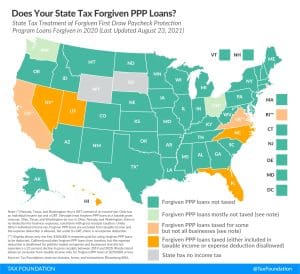

Does the American Rescue Plan Ban State Tax Cuts?

Senate amendments to the American Rescue Plan Act prohibit using any of the $350 billion in State and Local Fiscal Recovery Funds to cut taxes, but many are concerned that states which accept the funds could be prohibited from implementing tax cuts between now and 2024—an astonishing level of federal interference in states’ fiscal affairs.

8 min read