All Related Articles

Interest Deductibility – Issues and Reforms

Interest deductibility creates holes in the tax base, distorts corporate investment strategies, and contributes to a potentially dangerous macroeconomic environment of overleveraging.

17 min read

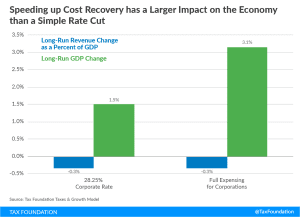

Why Full Expensing Encourages More Investment than A Corporate Rate Cut

If economic growth is the goal of your tax reform plan, moving towards full expensing and a cash-flow tax is the most efficient way to spur investment,

5 min read

Competitiveness Impact of Tax Reform for the United States

U.S. taxes on new business investment are uncompetitive globally. While corporate tax rate reductions would have a significant impact on competitiveness, expensing proposals currently being considered would add much more grease to make the wheels turn in the U.S. economy.

16 min read

Tax Freedom Day 2017 is April 23rd

Tax Freedom Day® is the day when the nation as a whole has earned enough money to pay its total tax bill for the year. This year, Tax Freedom Day falls on April 23rd, 113 days into the year.

4 min read