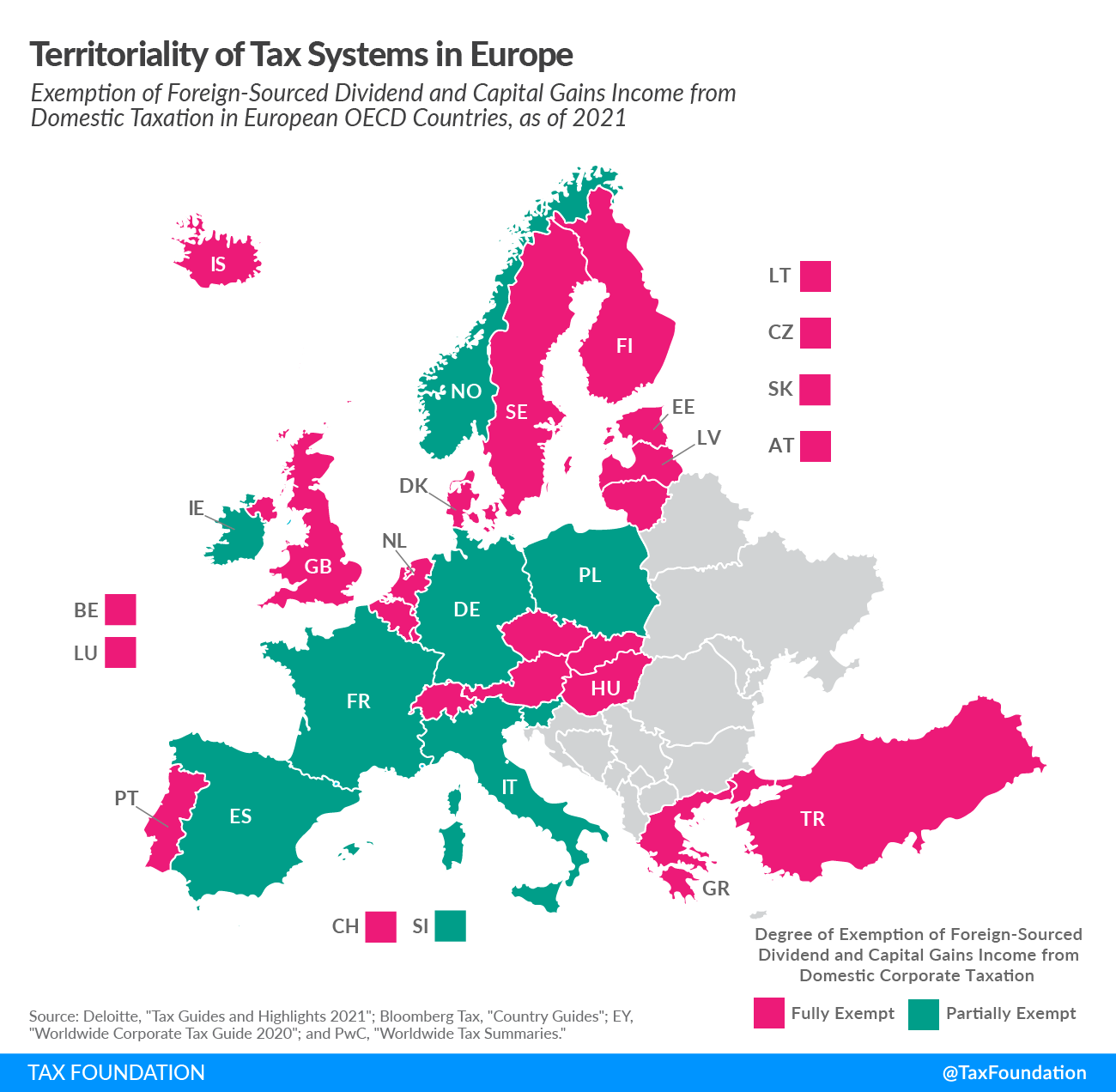

Territoriality of Tax Systems in Europe

3 min readBy:Under a territorial tax system, multinational businesses primarily pay taxes to the countries in which they are physically located and earn their income. This means that territorial taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. regimes do not generally tax the income companies earn in foreign countries. A worldwide tax system, on the other hand—such as the system previously employed by the United States—requires companies to pay taxes on worldwide income, regardless of where it is earned.

Countries enact territorial tax systems through what are called “participation exemptions,” which can include full or partial exemptions for foreign-sourced dividend or capital gains income or both. In this context, dividends can be used to repatriate profits earned in a foreign subsidiary back to the parent company, and capital gains emerge, for example, when foreign subsidiaries are sold at a profit. Participation exemptions eliminate domestic tax on such foreign income by allowing companies to ignore some or all of it when calculating their taxable income.

One can distinguish among three cases:

- A fully territorial tax systemA territorial tax system for corporations, as opposed to a worldwide tax system, excludes profits multinational companies earn in foreign countries from their domestic tax base. As part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation towards territorial taxation. exempts all foreign-sourced dividend and capital gains income

- A partially territorial tax system exempts only a certain share of foreign-sourced dividend and capital gains income or exempts foreign-sourced dividend income but includes foreign-sourced capital gains income (or vice versa)

- A worldwide tax systemA worldwide tax system for corporations, as opposed to a territorial tax system, includes foreign-earned income in the domestic tax base. As part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation towards territorial taxation. does not exempt any foreign-sourced dividend and capital gains income

Of the 27 European OECD countries covered in today’s map, 19 employ a fully territorial tax system, exempting all foreign-sourced dividend and capital gains income from domestic taxation. In the remaining eight countries, such income is partially exempted from domestic taxation. No European OECD country operates a worldwide tax system.

Of the eight countries with a partially territorial tax system, only Ireland fully taxes foreign-sourced dividend income and at the same time fully exempts foreign-sourced capital gains income. The opposite is the case in Poland (fully taxing foreign-sourced capital gains income and fully exempting foreign-sourced dividends). The remaining six countries have partial exemptions for both foreign-sourced dividend and capital gains income, though Slovenia allows for a 95 percent exemption on dividend income, but only a 47.5 percent exemption on capital gains.

Many countries treat foreign-sourced income differently depending on the country in which it was earned. For example, many countries restrict their territorial systems based on a “blacklist” of countries that do not follow certain requirements. Among European Union (EU) countries, it is common to restrict the participation exemption to EU member states or the European Economic Area (EEA).

| Dividend Exemption | Capital Gains Exemption | Country Limitations | |

|---|---|---|---|

| Austria (AT) | 100.0% | 100.0% | None |

| Belgium (BE) | 100.0% | 100.0% | None |

| Czech Republic (CZ) | 100.0% | 100.0% | EU member states and EEA member states or double tax treaty |

| Denmark (DK) | 100.0% | 100.0% | EU member states and EEA member states or double tax treaty |

| Estonia (EE) | 100.0% | 100.0% | EU member states and EEA member states and Switzerland |

| Finland (FI) | 100.0% | 100.0% | EU member states and EEA member states or double tax treaty |

| France (FR) | 95.0% | 88.0% | Blacklist countries are excluded |

| Germany (DE) | 95.0% | 95.0% | None |

| Greece (GR) | 100.0% | 100.0% | EU member states |

| Hungary (HU) | 100.0% | 100.0% | None |

| Iceland (IS) | 100.0% | 100.0% | None |

| Ireland (IE) | 0.0% | 100.0% | EU member states and tax treaty countries |

| Italy (IT) | 95.0% | 95.0% | Blacklist countries are excluded |

| Latvia (LV) | 100.0% | 100.0% | Blacklist countries are excluded |

| Lithuania (LT) | 100.0% | 100.0% | Blacklist countries are excluded |

| Luxembourg (LU) | 100.0% | 100.0% | None |

| Netherlands (NL) | 100.0% | 100.0% | None |

| Norway (NO) | 97.0% | 100.0% | Blacklist countries are excluded |

| Poland (PL) | 100.0% | 0.0% | EU member states and EEA member states and Switzerland |

| Portugal (PT) | 100.0% | 100.0% | Black-list countries are excluded |

| Slovak Republic (SK) | 100.0% | 100.0% | Tax treaty countries |

| Slovenia (SI) | 95.0% | 47.5% | Blacklist countries are excluded |

| Spain (ES) | 95.0% | 95.0% | Blacklist countries are excluded |

| Sweden (SE) | 100.0% | 100.0% | None |

| Switzerland (CH) | 100.0% | 100.0% | None |

| Turkey (TR) | 100.0% | 100.0% | None |

| United Kingdom (GB) | 100.0% | 100.0% | None |

|

Source: Deloitte, “Tax Guides and Highlights 2021″; Bloomberg Tax, “Country Guides”; EY, “Worldwide Corporate Tax Guide 2020”; and PwC, “Worldwide Tax Summaries.” |

|||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe