Property Tax Relief & Reform

Lawmakers can constrain the growth of property taxes without creating new problems. But the details matter.

Our experts provide leading tax policy research, analysis, and commentary of the latest state tax trends, including state income tax reform and relief, property tax relief, reforms related to remote work, and various emerging excise taxes.

Lawmakers can constrain the growth of property taxes without creating new problems. But the details matter.

From 2021-2024, within the span of 3.5 years, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

Gas tax revenues have decoupled from road expenses and have been unable to support road funding in recent years. As such, states nationwide are exploring ways to supplement or replace gas tax revenues.

8 min read

The trend of tax exemptions on tips, overtime, and bonuses may sound like a win for workers, but it is a shortsighted fix with long-term drawbacks.

11 min read

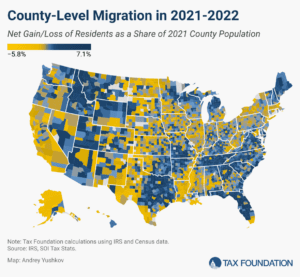

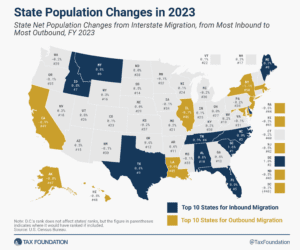

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

As a rule, an individual’s income can be taxed both by the state in which the taxpayer resides and by the state in which the taxpayer’s income is earned.

52 min read

States are unprepared for the ongoing shift to remote and flexible work arrangements, or for the industries and activities of today, to say nothing of tomorrow. In some states, moreover, existing tax provisions exacerbate the impact of high inflation and contribute to the supply chain crisis.

40 min read

The sales tax is the second-largest source of state tax revenue and an important source of local tax revenue, but decades of base erosion threaten the tax’s share of overall revenue and have prompted years of countervailing rate increases.

72 min read

Consumers legally wagered more than $100 billion on sporting contests in 2023, creating more than $1.8 billion in state revenue. Sports betting is now legal in 38 states and DC, and the landscape is rapidly evolving.

18 min read

Local income taxes in Maryland constitute about 35 percent of local tax collections and more than 17 percent of local revenue, giving Maryland’s localities the highest dependence on income taxes in the nation.

5 min read

After years of strong revenue growth, Kansas has substantial cash reserves on hand, and policymakers on both sides of the aisle have expressed a desire to return some of the extra revenue to taxpayers.

5 min read

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

Indiana’s tax code is structured in a relatively sound and economically efficient manner overall, but additional improvements should be considered to make the state even more economically competitive.

Responsible pro-growth reforms to Arkansas’s tax code can help ensure that the Natural State is indeed a Land of Opportunity.

9 min read

Given enough time, everything old is new again—including tax ideas best consigned to history. But worldwide combined reporting, which a few states flirted with in the 1980s, is rearing its head again.

6 min read

At least 32 notable tax policy changes recently took effect across 18 states, including alterations to income taxes, payroll taxes, sales and use taxes, property taxes, and excise taxes. See if your state tax code changed.

16 min read

As fiscal year 2023 draws to a close, North Carolina’s House and Senate have each passed their own versions of the biennial budget for fiscal years 2024-25. While legislative leaders have generally agreed to overall spending levels, negotiations remain ongoing to resolve different approaches to tax policy.

7 min read

In the closing days of the 2023 legislative session, Oklahoma lawmakers repealed the state’s corporate franchise tax and eliminated the marriage penalty in its individual income tax. Both tax changes represent a positive step forward for the state.

4 min read

The Pennsylvania Senate Finance Committee recently advanced two bills, SB 345 and SB 346, that would build on last year’s historic corporate net income tax (CNIT) reform.

7 min read

The tax base around the world is shrinking for traditional excise taxes, including taxes on tobacco, alcohol, and motor fuel. But newer excise taxes on things like carbon, cannabis, and ride-sharing are on the rise. What makes a good design for these taxes and where may excise taxes go in the future as the traditional “sin tax” base continues to shrink?

If Wisconsin policymakers return some of the projected continued revenue growth to taxpayers in a structurally sound and pro-growth manner, those tax cuts will benefit businesses and individuals throughout the state, leading to more innovation, more job and wage growth, more economic opportunities, and more vibrant communities.

As Minnesota lawmakers consider making theirs the first state to mandate worldwide combined reporting, they are relying on a revenue estimate that is—this may not be the technical term—completely bogus.

7 min read

By letting the corporate surtax expire, eliminating taxes on GILTI, and embracing full expensing, New Jersey would take important steps toward creating a more welcoming and competitive tax environment.

6 min read

Accelerating its current individual income tax triggers and setting up the corporate income tax for eventual elimination would increase Missouri’s attractiveness among states at a time when businesses are increasingly mobile and tax competition matters more than ever.

4 min read

Crafting a hybrid bill for a low, flat rate on a broad base—with well-designed revenue triggers to responsibly reduce rates in the future—could be an ideal way forward for the North Dakota Senate.

7 min read

In a day and age when businesses and individuals alike are increasingly mobile, West Virginians can be relieved that their state is getting off the sideline and into the action.

4 min read

With other states upping their game to attract ever-more-mobile people and businesses, lawmakers and the governor are not content to leave Tennessee’s business taxes in their current, uncompetitive form.

7 min read