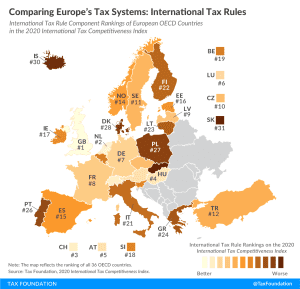

Comparing Europe’s Tax Systems: International Tax Rules

International tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of a country’s tax code.

3 min read

International tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of a country’s tax code.

3 min read

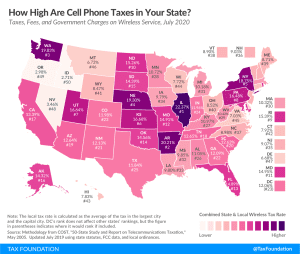

A typical American household with four phones on a “family share” wireless plan can expect to pay about $270 per year (or 22 percent of their cell phone bill) in taxes, fees, and surcharges.

36 min read

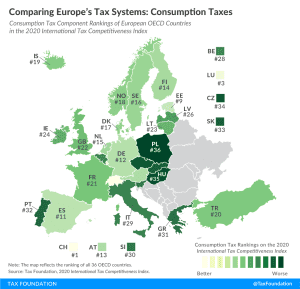

How do consumption tax codes compare among European OECD countries? Explore our new map to see how consumption tax systems in Europe compare.

2 min read

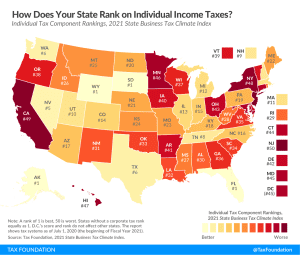

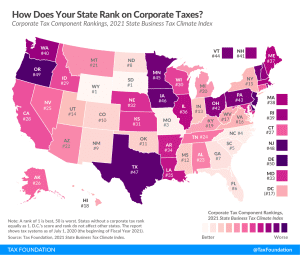

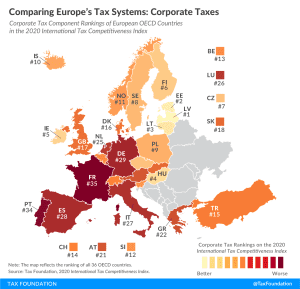

The corporate tax component of our Index measures each state’s principal tax on business activities. Most states levy a corporate income tax on a company’s profits (receipts minus most business expenses, including compensation and the cost of goods sold), while some states levy gross receipts taxes, which allow few or no deductions for a company’s expenses.

2 min read

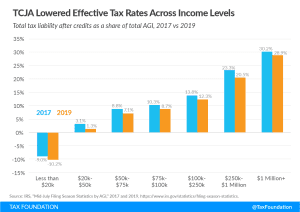

The latest IRS data continues to illustrate that the net effect of the Tax Cuts and Jobs Act was to reduce effective tax rates across income groups. In 2019, the TCJA again expanded the use of several deductions and credits, made the standard deduction more favorable than itemizing, and lowered taxes for most taxpayers.

4 min read

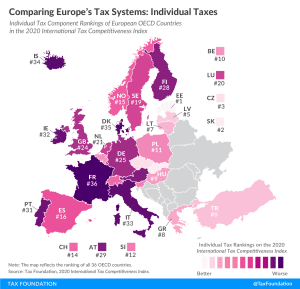

How do individual income tax codes compare among European OECD countries? Explore our new map to see how individual income tax systems in Europe compare.

3 min read

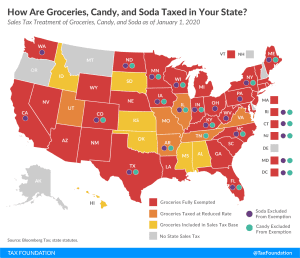

Even in 2020, jack-o’-lanterns and fake skeletons have popped up in neighborhoods as they do every October, although Halloween may look and play out differently this time around.

4 min read

The IRS recently released the new 2021 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

6 min read

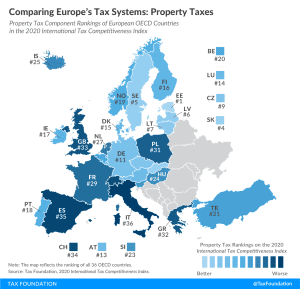

A tax code that is competitive and neutral promotes sustainable economic growth and investment while raising sufficient revenue for government priorities.

3 min read

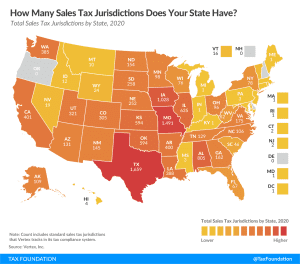

Following the Wayfair decision, states’ move to tax online sales has increased the importance of simplicity in sales tax systems, as sellers now have to deal with differing regulations in multiple states. There are over 11,000 standard sales tax jurisdictions in the United States in 2020

2 min read

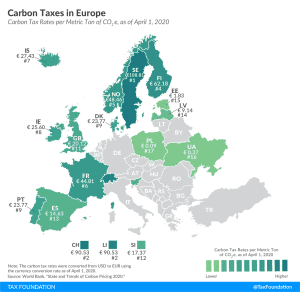

17 European countries have implemented a carbon tax, ranging from less than €1 per metric ton of carbon emissions in Ukraine and Poland to over €100 in Sweden.

3 min read

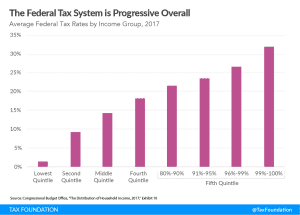

Contrary to the perceptions of some, new data indicate that (1) income earned after taxes and transfers has increased over the past several decades for all income groups; (2) the federal tax system is increasingly progressive; and (3) that system relies heavily on higher earners to raise revenue for government services and means-tested transfers.

3 min read

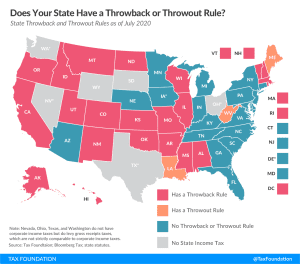

State throwback and throwout rules may not be widely understood, but they have a notable impact on business location and investment decisions and reduce economic efficiency for the states which impose such rules.

3 min read

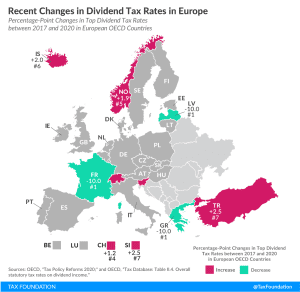

Over the last three years, eight European OECD countries have made changes to their dividend tax rates. Iceland, Norway, Slovenia, Switzerland, and Turkey increased their rates, each between roughly one and three percentage points. France, Greece, and Latvia cut their rates by 10 percentage points.

2 min read

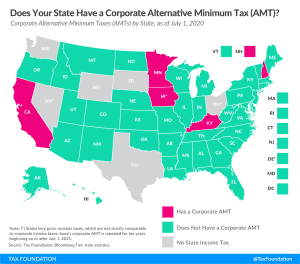

Five states currently collect corporate AMTs: California, Iowa, Kentucky, Minnesota, and New Hampshire. This is a significant drop from the eight states that levied AMTs in tax year 2017.

2 min read

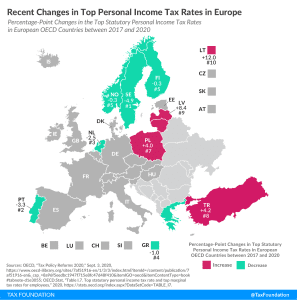

Ten European OECD countries recently changed their top personal income tax rates. Of the ten countries, six cut their top personal income tax rates while the other four raised their top rates.

4 min read

The pandemic precipitated the steepest decline in economic output and employment in recent history, which is leading to a drop in tax revenue. At the same time, the federal response to the crisis is producing a large increase in spending. This combination will cause the federal budget deficit to spike.

5 min read

State tax revenue collections were down 5.5 percent in FY 2020, driven by a dismal final quarter (April through June) as states began to feel the impact of the COVID-19 pandemic. While these early losses are certainly not desirable, they are manageable and far better than many feared.

16 min read