All Related Articles

Congressional Budget Office Shows 2017 Tax Law Reduced Tax Rates Across the Board in 2018

CBO data shows that the TCJA reduced federal tax rates for households across every income level while increasing the share of tax paid by the top 1 percent.

4 min read

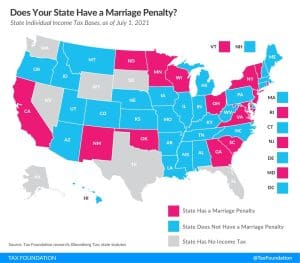

Does Your State Have a Marriage Penalty?

Fifteen states have a marriage penalty built into their bracket structure. Does your state have one?

2 min read

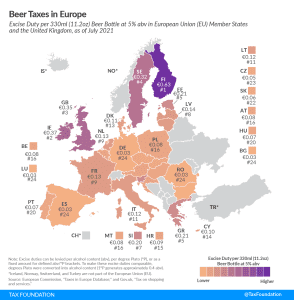

Beer Taxes in Europe, 2021

Finland has the highest excise tax on beer in Europe, followed by Ireland and the United Kingdom. Compare beer taxes in Europe this International Beer Day

3 min read

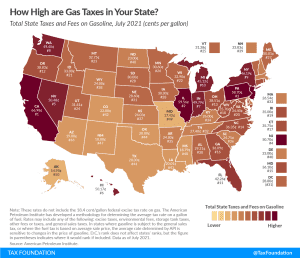

Gas Tax Rates by State, 2021

California pumps out the highest state gas tax rate of 66.98 cents per gallon, followed by Illinois (59.56 cpg), Pennsylvania (58.7 cpg), and New Jersey (50.7 cpg).

3 min read

Asian and Pacific Countries Faced Revenue Loss Prior to COVID-19 Outbreak

As economies are starting to recover and growth is expected to rebound in the region during 2021, Asian and Pacific countries should start exploring changes to their fiscal tax policies while carefully evaluating the optimal time for eliminating fiscal stimulus and temporary tax relief.

4 min read

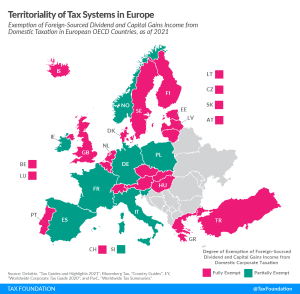

Territoriality of Tax Systems in Europe

19 European OECD countries employ a fully territorial tax system, exempting all foreign-sourced dividend and capital gains income from domestic taxation. No European OECD country operates a worldwide tax system.

3 min read

Sales Tax Holidays by State, 2021

Although state budgets may be in unusual places this year, sales tax holidays remain the same as they always have been—ineffective and inefficient.

4 min read

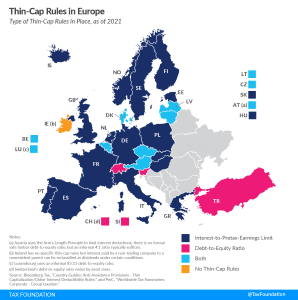

Thin-Cap Rules in Europe

To discourage this form of international debt shifting, many countries have implemented so-called thin-capitalization rules (thin-cap rules), which limit the amount of interest a multinational business can deduct for tax purposes.

5 min read

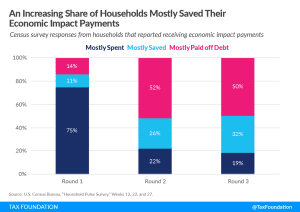

Census Data Shows Households Saved Economic Impact Payments

In 2020 and 2021, Congress enacted three rounds of economic impact payments (EIPs) for direct relief to households amidst the pandemic-induced downturn. Survey data from the U.S. Census Bureau indicates that households increasingly saved their EIPs or used them to pay down debt rather than spend them.

5 min read

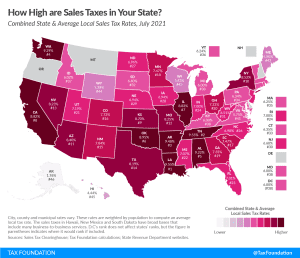

State and Local Sales Tax Rates, Midyear 2021

The highest average combined state and local sales tax rates are in Louisiana (9.55 percent), Tennessee (9.547 percent), Arkansas (9.48 percent), Washington (9.29 percent), and Alabama (9.22 percent).

12 min read

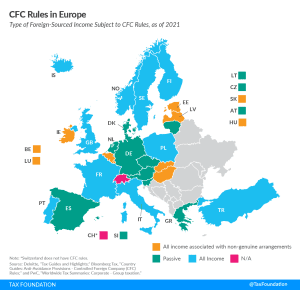

CFC Rules in Europe

To prevent businesses from minimizing their tax liability by taking advantage of cross-country differences, countries have implemented various anti-tax avoidance measures, such as the so-called Controlled Foreign Corporation (CFC) rules.

5 min read

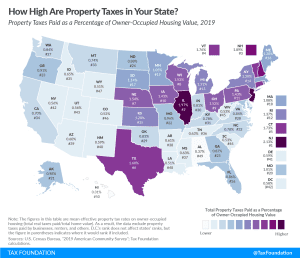

How High Are Property Taxes in Your State?

Because property taxes are tied to housing values, it makes sense that the actual dollar amounts of property taxes tend to be higher in places with higher housing prices. This map takes housing value into account to give a broader perspective for property tax comparison.

3 min read

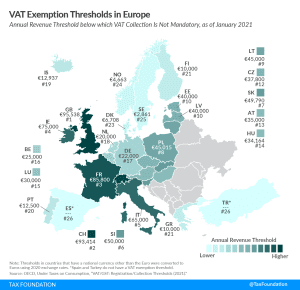

VAT Exemption Thresholds in Europe

To reduce tax compliance and administrative costs, most countries have VAT exemption thresholds: If a business is below a certain annual revenue threshold, it is not required to participate in the VAT system.

2 min read

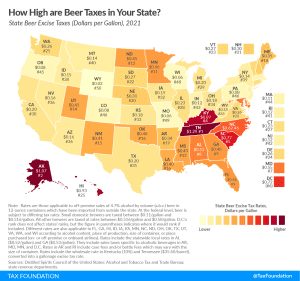

Beer Taxes by State, 2021

2021 state beer excise tax rates vary widely: as low as $0.02 per gallon in Wyoming and as high as $1.29 per gallon in Tennessee. Missouri and Wisconsin tie for second lowest at $0.06 per gallon, and Alaska is second highest with its $1.07 per gallon tax.

3 min read

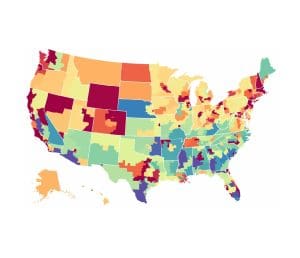

The Impact of the Biden Administration’s Tax Proposals by State and Congressional District

The redistribution of income from the Biden administration’s tax proposals would involve many winners and losers, not only across different types of taxpayers but also geographically across the country. Launch our new interactive map to see average tax changes by state and congressional district over the budget window from 2022 to 2031.

8 min read

U.S. Corporate Tax Expenditures and Effective Tax Rates in Line with OECD Peers

Last week, an analysis by Reuters suggested that U.S. firms pay less income tax than foreign competitors, in part because “the U.S. tax code is unusually generous with tax breaks and deductions,” also known as corporate tax expenditures. However, the Reuters analysis is at odds with other data and studies indicating that U.S. corporate tax expenditures and effective tax rates are about on par with those in peer countries in the OECD.

3 min read

State Tax Changes Taking Effect July 1, 2021

Thirteen states have notable tax changes taking effect on July 1, 2021, which is the first day of fiscal year (FY) 2022 for every state except Alabama, Michigan, New York, and Texas. Individual and corporate income tax changes usually take effect at the beginning of the calendar year for the sake of maintaining policy consistency throughout the tax year, but sales and excise tax changes often correspond with the beginning of a fiscal year.

11 min read

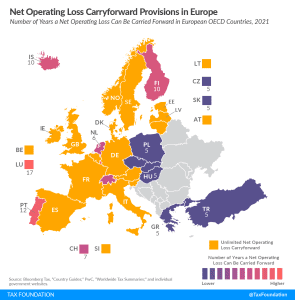

Net Operating Loss Carryforward and Carryback Provisions in Europe, 2021

Many companies have investment projects with different risk profiles and operate in industries that fluctuate greatly with the business cycle. Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

7 min read