Lawmakers May Vote on Making Key Provisions of the TCJA Permanent

The Tax Cuts and Jobs Act improved the US tax code, but key provisions are only temporary. Now Congress may vote to ensure those tax breaks are permanent.

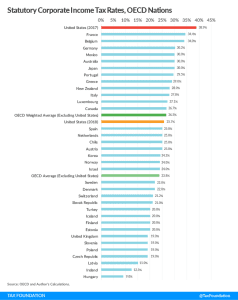

3 min readAcademic studies show that higher corporate tax rates depress worker wages and lead to fewer jobs. An Organisation for Co-operation and Development (OECD) study has found that the corporate tax is the least efficient and most harmful way for governments to raise revenue.

The Tax Cuts and Jobs Act improved the US tax code, but key provisions are only temporary. Now Congress may vote to ensure those tax breaks are permanent.

3 min read

The Trump administration’s plan to levy $60 billion in tariffs on Chinese products could negate 20 percent of the benefits of the recently adopted tax cuts.

3 min read

The Tax Cuts and Jobs Act was meant to boost growth and deter corporate inversions. What does it mean that an Ohio company is still moving its HQ to the UK?

5 min read

In the wake of the Tax Cuts and Jobs Act, Maine is considering conformity legislation that would improve the competitiveness of the state’s tax code.

3 min read

In response to federal tax reform, Georgia is poised to reform its own tax code in a way that would make the state more competitive with its neighbors.

3 min read

The Tax Cuts and Jobs Act significantly reduced the federal statutory corporate income tax rate. When combined with state and local taxes, it put the U.S.’s corporate tax rate in line with the average among OECD nations.

4 min read

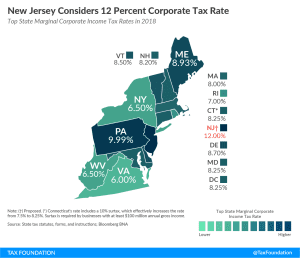

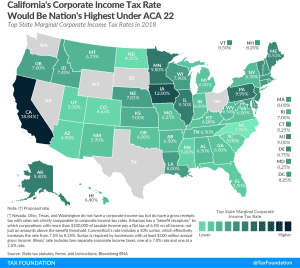

State corporate income tax rates range from 3 percent in North Carolina to 12 percent in Iowa. Download and compare each state’s 2018 rates and brackets here.

6 min read

While other states are working to promote growth, Pennsylvania is headed in the opposite direction with a policy that dramatically overtaxes investment.

4 min read