More Countries Target the Property Tax

A recent OECD report reveals a tendency towards higher property taxes, often in the form of base broadening, tax rate increases, or both.

5 min read

A recent OECD report reveals a tendency towards higher property taxes, often in the form of base broadening, tax rate increases, or both.

5 min read

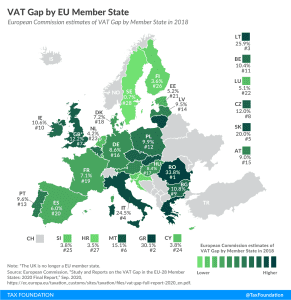

Just as COVID-19 is putting pressure on other sources of revenue, the loss of VAT revenues resulting from the crisis will force governments to evaluate their VAT systems.

3 min read

What does the Senate Republican coronavirus package do? Are there better ways of providing short-run relief without making the tax code more complicated?

6 min read

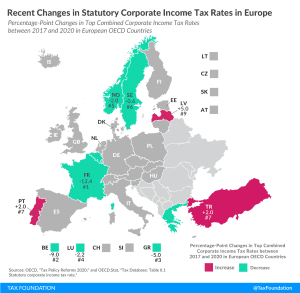

Over the last two decades, corporate income tax rates have declined around the world. Our new map shows the most recent changes in corporate tax rates in European OECD countries, comparing how combined statutory corporate income tax rates have changed between 2017 and 2020.

3 min read

If the goal of the Biden campaign is to bring new investment and jobs to the U.S., it is doubtful that these new tax rules will contribute to that goal.

4 min read

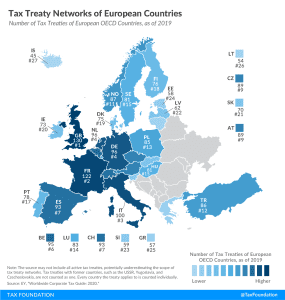

Tax treaties usually provide mechanisms to eliminate double taxation and can provide certainty and stability for taxpayers and encourage foreign investment and trade. A broad network of tax treaties contributes to the competitiveness of an economy.

1 min read

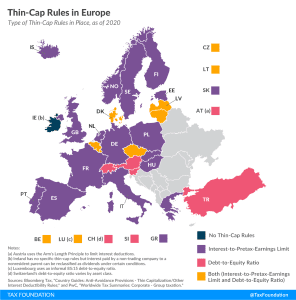

To discourage a certain form of international debt shifting, many countries have implemented so-called thin-capitalization rules (thin-cap rules), which limit the amount of interest a multinational business can deduct for tax purposes.

4 min read

Broad themes of the president’s agenda include providing tax relief to individuals and tax credits to businesses that engage in desired activities, while the status of expiring TCJA provisions and tariffs seems uncertain.

4 min read

Biden’s tax vision is twofold: higher taxes on high-income earners and businesses paired with more generous provisions for specific activities and households.

4 min read

One under-discussed part of the CARES Act, passed in March to provide economic relief during the COVID-19 epidemic, is a correction to a drafting error in the Tax Cuts and Jobs Act of 2017, often known as the “retail glitch.”

3 min read

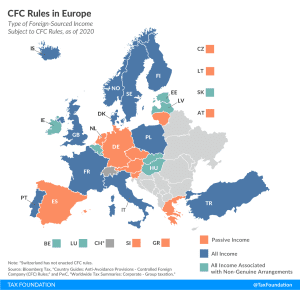

To prevent businesses from minimizing their tax liability by taking advantage of cross-country differences in taxation, countries have implemented various anti-tax avoidance measures, one known as Controlled Foreign Corporation (CFC) rules.

5 min read

In recent months, several countries have introduced accelerated depreciation as a measure to incentivize private investment, including Australia, Austria, Germany, and New Zealand. There are various ways of how this policy has been implemented in the respective countries, largely depending on the existing standard depreciation schedules.

5 min read

Value-added taxes (VAT) are traditionally considered regressive, meaning they place a disproportionate burden on low-income taxpayers. However, a recent OECD study used household expenditures micro-data from 27 OECD countries to reassess this conclusion.

5 min read

Tax credits like the ones approved in the Nebraska bill may help legislators buy some time to work toward a more permanent solution, but they are not, in and of themselves, an effective means of providing lasting relief or generating long-term economic growth.

7 min readTax treatment can affect investment decisions. Extending expensing treatment (full and immediate deductions) to all forms of capital investment, human and physical, would help facilitate sustainable long-run economic growth.

2 min read

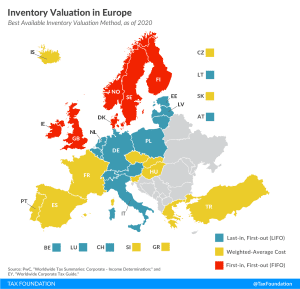

The method by which a country allows businesses to account for inventories can significantly impact a business’s taxable income. When prices are rising, as is usually the case due to factors like inflation, LIFO is the preferred method because it allows inventory costs to be closer to true costs at the time of sale.

2 min read

Nevada is not alone in its need to find revenue, but it should take care not to embrace bad tax policy in the process. Significant rate increases, a shift in the tax base, and provisions which make it easier to hike taxes than to cut them would heavily burden the mining industry in the state.

3 min read

What tax policy ideas did Harris propose along the campaign trail, and how do they differ from Biden’s plan?

4 min read

The fiscal response to the COVID-19 pandemic will require policymakers to consider what revenue resources should be used to fill budget gaps. Tax policy experts have proposed wealth taxes, (global) corporate minimum taxes, excess profits taxes, and digital taxes as opportunities for governments to raise new revenues.

20 min read