All Related Articles

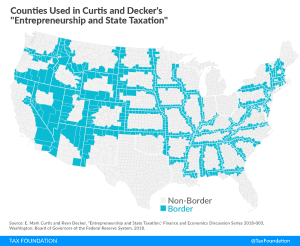

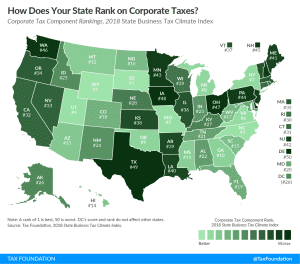

New Federal Reserve Paper: State Corporate Taxes Hurt Entrepreneurship

For every 1 percentage point increase in a state’s corporate tax rate, employment in start-up firms declines 3.7 percent, according to a recent Federal Reserve study.

2 min read

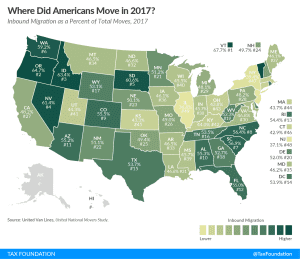

Where Did Americans Move in 2017?

There are many ways that states can compete with one another for residents, and tax rates and structures should certainly be part of the conversation for states looking to attract new residents.

2 min read

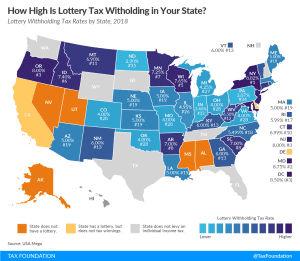

What Percentage of Lottery Winnings Would be Withheld in Your State?

You probably aren’t going to win the Powerball jackpot, but your state already has. Here’s a look at lottery withholding tax rates by state.

2 min read

2018 Tax Brackets

With the passage of the Tax Cuts and Jobs Act (TCJA), many tax brackets, thresholds, and rates will change in 2018. Explore 2018 tax brackets, standard and personal exemptions, earned income tax credit, and more.

4 min read

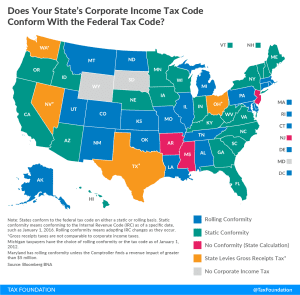

Does Your State’s Corporate Income Tax Code Conform with the Federal Tax Code?

Whether your state’s corporate income tax code conforms to the federal corporate income tax code matters a great deal for how the Tax Cuts and Jobs Act will impact revenue in your state.

2 min read

The Tax Cuts and Jobs Act: The Impacts of Jobs and Incomes by State

Overall, the Tax Cuts and Jobs Act is projected to add 339,000 new jobs to the U.S. economy and boost average after-tax incomes for middle-income families by $649.43. Here’s how jobs and after-tax wages will be impacted in your state.

2 min read

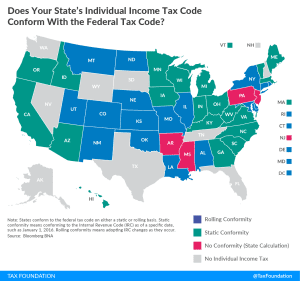

Does Your State’s Individual Income Tax Code Conform with the Federal Tax Code?

As the federal government continues to debate tax reform, states, and many taxpayers, are asking an important question: How is my state’s tax code impacted? The exact impacts won’t be known until the federal bill is finalized, but a good place to start is understanding the issue of conformity.

2 min read

The Senate Tax Cuts and Jobs Act: The Impacts of Jobs and Incomes by State

See the state-by-state impact of the Senate Tax Cuts and Jobs Act for both new jobs and the boost to after-tax incomes for middle-income families.

2 min read

Wireless Taxes and Fees in 2017

A typical American household with four wireless phones paying $100 per month for wireless voice service can expect to pay about $221 per year in wireless taxes, fees, and surcharges.

34 min read

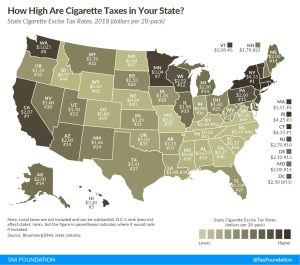

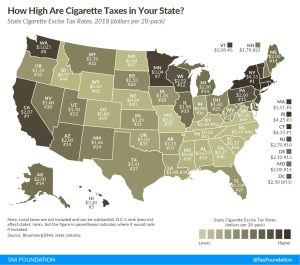

Cigarette Taxes and Cigarette Smuggling by State, 2015

Excessive tax rates on cigarettes approach de facto prohibition in some states, inducing black and gray market movement of tobacco products into high-tax states from low-tax states or foreign sources.

7 min read

Sales Tax Base Broadening: Right-Sizing a State Sales Tax

Due in part to historical accident and also to the proliferation of exemptions, the effectiveness of the state sales tax continues to erode. The median state sales tax, which should apply to all personal consumption, is nonly applied to 23 percent of personal consumption.

25 min read