Testimony: Capital Gains Taxation in the EU

It is essential to understand that the taxation of capital gains places a double tax on corporate income.

It is essential to understand that the taxation of capital gains places a double tax on corporate income.

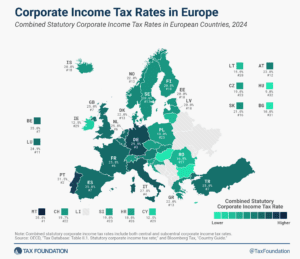

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read

In such a determinant semester for Europe, principled tax policy can be an important tool for a more competitive European Union.

5 min read

Spain’s central government could learn some valuable lessons from its regional governments about sound tax policy.

7 min read

In the end, the best way for the EU to support Ukraine’s post-war recovery is to guarantee its tax sovereignty, not just its territorial sovereignty.

5 min read

What historical lessons of wartime finance can Ukrainian and EU policymakers learn to put Ukraine’s economy on a path to success during, and especially after, the war?

5 min read

A multilateral agreement that eliminates digital services taxes would be valuable, but not if it introduces more complexity and leaves unanswered many questions about the impacts on the U.S. tax base.

The EU Tax Observatory has taken an extreme view in assessing the global minimum tax. The rules were not meant to immediately reduce the stock of shifted profits or align profitability levels more closely with employment costs. The rules do change incentives for multinationals, but profits may continue to remain in low-tax jurisdictions for many years.

6 min read

While the European Commission focuses on improving VAT compliance, policy is a major contributor to VAT revenue losses. The VAT actionable policy gap is 15.65 percent, more than triple the compliance gap.

5 min read

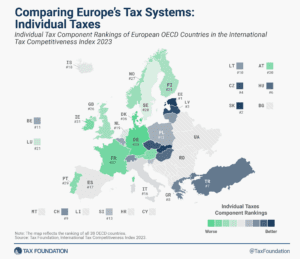

Estonia has the most competitive individual tax system in the OECD for the 10th consecutive year.

2 min read

While existing carbon taxes are a step towards the right direction in addressing climate change and incentivizing reductions in emissions, there is considerable room for improvement to reach the ideal theoretical carbon tax model.

59 min read

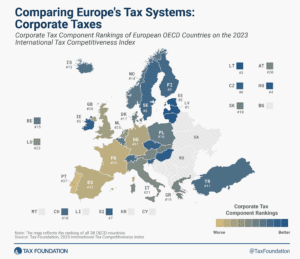

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min read

A harmonized EU tax base is a project in the making. Policymakers have a chance to put the Union on a path for increased investment and economic growth by focusing on the details of capital cost recovery.

3 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

If the EU is going to harmonize its tax base, it should do so in a way that increases the efficiency and competitiveness of tax policy for the EU as a whole, and not just seek out the lowest common denominator.

5 min read

The OECD recently released a trove of new documents on a draft multilateral tax treaty. The U.S. Treasury has opened a 60-day consultation period for the proposal and is requesting public review and input.

7 min read

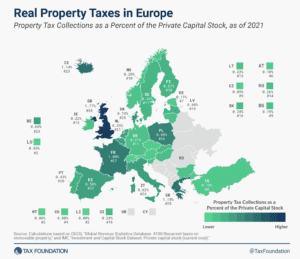

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

2 min read

The global minimum tax agreement known as Pillar Two is intended to curb profit shifting. However, OECD countries already have a variety of mechanisms in place that seek to prevent base erosion and profit shifting by multinational corporations.

40 min read

The 2023 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

6 min read