Property Tax Relief & Reform

Lawmakers can constrain the growth of property taxes without creating new problems. But the details matter.

Our experts provide leading tax policy research, analysis, and commentary of the latest state tax trends, including state income tax reform and relief, property tax relief, reforms related to remote work, and various emerging excise taxes.

Lawmakers can constrain the growth of property taxes without creating new problems. But the details matter.

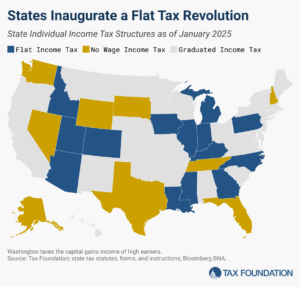

From 2021-2024, within the span of 3.5 years, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

Gas tax revenues have decoupled from road expenses and have been unable to support road funding in recent years. As such, states nationwide are exploring ways to supplement or replace gas tax revenues.

8 min read

The trend of tax exemptions on tips, overtime, and bonuses may sound like a win for workers, but it is a shortsighted fix with long-term drawbacks.

11 min read

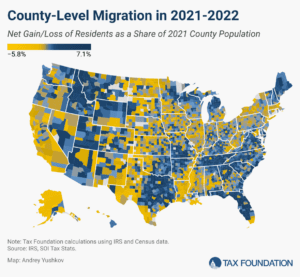

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

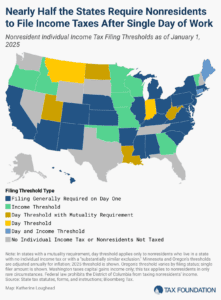

As a rule, an individual’s income can be taxed both by the state in which the taxpayer resides and by the state in which the taxpayer’s income is earned.

52 min read

States are unprepared for the ongoing shift to remote and flexible work arrangements, or for the industries and activities of today, to say nothing of tomorrow. In some states, moreover, existing tax provisions exacerbate the impact of high inflation and contribute to the supply chain crisis.

40 min read

The sales tax is the second-largest source of state tax revenue and an important source of local tax revenue, but decades of base erosion threaten the tax’s share of overall revenue and have prompted years of countervailing rate increases.

72 min read

Consumers legally wagered more than $100 billion on sporting contests in 2023, creating more than $1.8 billion in state revenue. Sports betting is now legal in 38 states and DC, and the landscape is rapidly evolving.

18 min read

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

President’s Trump’s policies would throw high-tax states a life raft as they swim against the tide—before potentially hitting all states with a tariff-induced economic tsunami that could force lawmakers’ hands and reverse recent tax relief.

Rhode Island lawmakers are debating raising the state’s top income tax rate. Though billed as a tax hike on high earners, the consequences would manifest across the state’s entire economy—creating a risk that Rhode Island will tax its way into uncompetitiveness.

Six states and DC assess a state-level non-UI payroll tax in addition to their mandatory federal UI payroll tax.

6 min read

With such important changes to Montana’s property tax system at stake, it’s important that lawmakers get the details right.

5 min read

As home values have spiked, Florida and other states are weighing elimination of property taxes.

The economic literature overwhelmingly suggests that an income tax increase of this magnitude would negatively affect economic growth and opportunity in Rhode Island.

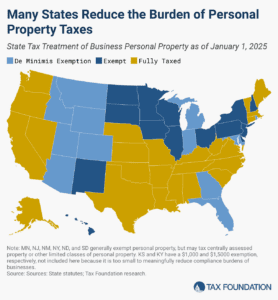

Does your state have a small business exemption for machinery and equipment?

4 min read

Hemp, intoxicating or otherwise, is a growing market that needs to be addressed with tax policy. A well-designed tax will generate tax revenues for states while improving public health by shifting consumers away from illicit markets.

5 min read

Policymakers may consider a broader, more comprehensive property tax reform that creates a uniform system with effective levy limits to prevent unauthorized increases in property tax revenues and, in most cases, property tax bills.

4 min read

One area of the tax code in which extreme complexity and low compliance go hand-in-hand—and where reform is desperately needed—is in states’ nonresident individual income tax filing and withholding laws.

7 min read

The flat tax trend is gaining momentum nationwide, and Missouri lawmakers are right to identify income tax rate reductions as particularly pro-growth.

4 min read

The trend of tax exemptions on tips, overtime, and bonuses may sound like a win for workers, but it is a shortsighted fix with long-term drawbacks.

11 min read

North Dakota’s financial position provides it with a rare capacity to deliver meaningful property tax relief. However, policymakers must balance immediate relief with fiscal sustainability and ensure that local governments remain adequately funded in the years ahead.

5 min read

If adopted, these reforms would make Kansas’ tax code substantially more competitive while returning revenue growth to taxpayers in a fiscally responsible manner.

5 min read

Lawmakers are right to enact a single-rate individual income tax. However, lawmakers should consider the full effects of the reform, ensuring that relief is not financed by shifting the tax burden to lower-income individuals and families.

4 min read

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.

What are the biggest tax stories shaping policy today—and what do they mean for you? In our 100th episode, we break down the five biggest tax stories, from the global tax deal to the looming expiration of the Tax Cuts and Jobs Act.

Many states regulate and tax legal marijuana sales and consumption, despite the ongoing federal prohibition. Explore the data here.

8 min read

This legislative session, local taxes are a major topic of debate in Indiana. Although the state’s property tax system is already nationally competitive, dramatic increases in assessed values have created discontent in recent years.

8 min read