Property Tax Relief & Reform

Lawmakers can constrain the growth of property taxes without creating new problems. But the details matter.

Our experts provide leading tax policy research, analysis, and commentary of the latest state tax trends, including state income tax reform and relief, property tax relief, reforms related to remote work, and various emerging excise taxes.

Lawmakers can constrain the growth of property taxes without creating new problems. But the details matter.

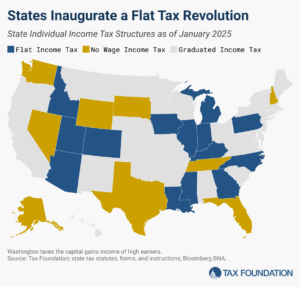

From 2021-2024, within the span of 3.5 years, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

Gas tax revenues have decoupled from road expenses and have been unable to support road funding in recent years. As such, states nationwide are exploring ways to supplement or replace gas tax revenues.

8 min read

The trend of tax exemptions on tips, overtime, and bonuses may sound like a win for workers, but it is a shortsighted fix with long-term drawbacks.

11 min read

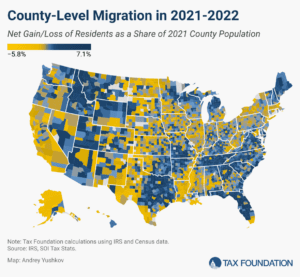

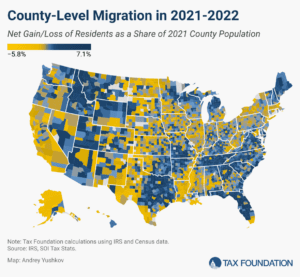

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

As a rule, an individual’s income can be taxed both by the state in which the taxpayer resides and by the state in which the taxpayer’s income is earned.

52 min read

States are unprepared for the ongoing shift to remote and flexible work arrangements, or for the industries and activities of today, to say nothing of tomorrow. In some states, moreover, existing tax provisions exacerbate the impact of high inflation and contribute to the supply chain crisis.

40 min read

The sales tax is the second-largest source of state tax revenue and an important source of local tax revenue, but decades of base erosion threaten the tax’s share of overall revenue and have prompted years of countervailing rate increases.

72 min read

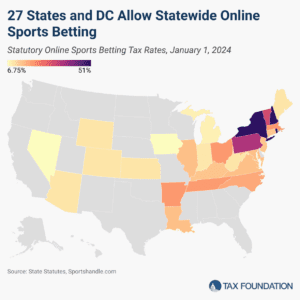

Consumers legally wagered more than $100 billion on sporting contests in 2023, creating more than $1.8 billion in state revenue. Sports betting is now legal in 38 states and DC, and the landscape is rapidly evolving.

18 min read

Recent data suggest that tax competitiveness plays a significant role in residents’ relocation decisions.

3 min read

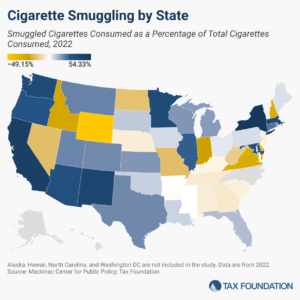

Growing cigarette tax levels and differentials have made cigarette smuggling both a national problem and a lucrative criminal enterprise.

16 min read

Tax reform in Alabama is desirable and very possible. However, the overtime exemption, which complicates the tax code, reduces neutrality, and adds to compliance and reporting costs, is not a good example.

4 min read

With the significant potential for state revenues, and the prior political success of arguments that legalization can shift consumers to safer legal markets, it seems likely that states will continue to see legislation and ballot initiatives to legalize marijuana at the state level—even states that failed to do so this election.

5 min read

Especially for a state that relies so heavily on the sales tax as a source of revenue—and where most people want to keep it that way—a broad base and a low rate is crucial.

5 min read

Louisiana’s tax code currently features a number of inefficient and uncompetitive policies that are leaving the state further and further behind.

Legal sports betting has grown rapidly since the Supreme Court granted states the ability to establish online sports betting markets in Murphy vs. NCAA in 2018.

3 min read

Nationwide, property owners have experienced surges in valuations and are demanding tax relief. Lawmakers are right to find ways to provide it, but should do so with sound tax principles in mind.

5 min read

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

Gov. Walz’s tax policy record is notable because of how much it contrasts with broader national trends. In recent years, most governors have championed tax cuts. Walz, rare among his peers, chose tax increases.

5 min read

Next year, West Virginians will see an income tax cut thanks to revenue triggers in a 2023 law. The Mountain State joins 14 other states that have cut income taxes this year.

4 min read

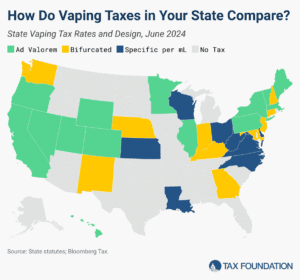

As much as 98 percent of vaping products sold in the US are illicit. Most states levy an excise tax on vaping products, but these tax systems vary substantially. The result is a messy tax system covering largely illicit products, and no one knows whether taxes are being collected and remitted on most products sold nationwide.

7 min read

The Fifth Circuit has affirmed states’ authority over their respective tax policies and has asserted that the offset clause—often called the “Tax Mandate”—of the American Rescue Plan Act (ARPA) has enough fiscal impact on a state’s budget so as to be coercive, as opposed to incentivizing.

5 min read

Governor Sarah Huckabee Sanders (R) recently called a brief special legislative session to enact the fourth round of reductions to the Natural State’s individual and corporate income taxes. Legislators also passed a modest property tax reform proposal.

4 min read

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min read

With a robust surplus and plenty saved for a rainy day, Kansas can afford substantial tax relief, but not all tax relief is created equal.

7 min read

Gas tax revenues have decoupled from road expenses and have been unable to support road funding in recent years. As such, states nationwide are exploring ways to supplement or replace gas tax revenues.

8 min read

With state tax revenues receding from all-time highs, there’s been a great deal of handwringing about whether states can afford the tax cuts adopted over the past few years. Given that 27 states reduced the rate of a major tax between 2021 and 2023, is there reason for concern?

4 min read

By violating the principles of simplicity, neutrality, and stability, and failing to raise significant revenue, worldwide combined reporting at the state level is doomed to fail.

6 min read

Working from home is great. The tax complications? Not so much.

4 min read