Property Tax Relief & Reform

Lawmakers can constrain the growth of property taxes without creating new problems. But the details matter.

Our experts provide leading tax policy research, analysis, and commentary of the latest state tax trends, including state income tax reform and relief, property tax relief, reforms related to remote work, and various emerging excise taxes.

Lawmakers can constrain the growth of property taxes without creating new problems. But the details matter.

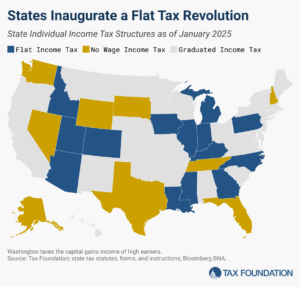

From 2021-2024, within the span of 3.5 years, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

Gas tax revenues have decoupled from road expenses and have been unable to support road funding in recent years. As such, states nationwide are exploring ways to supplement or replace gas tax revenues.

8 min read

The trend of tax exemptions on tips, overtime, and bonuses may sound like a win for workers, but it is a shortsighted fix with long-term drawbacks.

11 min read

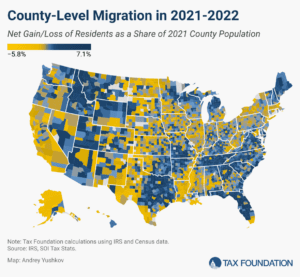

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

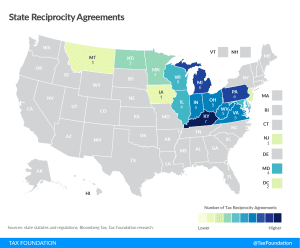

As a rule, an individual’s income can be taxed both by the state in which the taxpayer resides and by the state in which the taxpayer’s income is earned.

52 min read

States are unprepared for the ongoing shift to remote and flexible work arrangements, or for the industries and activities of today, to say nothing of tomorrow. In some states, moreover, existing tax provisions exacerbate the impact of high inflation and contribute to the supply chain crisis.

40 min read

The sales tax is the second-largest source of state tax revenue and an important source of local tax revenue, but decades of base erosion threaten the tax’s share of overall revenue and have prompted years of countervailing rate increases.

72 min read

Consumers legally wagered more than $100 billion on sporting contests in 2023, creating more than $1.8 billion in state revenue. Sports betting is now legal in 38 states and DC, and the landscape is rapidly evolving.

18 min read

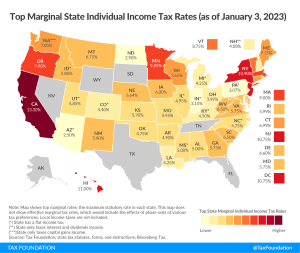

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min read

Done responsibly, reducing income tax rates while consolidating brackets would return excess tax collections to taxpayers and promote long-term economic growth in Nebraska.

Forty-three states adopted tax relief in 2021 or 2022—often in both years—and of those, 21 cut state income tax rates. It’s been a remarkable trend, driven by robust state revenues and an increasingly competitive tax environment.

4 min read

West Virginia is one of only seven states that hasn’t offered any significant tax relief since 2021—and five of the other six forgo an individual income tax.

6 min read

By shifting to a flat income tax, Georgia has already made an important commitment to tax competitiveness. Although the state’s top rate threshold is already very low, a true single-rate income tax will help protect taxpayers from inflation-related tax increases and provide a buffer against rising tax rates in the future. To combine responsible rate reductions with these benefits, Georgia should create tax triggers that empower the state to keep pace with its competition.

3 min read

Most of the 2023 state tax changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

20 min read

Remote and flexible work opportunities are here to stay, whether states like it or not. With enhanced opportunities to take their job with them wherever they please, more workers can factor tax burdens into their decision of where to live.

15 min read

With increases to the standard deduction, a flat tax could provide a net tax cut to taxpayers of all income levels, providing both short-term and long-term relief to taxpayers across the income spectrum. It would also simplify the tax code in ways that encourage greater investment and economic growth, particularly by ensuring that the marginal rate on small business investment is competitive with peer states.

4 min read

Maine has blueberry taxes. Alabama has mosquito taxes. Each state and county has its tax quirks. But when state and local governments want to raise revenues, there are four key taxes they turn to.

As Idaho attempts to further solidify its position as a growth-oriented, taxpayer-friendly state this special session, other states should look to its example and pursue similar reforms.

6 min read

As Missouri legislators head into a special session, they should consider making a pro-growth change that the state is already so close to achieving: creating a flat income tax.

4 min read

The Kansas experience is so infamous that “what about Kansas?” is almost guaranteed to be a question—sometimes as a retort, but often a genuine expression of concern—any time any state explores tax relief. But what about the other two dozen states that have cut their income taxes since then?

6 min read

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done. We discuss why states are looking to make so many tax changes now and how these proposals might play out in statehouses.

On this episode of The Deduction, host Jesse Solis and Senior Policy Analyst Katherine Loughead explore how stronger-than-expected revenues and increased workplace flexibility have led to a wave of reforms aimed at enhancing tax competitiveness in states around the country.

As states close their books for fiscal year 2021, many have much more revenue on hand than they anticipated last year. Eleven states have responded by reducing income tax rates and making related structural reforms as they strive to solidify a competitive advantage in an increasingly competitive national landscape.

29 min read

The legalization and taxation of recreational marijuana remains one of the hottest trends in state taxation. New York recently became one of the latest states to legalize it. Join us as we dive into the complex world of marijuana taxation and explain how policymakers should approach designing such taxes.

Marijuana, betting, soda, ride-sharing—over the last decade, the excise tax family has grown significantly and it’s more crucial than ever that lawmakers, businesses, and consumers understand the possibilities and, more importantly, limitations of excise tax application.

They may not draw as much attention as elections for office, but Election Day 2020 will also feature a number of important votes on tax-related ballot initiatives in states around the country. What are the ballot measures taxpayers should be paying attention to this year and what could they mean for the future of state tax policy? Tax Foundation Vice President of State Projects Jared Walczak and Senior Policy Analyst Katherine Loughead break down measures ranging from recreational marijuana legalization in New Jersey and Montana to income tax increases in Illinois and Arizona.