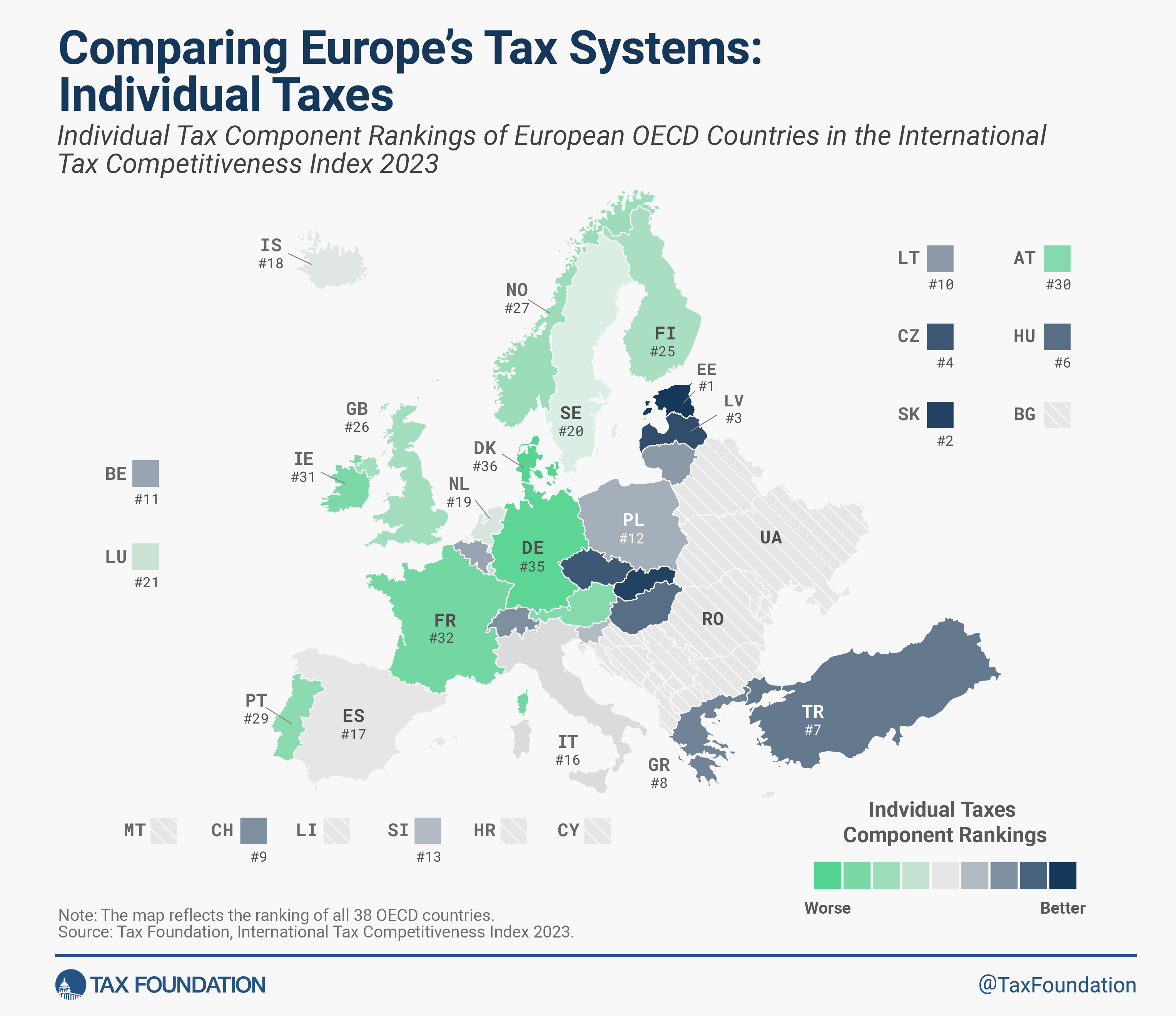

Comparing Europe’s Tax Systems: Individual Taxes

2 min readBy:The recently published International TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Competitiveness Index (ITCI) 2023 compares how well OECD countries promote sustainable economic growth and investment through competitive, neutral tax systems. This article examines how European OECD countries rank on individual taxes, continuing our series on the ITCI’s component rankings.

The ITCI’s individual tax component scores OECD countries on their top marginal individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rates and thresholds, how complex the income tax is, and the tax rates levied on income from capital gains and dividends.

Estonia has the most competitive individual tax system in the OECD for the 10th consecutive year. The Baltic country levies a top marginal income tax rate of 20 percent on wage income, the second lowest rate in the OECD. Estonia applies the top rate at 0.72 times the average national income, making it a relatively flat income tax.

Estonia’s labor tax payments are largely automated, resulting in one of the easiest income tax systems to comply with in the OECD. Estonian policymakers prioritize simplicity, which is consistently evident throughout the tax code.

Due to Estonia’s cash-flow tax on business profits, there is no separate levy on dividend income, setting the dividend tax rate to zero percent. Capital gains are taxed at a rate of 20 percent, close to the OECD average of 19 percent and aligned with its corporate tax.

In contrast, the Danish individual income tax system is the least competitive of all European OECD countries (Chile ranks the lowest in the OECD). Denmark’s top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. of 55.9 percent is applied at 9.6 times the average national income, including an 8 percent labor market tax. Capital gains and dividends are both taxed at top rates of 42 percent, the highest in the OECD.

Click here to see an interactive version of OECD countries’ individual tax rankings, then click on a specific country for more information about the strengths and weaknesses of its tax system.

To see whether a country’s individual tax rank has improved in recent years, check out the table below. To learn more about how we determined these rankings, read our methodology here.

Comparing Individual Tax Systems in the OECD, 2023

Individual Tax Component of the International Tax Competitiveness Index between 2021 and 2023 (All OECD Countries)

| Country | 2021 | 2022 | 2023 | Change from 2022 to 2023 |

|---|---|---|---|---|

| Australia | 15 | 15 | 14 | 1 |

| Austria | 26 | 30 | 30 | 0 |

| Belgium | 14 | 11 | 11 | 0 |

| Canada | 29 | 27 | 24 | 3 |

| Chile | 16 | 38 | 38 | 0 |

| Colombia | 10 | 13 | 15 | -2 |

| Costa Rica | 33 | 33 | 33 | 0 |

| Czech Republic | 4 | 4 | 4 | 0 |

| Denmark | 38 | 36 | 36 | 0 |

| Estonia | 2 | 2 | 1 | 1 |

| Finland | 28 | 25 | 25 | 0 |

| France | 32 | 32 | 32 | 0 |

| Germany | 35 | 35 | 35 | 0 |

| Greece | 9 | 7 | 8 | -1 |

| Hungary | 6 | 6 | 6 | 0 |

| Iceland | 23 | 18 | 18 | 0 |

| Ireland | 36 | 31 | 31 | 0 |

| Israel | 30 | 24 | 23 | 1 |

| Italy | 17 | 16 | 16 | 0 |

| Japan | 34 | 34 | 34 | 0 |

| Korea | 37 | 37 | 37 | 0 |

| Latvia | 3 | 3 | 3 | 0 |

| Lithuania | 11 | 10 | 10 | 0 |

| Luxembourg | 25 | 19 | 21 | -2 |

| Mexico | 20 | 28 | 28 | 0 |

| Netherlands | 21 | 20 | 19 | 1 |

| New Zealand | 5 | 5 | 5 | 0 |

| Norway | 19 | 23 | 27 | -4 |

| Poland | 12 | 14 | 12 | 2 |

| Portugal | 27 | 29 | 29 | 0 |

| Slovak Republic | 1 | 1 | 2 | -1 |

| Slovenia | 13 | 12 | 13 | -1 |

| Spain | 24 | 17 | 17 | 0 |

| Sweden | 22 | 21 | 20 | 1 |

| Switzerland | 8 | 8 | 9 | -1 |

| Turkey | 7 | 9 | 7 | 2 |

| United Kingdom | 31 | 26 | 26 | 0 |

| United States | 18 | 22 | 22 | 0 |

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe