All Related Articles

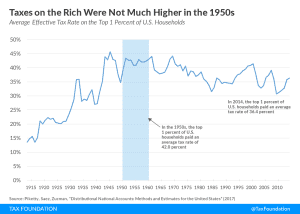

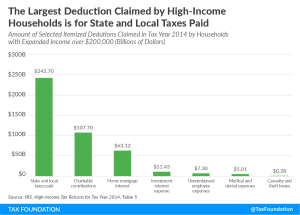

Taxes on the Rich Were Not That Much Higher in the 1950s

The top 1 percent of Americans today do not face an unusually low tax burden, by historical standards. In the 1950s, when the top marginal income tax rate reached 92 percent, the top 1 percent of taxpayers paid an effective rate of only 16.9 percent.

4 min read

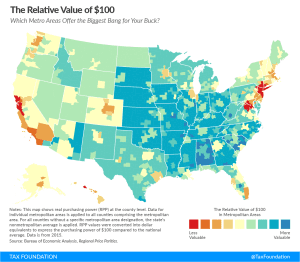

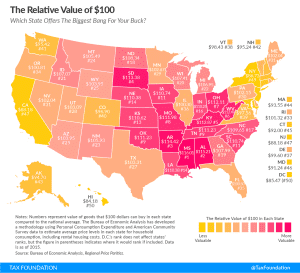

Real Value of $100 by State, 2017

Prices for the same goods are often much cheaper in some states than others. Check out our new map to see what the real value of $100 is in your state.

4 min read

Sales Tax Holidays by State, 2017

Sales tax holidays have enjoyed political success, but rather than providing a valuable tax cut or a boost to the economy, they impose serious costs on consumers and businesses without providing offsetting benefits.

43 min read

State Inheritance and Estate Taxes: Rates, Economic Implications, and the Return of Interstate Competition

Estate and inheritance taxes reduce investment, discourage business expansion, and sometimes drive wealthy taxpayers out of state. It’s little wonder that states are under pressure to reduce or eliminate them.

44 min read

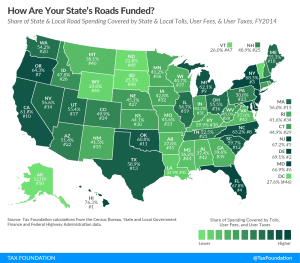

Road Taxes and Funding by State, 2017

2 min read

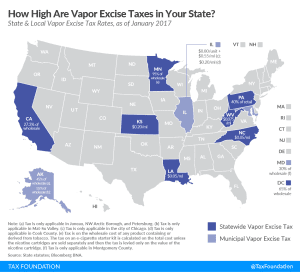

Vaping Taxes by State, 2017

2 min read

State Tax Changes Taking Effect July 1, 2017

While most states enact tax changes at the beginning of the calendar year, a number of them implement changes at the beginning of the fiscal year. Eight states have tax changes that will take effect on July 1, 2017, the beginning of the 2018 fiscal year.

8 min read

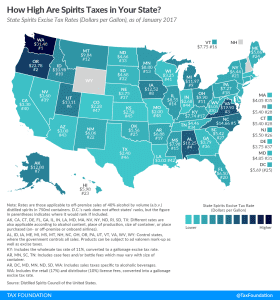

Distilled Spirits Taxes by State, 2017

2 min read

Unpacking the State and Local Tax Toolkit: Sources of State and Local Tax Collections

There are a number of sources of state and local tax collections each with important implications for revenue stability and economic growth. Which taxes does your state and/or locality rely on most?

22 min read

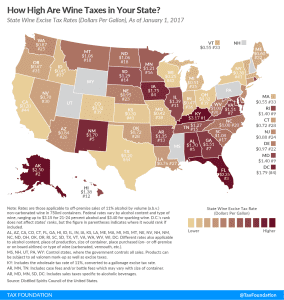

How High Are Wine Taxes In Your State?

1 min read

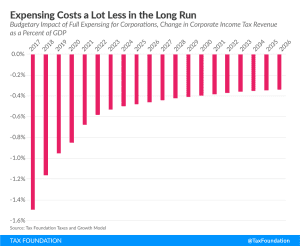

Full Expensing Costs Less Than You’d Think

Full expensing could grow the long-run size of the U.S. economy by 4.2 percent, which would lead to 3.6 percent higher wages and 808,000 full-time jobs. What’s more, it wouldn’t cost as much revenue as some think.

12 min read

Ohio Illustrated: A Visual Guide to Taxes & The Economy

This new chart book cuts through the complexity and gives you a broad perspective of Ohio’s overall economy and tax system. The result is a powerful diagnostic tool you can use to identify your state’s unique strengths and weaknesses.