FAQ: The One Big Beautiful Bill Act Tax Changes

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min readThe 2017 Trump Tax Cuts, known as the Tax Cuts and Jobs Act (TCJA), reduced average tax burdens for taxpayers across the income spectrum and temporarily simplified the tax filing process through structural reforms. It also boosted capital investment by reforming the corporate tax system and significantly improved the international tax system.

At the end of 2025, the individual portions of the Tax Cuts and Jobs Act expire all at once. Without congressional action, 62 percent of filers could soon face a tax increase relative to current policy in 2026. At the same time, the price tag for extending the 2017 Trump tax cuts is in the trillions.

Explore our related resources below, including our tariff tracker, our budget reconciliation tracker, our latest analysis and reform options regarding TCJA permanence, our interactive tax calculator and congressional districts map, and how 2026 brackets would change if the TCJA expires.

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

Several major new tax breaks are scheduled to expire at the end of 2028, setting the stage for another tax fight to either extend them or allow them to expire.

5 min read

The One Big Beautiful Bill Act makes many of the individual tax cuts and reforms of the TCJA permanent. It improves upon the TCJA by making expensing for R&D and equipment permanent. However, for the most part, it does not include further structural reforms, and instead introduces many new, narrow tax breaks to the code, adding complexity and raising revenue costs.

7 min read

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

18 min read

Permanently extending the Tax Cuts and Jobs Act would boost long-run economic output by 1.1 percent, the capital stock by 0.7 percent, wages by 0.5 percent, and hours worked by 847,000 full-time equivalent jobs.

6 min read

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

At the end of 2025, the individual tax provisions in the Tax Cuts and Jobs Act (TCJA) expire all at once. Without congressional action, most taxpayers will see a notable tax increase relative to current policy in 2026.

4 min read

Policymakers should have two priorities in the upcoming economic policy debates: a larger economy and fiscal responsibility. Principled, pro-growth tax policy can help accomplish both.

21 min read

If Congress allows the Tax Cuts and Jobs Act (TCJA) to expire as scheduled, most aspects of the individual income tax would undergo substantial changes, resulting in more than 62 percent of tax filers experiencing tax increases in 2026.

3 min read

Lawmakers should see 2025 as an opportunity to consider more fundamental tax reforms. While the TCJA addressed some of the deficiencies of the tax code, it by no means addressed them all.

8 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

The TCJA improved the U.S. tax code, but the meandering voyage of its passing and the compromises made to get it into law show the challenges of the legislative process.

6 min read

The Tax Cuts and Jobs Act’s changes to family tax policy serve as a reminder to avoid looking at tax reform provisions in a vacuum.

5 min read

The Tax Cuts and Jobs Act (TCJA) significantly lowered the effective tax rates on business income, but the impact was not the same for C corporations and pass-through businesses.

6 min read

As lawmakers consider which policies to prioritize in the upcoming tax policy debates, better cost recovery for all investment should be top of mind.

7 min read

Pro-growth tax reform that does not add to the deficit will require tough choices, but whether to raise the corporate tax rate is not one of them. If lawmakers want to craft fiscally responsible and pro-growth tax reform, a higher corporate tax rate simply does not fit into the puzzle.

3 min read

The 2017 Tax Cuts and Jobs Act (TCJA) was the largest corporate tax reform in a generation, lowering the corporate tax rate from 35 percent to 21 percent, temporarily allowing full expensing for short-lived assets (referred to as bonus depreciation), and overhauling the international tax code.

6 min read

As members of Congress prepare to address the expiration of the TCJA, they should appreciate how revenues have evolved since 2017.

4 min read

While the approaches differ, they share a reliance on similar linkages: new capital investment drives productivity growth, which grows the economy and raises wages for workers.

37 min read

The Tax Cuts and Jobs Act of 2017 (TCJA) reformed the U.S. system for taxing international corporate income. Understanding the impact of TCJA’s international provisions thus far can help lawmakers consider how to approach international tax policy in the coming years.

30 min read

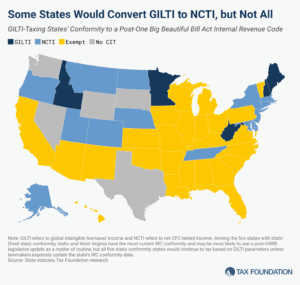

For Congress, work on the One Big Beautiful Bill Act is done. But in state capitols, the work has not yet begun. Many of the tax changes in the federal reconciliation act flow through to state tax codes—automatically in some states, and subject to an update in states’ Internal Revenue Code conformity date in others.

39 min read

Even when international relations are frayed, there is value in finding ways to combat corporate profit shifting while also fostering a healthy commercial atmosphere and positive trade relations.

7 min read

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

However states choose to respond to other tax provisions of the One Big Beautiful Bill Act, they should conform to the pro-growth provisions, which represent a marked improvement in the corporate tax code.

12 min read

Several major new tax breaks are scheduled to expire at the end of 2028, setting the stage for another tax fight to either extend them or allow them to expire.

5 min read

Our analysis finds that the Trump tariffs threaten to offset much of the economic benefits of the new tax cuts, while falling short of paying for them.

3 min read

The One Big Beautiful Bill is now law—but what does it actually do? In this episode, we break down the new tax law’s key provisions, including who benefits, who doesn’t, and what it means for the economy, tax certainty, and the federal deficit.

The One Big Beautiful Bill Act makes many of the individual tax cuts and reforms of the TCJA permanent. It improves upon the TCJA by making expensing for R&D and equipment permanent. However, for the most part, it does not include further structural reforms, and instead introduces many new, narrow tax breaks to the code, adding complexity and raising revenue costs.

7 min read

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

4 min read

The One Big Beautiful Bill’s changes to the taxation of international income have surprising implications for state codes, yielding tax increases and a revised tax base that, through quirks of state incorporation, bears very little resemblance to the federal base and almost nothing of its purpose.

10 min read

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

18 min read

We are living in an age of hyperbole, or as writer Matthew Hennessey calls it, the “Age of Excusability,” in which our politicians succeed by making outlandish claims. So it goes with the One Big Beautiful Bill, which will usher in a new golden age or send us down the tubes for good, depending on your sources.

Lawmakers should consider maintaining QBAI and applying the several billion dollars from the Senate’s change toward other pro-growth international tax reforms instead.

6 min read

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.

Lawmakers are right to be concerned about deficits and economic growth. The best path to address those concerns is to ensure OBBB provides permanent full expensing of capital investment, avoids inefficient tax cuts, and offsets remaining revenue losses by closing tax loopholes and reducing spending.

8 min read

The Senate draft overall makes more changes to international tax policy than the House draft. On net the changes are positive.

8 min read

The House-passed reconciliation bill leaves out Trump’s promise to eliminate taxes on Social Security benefits, opting instead to expand the standard deduction for seniors.

Senator Ted Cruz’s (R-TX) CREATE JOBS Act prioritizes permanence for the most cost-effective tax reforms—expensing and Neutral Cost Recovery (NCRS)—to boost growth in a relatively fiscally responsible way.

4 min read

President’s Trump’s policies would throw high-tax states a life raft as they swim against the tide—before potentially hitting all states with a tariff-induced economic tsunami that could force lawmakers’ hands and reverse recent tax relief.