All Related Articles

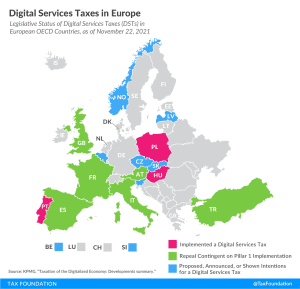

Digital Services Taxes in Europe, 2021

Despite ongoing multilateral negotiations in the OECD, about half of all European OECD countries have either announced, proposed, or implemented their own unilateral digital services tax.

7 min read

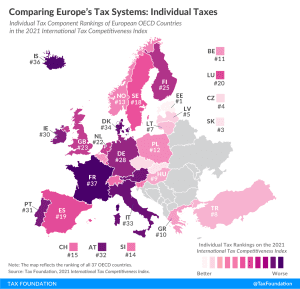

Comparing Europe’s Tax Systems: Individual Taxes

France’s individual income tax system is the least competitive of all OECD countries. It takes French businesses on average 80 hours annually to comply with the income tax.

3 min read

2022 Tax Brackets

The IRS recently released the new inflation adjusted 2022 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

5 min read

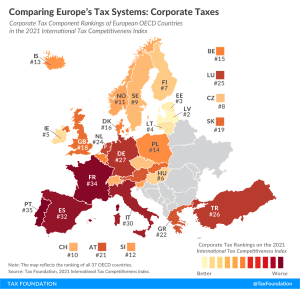

Comparing Europe’s Tax Systems: Corporate Taxes

According to the corporate tax component of the 2021 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min read

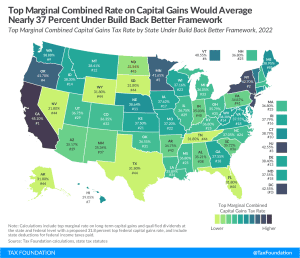

Top Combined Capital Gains Tax Rates Would Average Nearly 37 Percent Under Build Back Better Framework

Under the Build Back Better framework, six states and D.C. would face combined top marginal capital gains tax rates of more than 40 percent, nearing the top rate among OECD countries.

3 min read

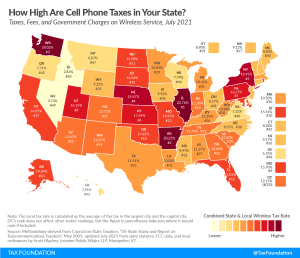

Excise Taxes and Fees on Wireless Services Increase Again in 2021

Taxes and fees on the typical American wireless consumer increased again this year, to a record 24.96 percent.

32 min read

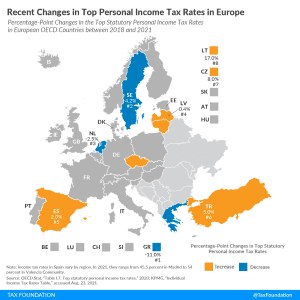

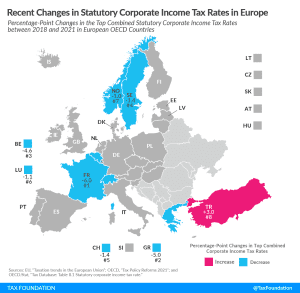

Recent Changes in Top Personal Income Tax Rates in Europe

In the past three years, eight European OECD countries changed their top personal income tax rate, of which four of them cut their top personal income tax rates.

3 min read

Yes, the US Tax Code Is Progressive

As Congress considers several tax proposals designed to raise taxes on high-income earners, it’s worth considering the distribution of the existing tax code.

3 min read

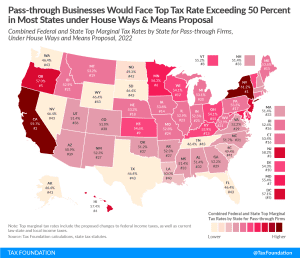

Top Tax Rate on Pass-through Business Income Would Exceed 50 Percent in Most States Under House Dems’ Plan

Under the House Democrats’ reconciliation plan, the top tax rate on pass-through business income would exceed 50 percent in most states. Pass-through businesses, such as sole proprietorships, S corporations, and partnerships, make up a majority of businesses and majority of private sector employment in the United States.

3 min read

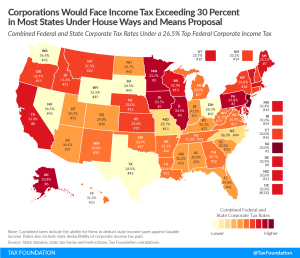

Corporations in Most States Would Face Income Tax Rate Exceeding 30 Percent Under Ways and Means Proposal

Under the House Democrats’ tax plan, companies in 21 states and D.C. would face a higher corporate tax rate than in any country in the OECD.

1 min read

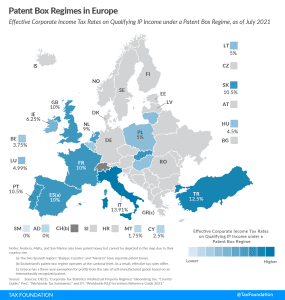

Patent Box Regimes in Europe, 2021

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP. Most commonly, eligible types of IP are patents and software copyrights. Currently, 14 of the 27 EU member states have a patent box regime.

4 min read

Top Ten Congressional Districts Impacted by Biden Corporate Tax Proposals

The Biden corporate tax plan would disproportionately harm these congressional districts and make the U.S. less internationally competitive. These tax hikes, along with individual tax increases, would also raise taxes on net for 96 percent of congressional districts by 2031 after these temporary credits expire in 2025.

2 min read

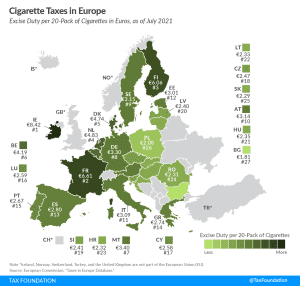

Cigarette Taxes in Europe, 2021

Ireland and France levy the highest excise duties on cigarettes in the EU, at €8.42 ($9.60) and €6.61 ($7.53) per 20-cigarette pack, respectively. This compares to an EU average of €3.34 ($3.80). Bulgaria (€1.81 or $2.06) and Poland (€2.08 or $2.37) levy the lowest excise duties.

3 min read

Property Taxes by County, 2021

The six counties with the highest median property tax payments all have bills exceeding $10,000—Bergen, Essex, and Union Counties in New Jersey, and Nassau, Rockland, and Westchester counties in New York. All six are near New York City, as is the next highest, Passaic County, New Jersey ($9,881).

3 min read

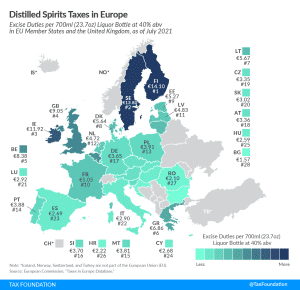

Distilled Spirits Taxes in Europe, 2021

The highest excise duties are applied in Finland, Sweden, and Ireland, where the rates for a standard-size bottle of liquor are €14.10 ($16.08), €13.80 ($15.73), and €11.92 ($13.59), respectively.

3 min read

Reviewing Benefits of the State and Local Tax Deduction by County in 2018

It is important to understand how the SALT deduction’s benefits have changed since the SALT cap was put into place in 2018 before repealing the cap or making the deduction more generous. Doing so would disproportionately benefit higher earners, making the tax code more regressive.

6 min read

Historical U.S. Federal Individual Income Tax Rates & Brackets, 1862-2021

How do current federal individual income tax rates and brackets compare historically?

1 min read

Sources of Personal Income, Tax Year 2018

Reviewing the sources of personal income shows that the personal income tax is largely a tax on labor, primarily because our personal income is mostly derived from labor. However, varied sources of capital income also play a role in American incomes. While capital income sources are small compared to labor income, they are still significant and need to be accounted for, both by policymakers trying to collect revenue efficiently and by those attempting to understand the distribution of personal income.

10 min read