All Related Articles

Tax Reform Moving Quickly in Georgia

In response to federal tax reform, Georgia is poised to reform its own tax code in a way that would make the state more competitive with its neighbors.

3 min read

Idaho Tax Reform Bill Advances

3 min read

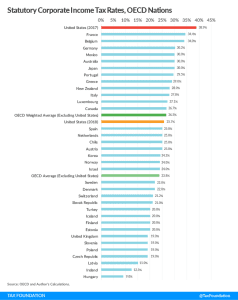

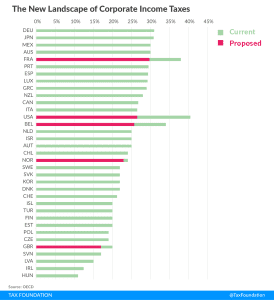

The United States’ Corporate Income Tax Rate is Now More in Line with Those Levied by Other Major Nations

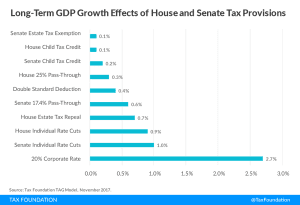

The Tax Cuts and Jobs Act significantly reduced the federal statutory corporate income tax rate. When combined with state and local taxes, it put the U.S.’s corporate tax rate in line with the average among OECD nations.

4 min read

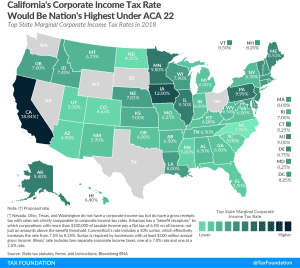

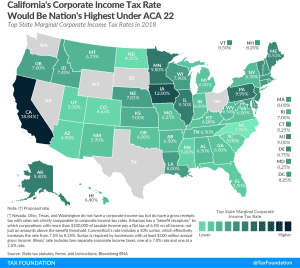

State Corporate Income Tax Rates and Brackets, 2018

State corporate income tax rates range from 3 percent in North Carolina to 12 percent in Iowa. Download and compare each state’s 2018 rates and brackets here.

6 min read

Pennsylvania’s New Penalties on Investment Could Scare off Amazon, Others

While other states are working to promote growth, Pennsylvania is headed in the opposite direction with a policy that dramatically overtaxes investment.

4 min read

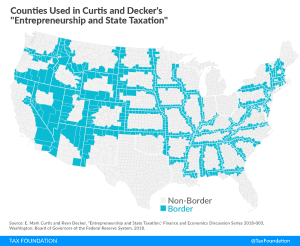

New Federal Reserve Paper: State Corporate Taxes Hurt Entrepreneurship

For every 1 percentage point increase in a state’s corporate tax rate, employment in start-up firms declines 3.7 percent, according to a recent Federal Reserve study.

2 min read

Trade and Capital Flow Consequences of Tax Reform: A Means to a Faster Expansion of U.S. Capital Formation and Employment

The tax bill will boost investment and incomes in the United States, and make the country a better place to locate production and hiring. There will be a transitory rise in the trade deficit, but in the context of a stronger, faster-growing economy.

5 min read

Statement on Final Passage of the Tax Cuts and Jobs Act

With the Tax Cuts and Jobs Act, Congress took a historic step toward rewriting the U.S. tax code for the first time since 1986.

1 min read

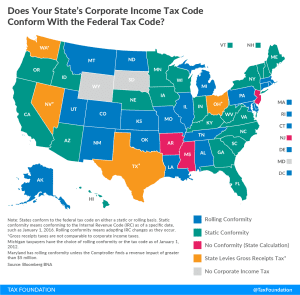

Does Your State’s Corporate Income Tax Code Conform with the Federal Tax Code?

Whether your state’s corporate income tax code conforms to the federal corporate income tax code matters a great deal for how the Tax Cuts and Jobs Act will impact revenue in your state.

2 min read

Tax Cuts and Jobs Act Puts the U.S. with its International Peers

If enacted, the Tax Cuts and Jobs Act would put the U.S. corporate tax rate more in line with its international peers at 13th highest of 35 OECD countries.

2 min read

Trends in State Tax Policy, 2018

In 2018, trends to watch in state tax policy will include reductions in corporate tax rates, the spread of gross receipts taxes, new and lower taxes on marijuana, estate tax repeal, a wait-and-see approach on federal tax reform, and more.

16 min read