All Related Articles

Tax Expenditures Taken by Small Businesses in the Federal Tax Code

The expenditures offered to small businesses are not created equal. We review the tax expenditures small businesses rely on most.

3 min read

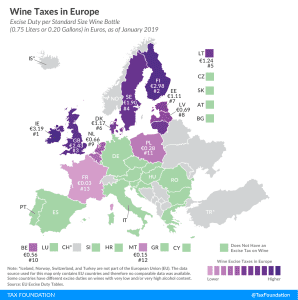

Wine Taxes in Europe

1 min read

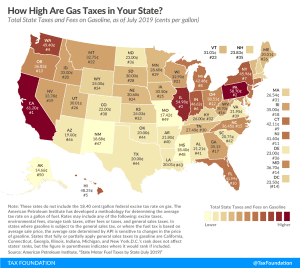

Gas Tax Rates by State, 2019

3 min readLocal Income Taxes in 2019

13 min read

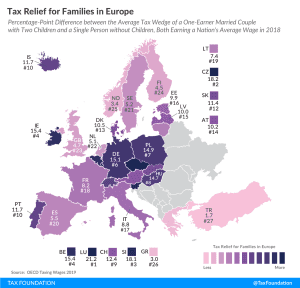

Tax Relief for Families in Europe

2 min read

Sales Tax Holidays by State, 2019

If a state must offer a “holiday” from its tax system, it is an implicit recognition that the state’s tax system is uncompetitive.

44 min read

A Preliminary Look at 2018 Tax Data

Initial 2018 IRS tax return data shows that the TCJA expanded the use of several credits and deductions, made the standard deduction more favorable than itemizing, reduced tax refunds, and lowered taxes for most Americans.

4 min read

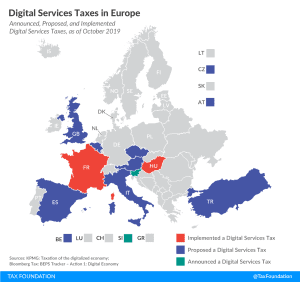

Digital Services Taxes in Europe, 2019

4 min read

State Tax Changes as of July 1, 2019

15 min read

State and Local Sales Tax Rates, Midyear 2019

The role of competition in setting sales tax rates is often overlooked. One study shows that per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s, while per capita sales in border counties in Vermont have remained stagnant.

13 min read

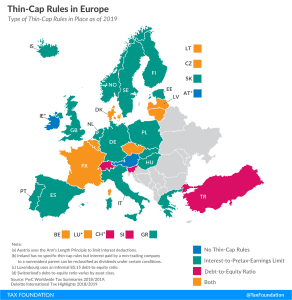

Thin-Cap Rules in Europe

2 min read

Vaping Taxes by State, 2019

3 min read

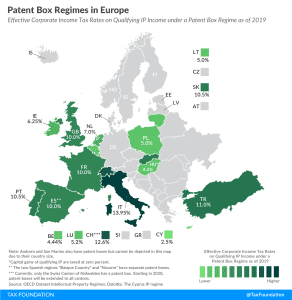

Patent Box Regimes in Europe, 2019

4 min read

Distilled Spirits Taxes by State, 2019

3 min read