Key Findings

- Excessive taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates on cigarettes approach de facto prohibition in some states, inducing black and gray market movement of tobacco products into high-tax states from low-tax states or foreign sources.

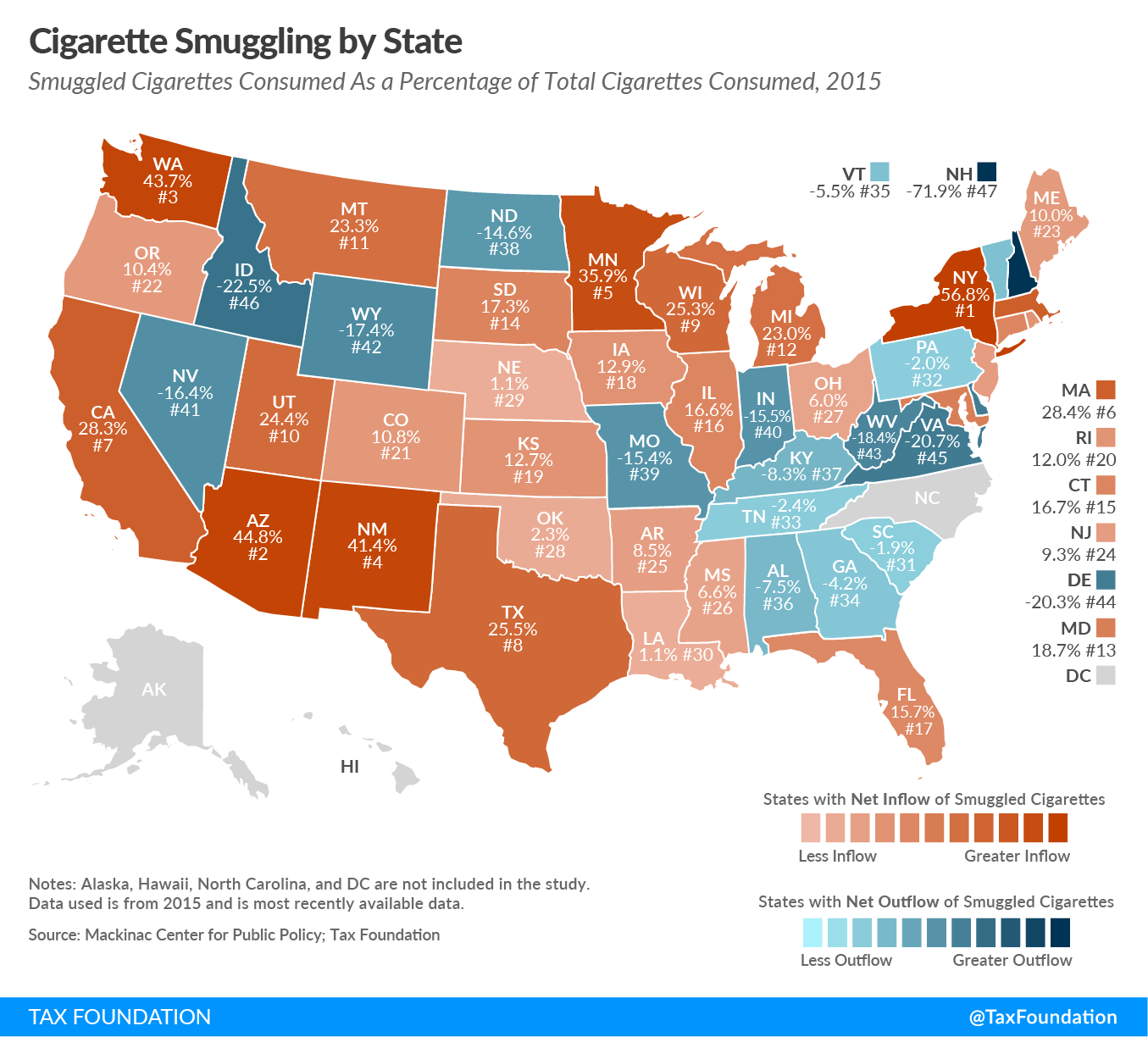

- New York has the highest inbound smuggling activity, with an estimated 56.8 percent of cigarettes consumed in the state deriving from smuggled sources in 2015. New York is followed by Arizona (44.8 percent of consumption smuggled), Washington (43.7 percent), New Mexico (41.4 percent), and Minnesota (35.9 percent).

- New Hampshire has the highest level of outbound smuggling at 71.9 percent of consumption, likely due to its relatively low tax rates and proximity to high-tax states in the northeastern United States. Following New Hampshire is Idaho (22.5 percent outbound smuggling), Virginia (20.7 percent), Delaware (20.3 percent), and West Virginia (18.4 percent).

- Vermont, following a cigarette tax increase from $2.62 to $2.75 in midyear 2014, has seen a decrease in how much is smuggled out of the state from 10.4 percent to 5.5 percent of consumption.

- Cigarette tax rates increased in 31 states and the District of Columbia between 2006 and 2015.

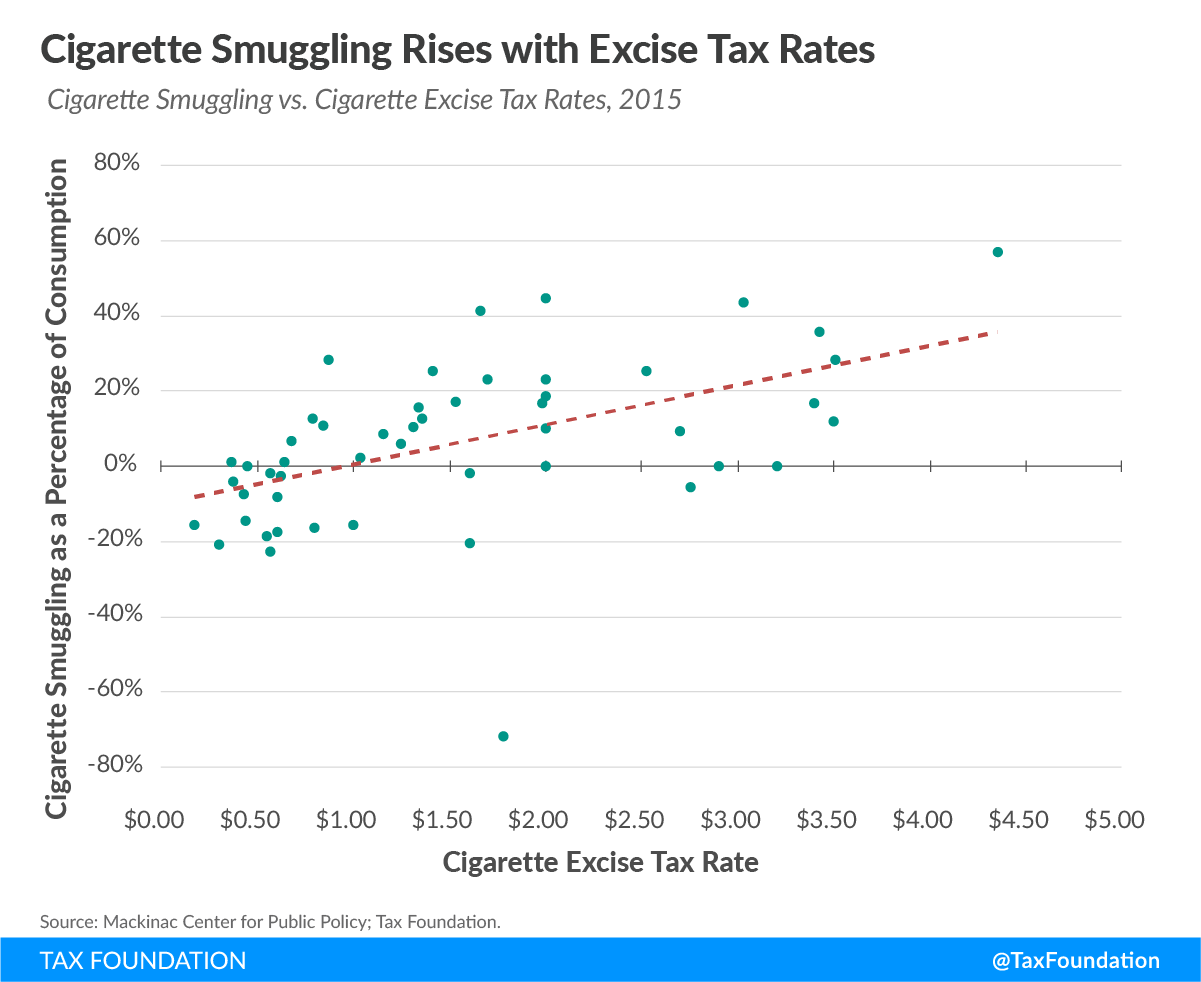

Public policies often have unintended consequences that outweigh their benefits. One consequence of high state cigarette tax rates has been increased smuggling as people procure discounted packs from low-tax states to sell in high-tax states. Growing cigarette tax differentials have made cigarette smuggling both a national problem and in some cases, a lucrative criminal enterprise.

Each year, scholars at the Mackinac Center for Public Policy, a Michigan think tank, use a statistical analysis of available data to estimate smuggling rates for each state.[1] Their most recent report uses 2015 data and finds that smuggling rates generally rise in states after they adopt cigarette tax increases. Smuggling rates have dropped in some states, often, however, where neighboring states have higher cigarette tax rates. Table 1 shows the data for each state, comparing 2015 and 2006 smuggling rates and tax changes.

New York is the highest net importer of smuggled cigarettes, totaling 56.8 percent of total cigarette consumption in the state. New York also has the highest state cigarette tax ($4.35 per pack), not counting the additional local New York City cigarette tax ($1.50 per pack). Smuggling in New York has risen sharply since 2006 (+59 percent), as has the tax rate (+190 percent).

Vermont was a net importer in 2006 (4.5 percent inbound smuggling). But after only modest tax increases from 2006 to 2014 (+46 percent), the state flipped to a net exporter by 2014 (10.4 percent outbound smuggling). However, after raising its cigarette tax by 13 cents in 2015, Vermont’s rate of smuggling cigarettes into other states dropped by almost half (47 percent).

Other peer-reviewed studies provide support for these findings.[2] Recently, a study in Tobacco Control examined littered packs of cigarettes in five Northeast cities, finding that 58.7 percent of packs did not have proper local stamps. The authors estimated 30.5 to 42.1 percent of packs were trafficked.[3]

The study’s authors, LaFaive and Nesbit, note that smuggling comes in different forms: “casual” smuggling, where smaller quantities of cigarettes are purchased in one area and then transported for personal consumption, and “commercial” smuggling, which is large-scale criminal activity that can involve counterfeit state tax stamps, counterfeit versions of legitimate brands, hijacked trucks, or officials turning a blind eye.[4]

The Mackinac Center has cited numerous examples over the many editions of this report, including stories of a Maryland police officer running illicit cigarettes while on duty, a Virginia man hiring a contract killer over a cigarette smuggling dispute, and prison guards caught smuggling cigarettes into prisons.

Policy responses in recent years have included banning common carrier delivery of cigarettes,[5] greater law enforcement activity on interstate roads,[6] differential tax rates near low-tax jurisdictions,[7] and cracking down on tribal reservations that sell tax-free cigarettes.[8] However, the underlying problem remains: high cigarette taxes amount to a “price prohibition” of the product in many U.S. states.[9]

|

Note: Alaska, Hawaii, North Carolina, and the District of Columbia are not included in the study. Cigarette tax rates have changed for some states since 2015. Source: Mackinac Center for Public Policy; Tax Foundation. |

||||||

| State | 2015 Tax Rate (per pack) | 2015 Consumption Smuggled (positive is inflow, negative is outflow) | 2006 Consumption Smuggled (positive is inflow, negative is outflow) | 2015 Smuggling Ranking (1 is most smuggling, 50 least) | Smuggling Rank Change Since 2006 (e.g., NY changed from #5 to #1, so rank changed +4) | Cigarette Tax Rate Change, 2006-2015 |

|---|---|---|---|---|---|---|

| Alabama | $0.425 | -7.5% | +0.5% | 36 | -2 | No Change |

| Alaska | $2.00 | N/A | N/A | N/A | N/A | +25% |

| Arizona | $2.00 | +44.8% | +32.1% | 2 | +5 | +69% |

| Arkansas | $1.15 | +8.5% | +3.9% | 25 | +6 | +95% |

| California | $0.87 | +28.3% | +34.6% | 7 | -1 | No Change |

| Colorado | $0.84 | +10.8% | +16.6% | 21 | -7 | No Change |

| Connecticut | $3.40 | +16.7% | +12.3% | 15 | +7 | +125% |

| Delaware | $1.60 | -20.3% | -61.5% | 44 | +3 | +191% |

| District of Columbia | $2.90 | N/A | N/A | N/A | N/A | +190% |

| Florida | $1.339 | +15.7% | +6.9% | 17 | +9 | +294% |

| Georgia | $0.37 | -4.2% | -0.3% | 34 | +1 | No Change |

| Hawaii | $3.20 | N/A | N/A | N/A | N/A | +129% |

| Idaho | $0.57 | -22.5% | -6.0% | 46 | -7 | No Change |

| Illinois | $1.98 | +16.6% | +13.7% | 16 | +1 | +102% |

| Indiana | $0.995 | -15.5% | -10.8% | 40 | +3 | +79% |

| Iowa | $1.36 | +12.9% | +2.4% | 18 | +15 | +278% |

| Kansas | $0.79 | +12.7% | +18.4% | 19 | -7 | No Change |

| Kentucky | $0.60 | -8.3% | -6.4% | 37 | +3 | +100% |

| Louisiana | $0.36 | +1.1% | +6.4% | 30 | -3 | No Change |

| Maine | $2.00 | +10.0% | +16.6% | 23 | -8 | No Change |

| Maryland | $2.00 | +18.7% | +10.4% | 13 | +11 | +100% |

| Massachusetts | $3.51 | +28.4% | +17.5% | 6 | +7 | +132% |

| Michigan | $2.00 | +23.0% | +31.0% | 12 | -3 | No Change |

| Minnesota | $3.43 | +35.9% | +23.6% | 5 | +5 | +130% |

| Mississippi | $0.68 | +6.6% | -1.7% | 26 | +11 | +36% |

| Missouri | $0.17 | -15.4% | -11.3% | 39 | +5 | No Change |

| Montana | $1.70 | +23.3% | +31.2% | 11 | -3 | No Change |

| Nebraska | $0.64 | +1.1% | +12.0% | 29 | -6 | No Change |

| Nevada | $0.80 | -16.4% | +4.8% | 41 | -12 | No Change |

| New Hampshire | $1.78 | -71.9% | -29.7% | 47 | -1 | +123% |

| New Jersey | $2.70 | +9.3% | +38.4% | 24 | -21 | +13% |

| New Mexico | $1.66 | +41.4% | +39.9% | 4 | -2 | +82% |

| New York | $4.35 | +56.8% | +35.8% | 1 | +4 | +190% |

| North Carolina | $0.45 | N/A | N/A | N/A | N/A | +50% |

| North Dakota | $0.44 | -14.6% | +3.0% | 38 | -6 | No Change |

| Ohio | $1.25 | +6.0% | +13.1% | 27 | -8 | No Change |

| Oklahoma | $1.03 | +2.3% | +9.6% | 28 | -3 | No Change |

| Oregon | $1.31 | +10.4% | +21.1% | 22 | -11 | +11% |

| Pennsylvania | $1.60 | -2.0% | +12.9% | 32 | -11 | +19% |

| Rhode Island | $3.50 | +12.0% | +43.2% | 20 | -19 | +42% |

| South Carolina | $0.57 | -1.9% | -8.1% | 31 | +10 | +14% |

| South Dakota | $1.53 | +17.3% | +5.3% | 14 | +14 | +189% |

| Tennessee | $0.62 | -2.4% | -4.5% | 33 | +5 | +210% |

| Texas | $1.41 | +25.5% | +14.8% | 8 | +8 | +244% |

| Utah | $1.70 | +24.4% | +12.9% | 10 | +10 | +145% |

| Vermont | $2.75 | -5.5% | +4.5% | 35 | -5 | +53% |

| Virginia | $0.30 | -20.7% | -23.5% | 45 | +0 | No Change |

| Washington | $3.025 | +43.7% | +38.2% | 3 | +1 | +49% |

| West Virginia | $0.55 | -18.4% | -8.4% | 43 | -1 | No Change |

| Wisconsin | $2.52 | +25.3% | +13.1% | 9 | +9 | +227% |

| Wyoming | $0.60 | -17.4% | -0.6% | 42 | +0 | No Change |

Figure 1.

Figure 2.

[1] See, e.g., Michael D. LaFaive, Todd Nesbit, and Scott Drenkard, “Cigarette Taxes & Smuggling (2015 data),” Mackinac Center for Public Policy, 2017, https://www.mackinac.org/smokes; Michael D. LaFaive, Todd Nesbit, and Scott Drenkard, “Cigarette Taxes and Smuggling: A 2016 Update,” Mackinac Center for Public Policy, Dec. 19, 2016, https://www.mackinac.org/s2016-09; Michael D. LaFaive, Todd Nesbit, and Scott Drenkard, “Cigarette Smugglers Still Love New York and Michigan, but Illinois Closing In,” Mackinac Center for Public Policy, Jan. 14, 2015, http://www.mackinac.org/20900; Michael D. LaFaive, and Todd Nesbit, “Cigarette Smuggling Still Rampant in Michigan, Nation,” Mackinac Center for Public Policy, Feb. 17, 2014, http://www.mackinac.org/19725; Michael D. LaFaive, and Todd Nesbit, “Higher Cigarette Taxes Create Lucrative, Dangerous Black Market,” Mackinac Center for Public Policy, Jan. 8, 2013, http://www.mackinac.org/18128; Michael D. LaFaive and Todd Nesbit, “Cigarette Taxes and Smuggling 2010: An Update of Earlier Research,” Mackinac Center for Public Policy, Dec. 17, 2010, http://www.mackinac.org/14210; Michael D. LaFaive, Patrick Fleenor, and Todd Nesbit, “Cigarette Taxes and Smuggling: A Statistical Analysis and Historical Review,” Mackinac Center for Public Policy7, Dec. 2, 2008, http://www.mackinac.org/10005.

[2] See, e.g., Michael F. Lovenheim, “How Far to the Border?: The Extent and Impact of Cross-Border Casual Cigarette Smuggling,” National Tax Journal, Vol. LXI, no. 1, March 2008, https://www.ntanet.org/NTJ/61/1/ntj-v61n01p7-33-how-far-border-extent.pdf?v=%CE%B1&r=04833355782549953; R. Morris Coats, “A Note on Estimating Cross-Border Effects of State Cigarette Taxes,” National Tax Journal, Vol. 48, no. 4, December 1995, 573-84, https://www.ntanet.org/NTJ/48/4/ntj-v48n04p573-84-note-estimating-cross-border.pdf?v=%CE%B1&r=46492996768229045; Mark Stehr, “Cigarette tax avoidance and evasion,” Journal of Health Economics, Vol. 24, no. 2, March 2005, 277-97, http://www.sciencedirect.com/science/article/pii/S0167629604001225.

[3] Kevin C. Davis et. al., “Cigarette trafficking in five northeastern US cities,” Tobacco Control, Dec. 11, 2013, http://tobaccocontrol.bmj.com/content/early/2013/12/11/tobaccocontrol-2013-051244.

[4] See, e.g., Scott Drenkard, “Tobacco Taxation and Unintended Consequences: U.S. Senate Hearing on Tobacco Taxes Owed, Avoided, and Evaded,” Tax Foundation, July 29, 2014, http://taxfoundation.org/article/tobacco-taxation-and-unintended-consequences-us-senate-hearing-tobacco-taxes-owed-avoided-and-evaded.

[5] See, e.g., Curtis S. Dubay, “UPS Decision Unlikely to Stop Cigarette Smuggling,” Tax Foundation, Oct. 25, 2005, http://taxfoundation.org/blog/ups-decision-unlikely-stop-cigarette-smuggling.

[6] See, e.g., Gary Fields, “States Go to War on Cigarette Smuggling,” The Wall Street Journal, July 20, 2009, http://www.wsj.com/articles/SB124804682785163691.

[7] See, e.g., Mark Robyn, “Border Zone Cigarette Taxation: Arkansas’s Novel Solution to the Border Shopping Problem,” Tax Foundation, April 9, 2009, http://taxfoundation.org/article/border-zone-cigarette-taxation-arkansass-novel-solution-border-shopping-problem.

[8] See, e.g., Joseph Bishop-Henchman, “New York Governor Signs Law to Tax Cigarettes Sold on Tribal Lands,” Tax Foundation, Dec. 16, 2008, http://taxfoundation.org/blog/new-york-governor-signs-law-tax-cigarettes-sold-tribal-lands.

[9] See Patrick Fleenor, “Tax Differentials on the Interstate Smuggling and Cross-Border Sales of Cigarettes in the United States,” Tax Foundation, Oct. 1, 1996, http://taxfoundation.org/article/tax-differentials-interstate-smuggling-and-cross-border-sales-cigarettes-united-states.

Share this article