Thin-Cap Rules in Europe

5 min readBy:Thin capitalization occurs when companies finance investments and operations through a level of debt far higher than their level of equity. High-tax countries create an incentive for companies to finance investments with debt because interest payments are taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. -deductible, while the costs associated with equity financing are most often not. Some multinational corporations take advantage of the tax benefits associated with debt financing by lending money internally from subsidiary entities in low-tax countries to entities in high-tax countries. Tax savings in high-tax countries typically exceed the increased tax paid in low-tax countries, decreasing worldwide tax liability.

To discourage this form of international debt shifting, many countries have implemented so-called thin-capitalization rules (thin-cap rules), which limit the amount of interest a multinational business can deduct for tax purposes. The two most common types used in practice are “safe harbor rules” and “earnings stripping rules.” Safe harbor rules restrict the amount of debt for which interest is tax-deductible to a predefined debt-to-equity ratio. Interest paid on debt exceeding this set ratio is not tax-deductible. Earnings stripping rules limit the tax-deductible share of debt interest to pretax earnings.

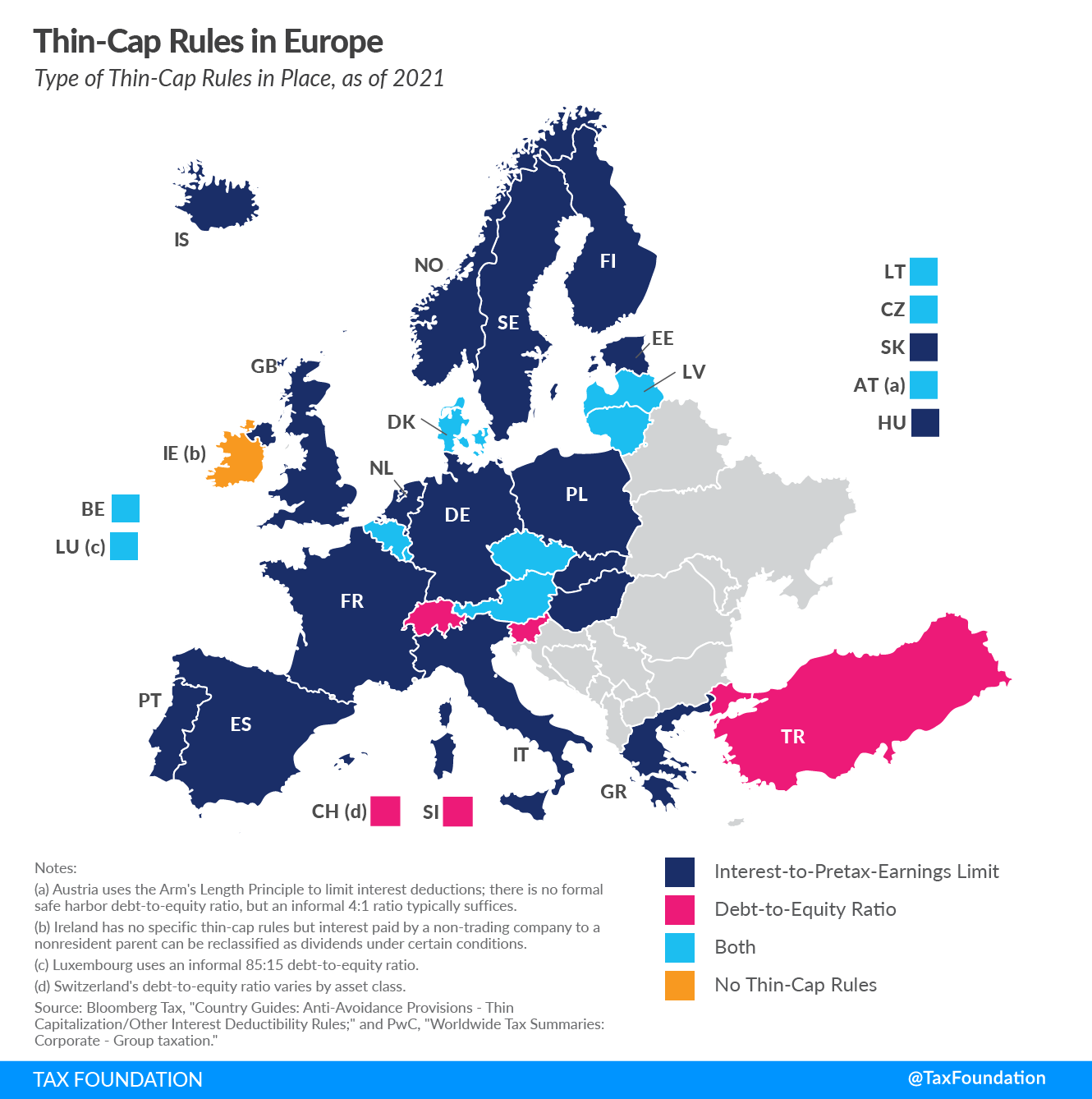

Just three of 27 countries covered have only a debt-to-equity ratio in place. For instance, Turkey’s debt-to-equity ratio is 3:1. Let’s say a Turkish business takes a $100 loan from its foreign subsidiary. Its current equity amounts to $10, resulting in a debt-to-equity ratio of 10:1. The annual interest on the loan is 5 percent, or $5. Because the business’ debt-to-equity ratio is 10:1, but Turkey’s debt-to-equity ratio is 3:1, only the tax liability of the debt within the set ratio—5 percent of $30, or $1.5—is tax-deductible.

Most European countries covered have interest-to-pretax-earning limits in place. Most commonly, the limit is set at 30 percent of EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization). For example, assume that a parent company takes a $100 loan from its subsidiary requiring interest payments of $5. If EBITDA are $10, only $3 (30 percent of $10) of the $5 in interest paid are tax-deductible.

Ireland is the only country covered in this map with no formal thin-cap rules.

It is important to keep in mind that thin-cap rules not only limit international debt shifting but can also impact real economic activity, such as investment and employment.

Detailed information on OECD countries’ interest deduction limitations can be found here.

| Country | Interest Deduction Limitations |

|---|---|

| Austria (AT) | Interest limitation rule applies for “excessive borrowing costs,” i.e., costs greater than EUR 3 million and greater than 30% of adjusted EBITDA. Arm’s length standard applicable. No formal safe harbor rule, but informal 4:1 debt-to-equity ratio applies. |

| Belgium (BE) | Interest deductions limited to the higher of €3 million or 30% of EBITDA. 5:1 debt-to-equity ratio applies to intragroup loans. 1:1 debt-to-equity ratio applies to receivables from shareholders or directors, managers, and liquidators. |

| Czech Republic (CZ) | Interest deductions limited to the higher of CZK 80 million or 30% of EBITDA. 4:1 debt-to-equity ratio (6:1 debt-to-equity ratio for certain financial services companies) applies. |

| Denmark (DK) | 4:1 debt-to-equity ratio applies. Interest deductions are limited to 2.3% of assets to the extent net financing costs exceed DKK 21.3 million. Interest deduction limited to 30% of EBITDA, a minimum deduction of DKK 22.3 million is allowed. Other rules can apply. |

| Estonia (EE) | Interest deductions limited to the higher of €3 million or 30% of EBITDA. |

| Finland (FI) | Intragroup interest expense limited to 25% of the company adjusted taxable income (“taxable EBITD”). Subject to certain exceptions. Interest expense does not exceed the interest income derived by the company that pays. Net interest expense up to €500,000 fully deductible. Company equity/assets ratio is equal or greater than the group ratio. Net interest expenses between non-related parties limited to €3 million |

| France (FR) | Interest deductions limited to the higher of €3 million or 30% of EBITDA. Different limits apply to related-party debt, and banking & credit institutions. |

| Germany (DE) | Interest deductions limited to the higher of €3 million or 30% of EBITDA. Carryforwards allowed. Taxpayer is not part of a group of companies. Taxpayer cannot demonstrate that the equity ratio of the borrower is not more than 2 percentage points below worldwide group’s equity ratio. |

| Greece (GR) | Net interest deduction limitation in certain categories of interest if it exceeds €3 million or 30% of EBITDA after tax adjustments. |

| Hungary (HU) | Excess borrowing costs are deductible up to 30% of EBITDA. Standalone entities are exempted as borrowing costs under €3 million. Loans concluded before June 2016 are subject to the previous thin-cap rules and a 3:1 debt to equity ratio applies instead. |

| Iceland (IS) | Interest deductions limited to 30% of EBITDA. Rule does not apply if total interest paid does not exceed ISK 100 million. Other exemptions can apply. |

| Ireland (IE) | None. However, in specific cases, interest can be reclassified as a dividend. New rules expected to be effective on January 1, 2022. |

| Italy (IT) | Interest deductions limited to 30% of EBITDA. |

| Latvia (LV) | 4:1 debt-to-equity ratio applies for deduction up to €3 million (certain financial institutions exempt). Interest deductions limited to 30% of EBITDA for deduction exceeding €3 million (certain financial institutions exempt). |

| Lithuania (LT) | 4:1 debt-to-equity ratio applies. Interest deductions limited to €3 million or 30% of EBITDA. Rule does not apply if entity’s debt-to-equity ratio is not (or at most 2 percentage points) lower than the group-consolidated ratio. |

| Luxembourg (LU) | Informal 85:15 debt-to-equity ratio applies. Interest deductions limited to 30% of EBITDA if deduction exceeds €3 million (financial institutions exempt). |

| Netherlands (NL) | Interest deductions limited to the higher of €1 million or 30% of EBITDA. |

| Norway (NO) | Interest deductions limited to 25% of EBITDA if deduction exceeds NOK 5 million. |

| Poland (PL) | Interest deductions limited to 30% of EBITDA if deduction exceeds PLN 3 million. |

| Portugal (PT) | Interest deductions limited to the higher of €1 million or 30% of EBITDA. |

| Slovak Republic (SK) | Interest deductions limited to 25% of EBITDA (financial institutions exempted). |

| Slovenia (SI) | 4:1 debt-to-equity ratio applies. Additional rules apply. |

| Spain (ES) | Interest deductions limited to 30% of EBITDA if deduction exceeds €1 million. |

| Sweden (SE) | Interest deductions limited to 30% of EBITDA if deduction exceeds SEK 5 million. |

| Switzerland (CH) | Debt-to-equity ratios apply and vary by asset class. |

| Turkey (TR) | 3:1 debt-to-equity ratio (6:1 for financial institutions) applies. |

| United Kingdom (GB) | Interest deductions limited to 30% of EBITDA if deduction exceeds GBP 2 million. |

|

Source: Bloomberg Tax, “Country Guides: Anti-Avoidance Provisions – Thin Capitalization/Other Interest Deductibility Rules”; and PwC, “Worldwide Tax Summaries: Corporate – Group taxation.” |

|