Key Findings

- The TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Cuts and Jobs Act (TCJA), enacted in 2017, presents one example of supply-side economic policymaking focused on lowering the cost of capital across the economy.

- The CHIPS and Science Act (CHIPS) and InflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. Reduction Act (IRA), both enacted in 2022, represent an alternative approach focused on large subsidies for semiconductors and renewable energy.

- The conventional supply-side approach relies on incentivizing investment across the economy, while the industrial policy approach relies on reallocating investment to specific industries.

- While the approaches differ, they share a reliance on similar linkages: new capital investment drives productivity growth, which grows the economy and raises wages for workers.

- The linkages take time to take effect, and it can be difficult to isolate the effects of tax policy on productivity and wage variables, particularly in the short term.

- One simple approach is to consider how investment performed relative to pre-law baseline projections.

- Following the TCJA, private nonresidential fixed investment outperformed pre-TCJA expectations. More complex academic research to date has supported the finding that the TCJA boosted investment.

- Following the IRA and CHIPS Act, aggregate private nonresidential fixed investment has roughly followed pre-law baseline projections, but the subcomponent of manufacturing structure investment has boomed.

- While we should be cautious about drawing too-strong conclusions based on the data so far, there is plenty of reason to be skeptical of the merits sector-specific policymaking exemplified in IRA/CHIPS.

Introduction

Over the past few years, policymakers have regained interest in “industrial policy” in various forms. Advocates contrast the new approach, focused on protections for American industry and government incentives reallocating capital between sectors, with a perceived old consensus, focused on broad, neutral incentives for work and investment as the means to grow the economy.

The new push for industrial policy ultimately produced the Inflation Reduction Act (IRA) and the CHIPS and Science Act (CHIPS), both enacted in 2022. The laws provide substantial support for the renewable energy and semiconductor industries, respectively. While the IRA and CHIPS have policy goals other than increasing economic growth, Biden administration officials see the targeted industry-specific incentives as ways to grow the broader economy, not just as solutions to problems like climate change or strengthening national security by reducing overreliance on China.[1]

Meanwhile, the Tax Cuts and Jobs Act (TCJA) of 2017 largely represents the old approach. The TCJA was not solely a growth bill—a substantial portion of the law’s fiscal cost was devoted to middle-class tax relief and simplification—but the major corporate provisions, such as lowering the corporate tax rate from 35 percent to 21 percent and introducing 100 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. for investment in machinery and equipment, represent more traditional supply-side growth orthodoxy—namely, broad improvement in the tax treatment of business investment across the board.

The policies are still new, especially IRA and CHIPS. Data so far is limited, and isolating the effects of IRA and CHIPS in particular is challenging due to the post-pandemic economic rebound, associated turmoil, and substantial interest rate hikes by the Federal Reserve. However, we can compare and contrast the justifications for each policy and determine how to best evaluate whether they have reached their goals.

The Policy Background

The Tax Cuts and Jobs Act was signed into law in December 2017.[2] The TCJA was a major reform of the tax code, significantly changing individual, corporate, and international taxation. While the temporary reductions in individual taxes are partly pro-growth, as the reduction in marginal personal income taxes would temporarily increase the labor supply, one could split the bill into “broad tax relief” and “pro-growth tax reform” buckets. The most pro-growth parts of the bill, on which this paper primarily focuses, were the corporate rate cut, which reduced the corporate tax rate from 35 percent to 21 percent, and the temporary reintroduction of 100 percent bonus depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. for short-lived assets.[3] The bill also included new limits to interest deductibility, as well as several other small, base-broadening revenue offsets.

The CHIPS and Science Act was signed into law in August 2022. Most of the CHIPS and Science Act is not tax policy, but it includes $24 billion in semiconductor manufacturing investment tax credits.[4] It also includes $39 billion in funding for the CHIPS for America Fund and an additional roughly $15 billion for a handful of other priorities.[5] These costs are over a 10-year period, but most of the impact comes earlier in the decade. The “science” part of the CHIPS and Science Act included $200 billion in authorizations for a series of scientific initiatives across several federal agencies, but those changes must be appropriated in subsequent legislation.[6]

The Inflation Reduction Act was also signed into law in August 2022.[7] A large share of the IRA was devoted to tax policy. The law introduced new credits for green energy, expanded existing ones, and continued an expansion of Affordable Care Act subsidies for health insurance. To pay for the programs, the law raised funding for IRS enforcement, instituted controls on drug pricing, and introduced two notable new taxes: a corporate minimum tax based on book incomeBook income is the amount of income corporations publicly report on their financial statements to shareholders. This measure is useful for assessing the financial health of a business but often does not reflect economic reality and can result in a firm appearing profitable while paying little or no income tax. , and a 1 percent excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on stock buybacks.[8]

In fiscal terms, the Tax Cuts and Jobs Act was a larger piece of legislation than the CHIPS and Science Act and Inflation Reduction Act combined, but for the purposes of evaluating each policy’s impact on investment in the short term, contrasting the legislation’s scale is surprisingly complex.

It makes more sense to compare the costs of the legislative packages over 10 years rather than in the first year because of timing issues. For example, both 100 percent bonus depreciation and a tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. for renewable energy production incentivize investment. However, the cost of 100 percent bonus depreciation is brought forward, as a company deducts the full cost of their investment immediately instead of spreading the deductions out over the life of the asset. Conversely, the cost of the production tax credit is pushed later in the budget window. While it incentivizes new investment in the subsidized energy type, the fiscal cost of the production tax credit is skewed towards the end of the budget window (e.g., new wind production would take years to come online).

Tax Foundation estimated the business and international provisions of the TCJA to cost around $373 billion on net over a decade.[9] Meanwhile, the Joint Committee on Taxation estimated they would cost around $594 billion over a decade.[10]

The process of narrowing down key supply-side-relevant provisions for the IRA and CHIPS is less straightforward. But subtracting out the major healthcare provisions of the IRA (though price controls on drugs will reduce pharmaceutical sector R&D investment)[11] and the IRS enforcement expansion, the cost of the IRA comes out to roughly $110 billion over a decade, according to Tax Foundation’s analysis.[12] Meanwhile, CHIPS sums to $79 billion over a decade according to the Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT).[13]

However, the CBO recently raised its estimate of the IRA’s cost by $428 billion.[14] Part of the change ($224 billion) is related to new EPA regulations on vehicle emissions, which will further accelerate the adoption of EVs and increase usage of the IRA’s EV tax credits, while also reducing gasoline excise tax revenue. But $204 billion of the change relates to the several other green energy tax credits. Even when setting aside the $224 billion driven by the EPA regulatory change, adding $204 billion to the initial cost estimates of the business-related provisions of the IRA puts it on par with the cost of the TCJA’s business provisions. Furthermore, other research has also found the IRA will cost substantially more than originally expected.[15]

When factoring in the increased cost estimates, the combined IRA/CHIPS package is much more comparable to the net cost of TCJA’s business-side reforms.

“Orthodox” Supply-Side Economics versus Industrial Policy

One commonality between industrial policy and the more conventional supply-side orthodoxy is that they are both concerned with growing an economy’s productive capacity—in other words, the supply side. That means technological advancement, increased capital stock, and expanded labor supply. While both conventional supply-side and industrial policy often include policies that increase aggregate demand as well, the core justification is improving production rather than goosing spending.

As Dani Rodrik, heterodox economist and leading advocate for new industrial policy, wrote in a recent paper, there are several challenges to measuring an industrial policy’s impact.[16] Rodrik and his coauthors define industrial policies as:

. . . those government policies that explicitly target the transformation of the structure of economic activity in pursuit of some public goal. The goal is typically to stimulate innovation, productivity, and economic growth. But it could also be to promote climate transition, good jobs, lagging regions, exports, or import substitution.[17]

The source of the most ambiguity in this definition is “targeting the transformation of the structure of economic activity in pursuit of some public goal.” For instance, in the course of the government’s operations, it needs office supplies, such as staplers. It purchases staplers to facilitate the government’s provision of a variety of public services. By purchasing staplers, it redirects resources to stapler production, thus transforming the structure of economic activity (towards staplers). Thus, government procurement is a stapler industrial policy.

That is a facetious example. But there needs to be some form of differentiation between “industrial policy” and “government policy.” Broad definitions of industrial policy could end up including almost any policy a government enacts, including deregulation, broad-based tax cuts, or basic government procurement practices.

One way to distinguish “government policy” from “industrial policy” is design. Scott Lincicome of the Cato Institute emphasizes the use of narrow, industry-specific policy (as opposed to broad, economy-wide policy) as key to what constitutes industrial policy, as well as a focus on the manufacturing sector and the improvement of commercial market outcomes.[18]

Another way to distinguish “government policy” from “industrial policy” is intent. If policymakers argue for a policy in industrial policy terms (promoting a specific sector as a means to transform or grow the economy), then perhaps it makes sense to classify that policy as industrial policy. For example, policymakers rarely talk about the F-35 fighter program as a transformative industrial policy for the broader economy, as opposed to a solution to a specific military need. However, if it was sold as a strategy for advancing American aviation manufacturing first and foremost, then the label would make more sense.

Which Other Policy Goals?

Both orthodox supply-side policy and industrial policy approach issues beyond broad economic and wage growth. However, their approaches are different.

The more orthodox supply-side perspective suggests higher investment will help address a series of other issues. In certain cases, some problems might be driven by structural biases against investment in a particular sector. Long depreciation schedules create substantial disincentives to building multifamily housing, so moving to full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. will help address the housing supply shortage.[19] Expensing for capital investment would also help with capital stock turnover in the green transition, as it would make replacing older, dirtier, or less efficient equipment and structures across the economy with newer, cleaner versions marginally cheaper.[20] However, just eliminating tax disincentives that are making an existing problem worse is not a full solution to many problems—in the case of climate change, for instance, just eliminating investment penalties does not address the negative externalities of greenhouse gas emissions.

On the other hand, IRA and CHIPS are both sold as larger packages with many distinct policy goals. CHIPS is as much about strategic competition with and independence from China as it is about developing a cutting-edge industry to drive broader growth. The law also includes some subsidies for childcare at the same time. The IRA is a climate law first, which also seeks to distribute climate investment geographically to distressed areas and provide them with high-paying, middle-class jobs. It also purports to be an efficient reallocation of capital towards growth industries of the future, although private capital markets generally perform this function quite well and advocates have not shown how the policy would improve results. The IRA and CHIPS could end up succeeding at some of those goals and failing at others. According to the administration and advocates of the approach, the goals are harmonious with each other.[21]

Perhaps the most salient example is provided by Secretary of Commerce Gina Raimondo, who stated in September 2023, “CHIPS for America is fundamentally a national security initiative,” related to strengthening supply chains for advanced technologies like semiconductors and preventing advanced technology transfers to unfriendly nations.[22]

Some private sector industries have particular relevance to national security. On the other hand, policymakers have a long history of abusing national security as a justification for protectionism.[23] Even if an industry may merit protection for national security purposes, a protectionist measure may still prove counterproductive, and even a successful national security policy might not be a successful economic industrial policy.[24]

Ultimately, the orthodox view sees broader pro-growth policy as providing possible spillover benefits in other policy issues, while industrial policy often sees both idiosyncratic issues and broader economic growth as directly entwined.

Which Relative Prices?

The orthodox view is focused on the price of investment relative to consumption. Under that view, reducing marginal tax rates on investment will increase capital investment, and capital investment will spur greater productivity growth and economic growth.[25] This view leaves the allocation of investment across sectors up to markets as much as possible, trusting markets to know better than policymakers where the most productive investments are.

The industrial policy view is more focused on the relative price of investment in different industries. The core premise in this case is that markets are not efficient at optimally allocating capital across sectors to maximize economic growth. Instead, government policy should push investment towards certain sectors with greater growth potential.[26] As National Security Adviser Jake Sullivan put it, “A modern American industrial strategy identifies specific sectors that are foundational to economic growth, strategic from a national security perspective, and where private industry on its own isn’t poised to make the investments needed to secure our national ambitions.”[27]

For what it is worth, neither supply-siders nor industrial policy advocates limit themselves to marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. changes (of various kinds). For the sake of conceptual symmetry though, the first part of this paper will juxtapose broad investment tax cuts with narrower investment tax cuts aimed at specific industries or sectors.

The distinction between the two can end up blurred in practice. Perhaps most importantly, the U.S. tax code is not working from a neutral baseline, where all industries are treated equally. Tax changes that improve the treatment of investment as a whole benefit some industries more than others because some industries are more investment-intensive, and/or the status quo treats them unfairly.[28] Tax changes to investment also often only focus on one investment asset class; for instance, the TCJA introduced 100 percent bonus depreciation for short-lived assets, namely equipment and machinery, but not long-lived assets, namely structures.[29] Historically, some policymakers have cut back on neutrally pro-investment tax provisions under the erroneous belief that they provide unique, non-neutral support for some industries.[30] Accordingly, policymakers looking to make broad pro-investment policy choices have often ended up changing the relative price of investment in different industries.

Conversely, on the industrial policy side, major incentives to invest in specific industries also reduce the price of investment (in aggregate) relative to consumption. While the focus of investment tax credits for specific industries is typically shifting investment to that sector, the tax subsidy also changes the overall price of investment relative to consumption.

Important Linkages

A standard tool economists use to analyze the productive capacity of an economy is the Cobb-Douglas production function. Cobb-Douglas suggests an economy’s potential output is a function of the economy’s labor (L) and capital (K), along with an error term, total factor productivity (A). Labor is people (namely, their time spent working), and capital is the tools and other assets they use in the production process (e.g., buildings, machines, computers, intellectual property, etc.). Total factor productivity is harder to define. Technically, it is how effectively the economy can make use of labor and capital. In practice, total factor productivity is a function of knowledge, skill, and innovation.

The differing approaches of both TCJA and IRA/CHIPS in generating supply-side growth can be seen in how they plan to drive changes in A, L, or K.

In the case of the TCJA, the lower corporate tax rate and temporary 100 percent bonus depreciation for short-lived assets reduce the cost of capital, thus reducing the relative price of investment. This leads to increased investment, which means an increase in capital (K). Increased capital makes workers more productive and increases demand for workers. This leads to both higher overall output and higher wages for workers.

Industrial policy is more complex, given the multitude of policy tools under the broader umbrella of industrial policy and the problems industrial policy attempts to solve. But focusing on growth and innovation, the industrial policy view holds that different industries or sectors have different social benefits or growth potential in a way that is not adequately priced by market forces.

Take a sector-specific investment tax credit. It reduces the cost of capital in that sector relative to the rest of the economy and increases investment in the sector, increasing K (both by shifting investment from other sectors and shifting consumption to investment). Then, thanks to the increase in sector investment, the sector develops faster. This raises sector-level productivity. If policymakers have correctly identified a sector with particular growth potential, then the policy will translate to higher total factor productivity growth than would otherwise have taken place had the government maintained a laissez-faire approach to investment incentives.

When considering the orthodox view, lowering the cost of capital across the board makes countless projects across the economy that were just barely not worth pursuing on a risk-adjusted basis viable, changing investment decisions on the margin. Conversely, in the narrow sector- or industry-specific investment tax credit case, the policy makes many projects in that subset of the economy viable, even ones with expected negative returns without the tax subsidy.

Now, perhaps those projects with negative expected (private) returns have an untapped social benefit or potential. But if not, then the sector-specific policy has dragged investment and resources away from more productive sectors to the subsidized sector. The subsidized sector could still grow, but its growth is coming at the expense of foregone greater growth elsewhere in the economy. Another possibility is the reason the expected returns of projects in the subsidized sector are negative to begin with is they face some kind of hard constraint beyond just the capital cost, such as regulatory hurdles or a mismatch with the existing workforce, that make investment still infeasible.

Rodrik et al. describe the view that government can effectively target firms and industries of interest as the developmentalist view.[31] In the idealized industrial policy case, the government acts almost like a venture capital firm, accelerating the most potent areas for technological change.

Rodrik et al. concede two objections to the industrial policy view. The first is the “inefficacy” objection: government seeks to support growth industries but cannot do so effectively. Central planners lack the information that millions of decentralized actors spread across the economy have. Accordingly, it is doubtful they would be able to pinpoint industries with unique growth potential that these other actors have failed to recognize. The classic F. A. Hayek essay “The Use of Knowledge in Society” is the foundational tract of this critique.[32]

The second is the rent-seeking objection: government is captured by special interest groups and is interested in benefitting them, not the public.[33] Given a system of a series of discretionary, targeted policy interventions, firms will expend more resources chasing these preferential policymaking interventions instead of expanding and improving production.[34] For instance, while the classic infant industry argument holds subsidies or protections will lead a new domestic industry to become competitive with international firms, an alternative outcome is the domestic industry will invest in maintaining its exclusive access to the domestic market rather than improving its products and processes.

Rodrik et al. acknowledge these critiques but argue for a more pragmatic approach focused on evaluating industrial policies in practice to see if they are able to overcome these hurdles.

A broad definition of industrial policy, along with numerous countries around the world and a modern time horizon of a few centuries, create a wide-ranging set of case studies to draw from to argue either for or against industrial policy. Some industrial policy advocates reach back to former Treasury Secretary Alexander Hamilton’s Report on Manufacturers and the American System. Around the world, Latin American nations’ experiences in import-substitution industrialization are a gift to industrial policy critics.[35] Industrial policy advocates credit industrial policy for the rapid growth of East Asian economies like Japan, South Korea, Taiwan, and China, while critics argue broader moves toward private markets deserve credit.[36] Furthermore, East Asia provides plenty of examples of failed industrial policy initiatives as well.[37]

In How Asia Works, something of an industrial policy Bible, Joe Studwell argues industrial policy was important for the development of South Korea, Japan, and Taiwan, over the opposition of foreign mainstream economists who were, in Studwell’s view, attempting to force an economic model that works for wealthy, developed economies onto relatively poor, developing economies (as Japan, Taiwan, and South Korea were in the aftermath of World War II). By the same token, however, it might not make sense to draw lessons from poor, developing economies (like, say, 1960s South Korea) and apply them to the United States.

To avoid these concerns about external validity, it makes sense to focus on more recent efforts in U.S. policy. Further narrowing the search to policy mechanisms similar to the IRA and CHIPS (e.g., sector-specific tax policy and domestic content requirements of various kinds) and policies in similar industries (semiconductors and energy), reveals a discouraging track record.

The history of using tax policy to reallocate capital across sectors in the U.S. provides many cautionary tales to this effect. As referenced earlier, policymakers designing the 1986 tax reform saw (neutral) accelerated depreciation benefitting manufacturers as a reason to pull back on accelerated depreciation. Part of their justification was that the manufacturers were industries of the past, not industries of the future.[38] By reducing the benefits of accelerated cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. , the 1986 tax reform penalized the manufacturing sector relative to more capital-light economic activity. For those who argue manufacturing is particularly important for economic growth, that incident should raise doubts about policymakers’ ability to soundly select the “right” industries.

The American steel industry has consistently struggled despite (or because of) protectionist tariffs (as well as non-tax trade barriers, and “Buy American” requirements), while those policies also hurt other downstream manufacturers in the process.[39] While not an industrial policy per se, the low-income housing tax credit (LIHTC) provides little affordable housing for its cost.[40] In the energy sector, tax credits may have played a role in developing the solar industry, but credits for other fuels such as ethanol have been potentially counterproductive.[41] Furthermore, tariffs have not preserved or accelerated U.S. solar manufacturers. Various predominantly non-tax measures in the Synthetic Fuels Corporation (created in 1980 in the aftermath of the 1970s energy crises) also failed to produce notable technological improvements.[42]

In the case of the semiconductor industry, government research played an important role in its development, but mostly due to unplanned research spillovers from military projects, rather than a top-down strategy to develop the industry.[43] In the 1980s, when policymakers became concerned the United States had lost its edge in semiconductors to Japan, they established Sematech, a research consortium of private companies and government actors, with the goal of regaining leadership. While the U.S. semiconductor industry gained ground in the late 1980s and early 1990s, it was likely not due to Sematech, which championed several failed companies and focused on markets for existing memory chips. The U.S. resurgence is mostly credited to companies focusing on cutting-edge logic chips.[44]

In fairness to industrial policy advocates, it is empirically challenging to prove a reform that reallocated capital to a sector drove higher economic growth overall.[45] But many of the sector-specific tax policies the U.S. has enacted have failed to develop a productive sector, let alone a more productive economy in the aggregate.

What Do the Data Say?

Returning to the big picture, both supply-side tax reform and industrial policy rely on the linkage between additional investment and additional productivity growth, and that linkage takes time. New plant and equipment must be built and installed, and then workers must be hired and subsequently learn or be trained to use said equipment. On the technology front, technological change does not immediately result in productivity growth either—the steps from invention to innovation to diffusion can take several years.

As a result, it is difficult to evaluate either supply-side tax reform or industrial policy in the first few years of enactment. However, we can at least examine how some of the early sets of those linkages (in particular, investment) have fared relative to projections, and consider other factors that may predict how the policies will continue to fare.

One might jump to investment, growth, or wage time series data and begin making conclusions about the impacts of the policies. However, neither the TCJA, nor CHIPS, nor the IRA were enacted in vacuums. This paper presents basic counterfactual analysis, comparing investment behavior following the passage of each legislative package to CBO projections preceding each package’s enactment. In the case of the TCJA, some more rigorous analysis is available.

Tax Cuts and Jobs Act

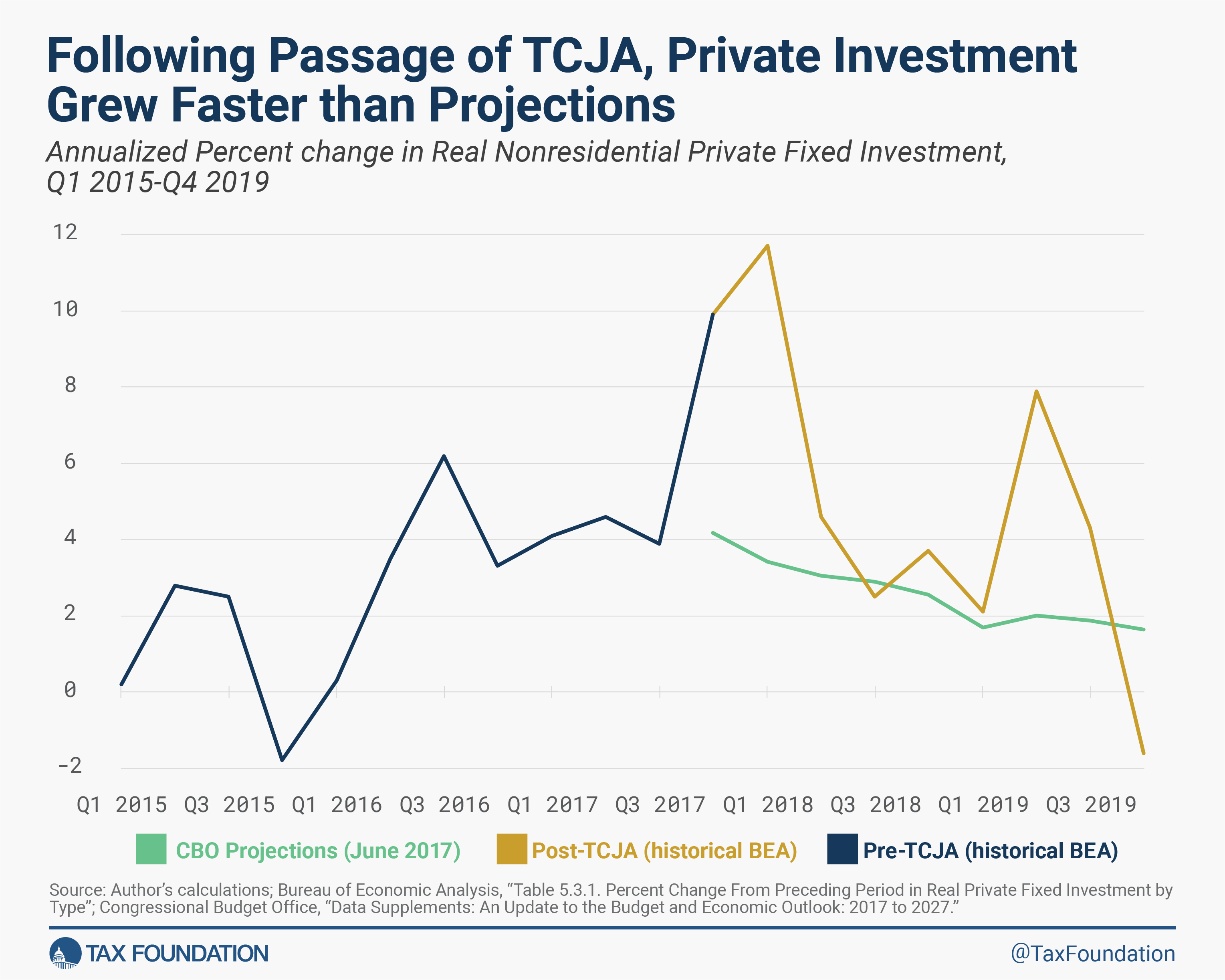

A basic approach to evaluating whether the TCJA has stimulated new investment is to consider a crude counterfactual of the U.S. economy had the TCJA not passed. This can be done by comparing investment following the act’s passage to investment projections made before the act’s passage. Initially, aggregate investment substantially outperformed expectations, growing by over 10 percent on an annualized basis in the first quarter of 2018. Investment growth slowed back closer to expectations in subsequent quarters but rallied again in 2019.

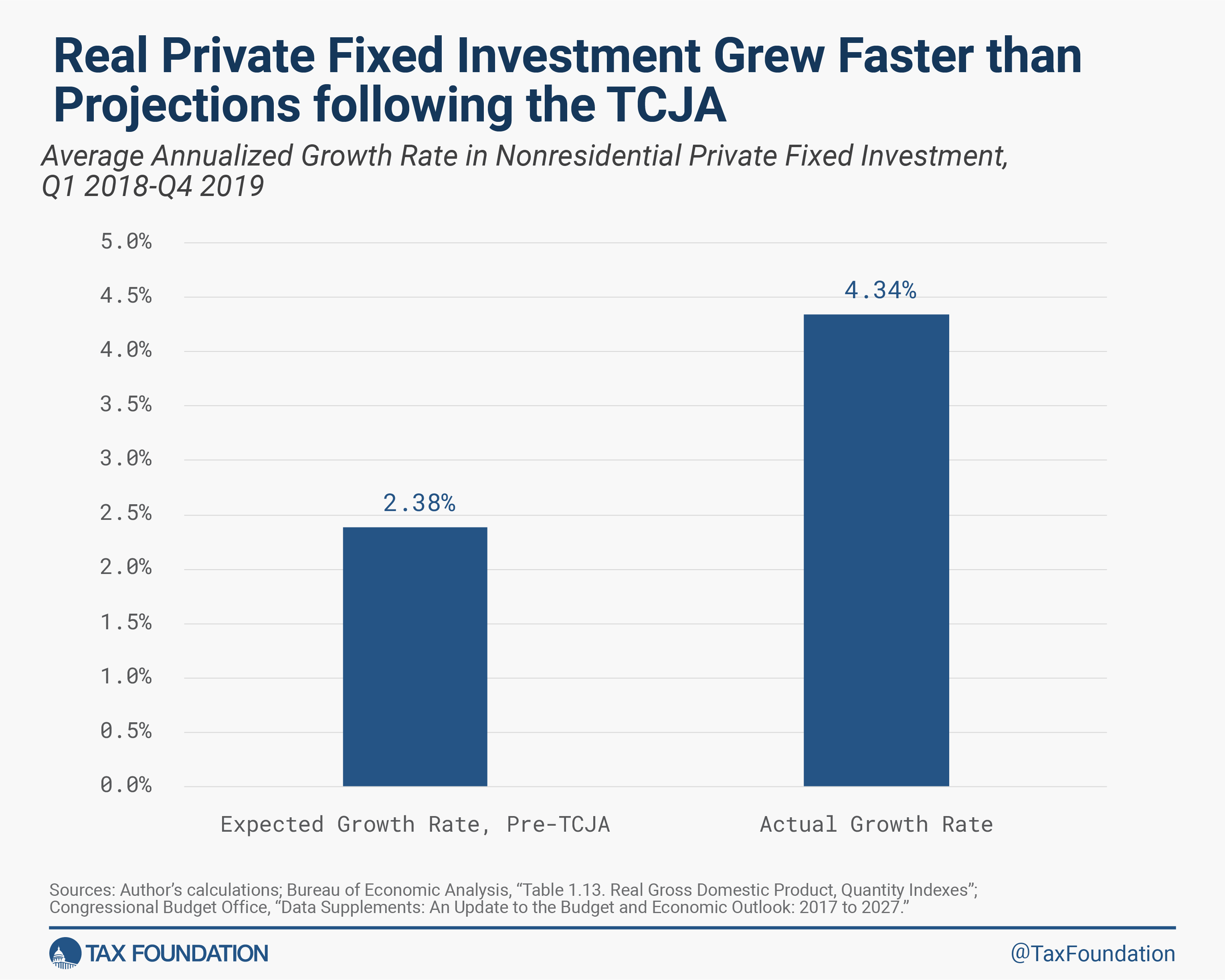

Approached differently, in the eight quarters immediately following the passage of the TCJA, real nonresidential private fixed investment grew by an average annual rate of 4.3 percent, whereas pre-TCJA estimates projected real nonresidential private fixed investment to grow by an average annual rate of 2.4 percent.[46]

Contrasting the actual investment data to the pre-enactment projections is not a complete counterfactual. Other unexpected changes in policy, along with unexpected changes in the economic environment, muddy the picture. Some of these changes put additional upward pressure on investment. Perhaps most notably, the broad individual tax cuts from the TCJA, coupled with increases in government spending, increased aggregate demand, which would support investment in the short term. Additionally, an increase in oil prices spurred new investment in oil and gas extraction in 2018, before it subsided in 2019.[47]

On the other hand, some factors put downward pressure a few months after the TCJA was enacted. The Trump administration initiated a trade war with China, raising taxes on imports and introducing business uncertainty, particularly for manufacturing firms that are typically more trade-exposed.[48] The Federal Reserve also raised interest rates, although the June 2017 CBO report anticipated increases in the federal funds rate.[49] Further complicating the picture, the COVID-19 pandemic hit roughly two years after the TCJA’s enactment, making data for the subsequent two years difficult to interpret.

Over the years since the TCJA’s passage, a few studies have examined the effects of the reform on investment and growth, with several indicating the TCJA caused companies to increase investment in the United States. New research from Gabriel Chodorow-Reich, Matthew Smith, Owen Zidar, and Eric Zwick finds the TCJA raised investment by 20 percent among firms with the mean tax change compared to firms with no tax change, and that the law increased long-run equilibrium capital stock by 7.4 percent.[50] Other firm-level studies have found increased investment in response to the TCJA, particularly among firms with higher costs of capital before the law was enacted.[51]

While the positive impact on investment is clear, the TCJA’s impact on wages is less certain. One recent working paper found firms with reduced marginal tax rates increased investment, sales, employment, and profits, but wages did not rise in those same firms across the board.[52] Now, real wage growth accelerated in the two years following the Tax Cuts and Jobs Act, but that wage growth is not necessarily a vindication of the supply-side linkages proposed by the orthodox supply-side theory.[53] Under the supply-side theory, reductions in the cost of capital spur investment, which spurs productivity growth, which spurs wage growth. Such linkages would not occur immediately, but rather over several years.

Inflation Reduction Act and CHIPS Act

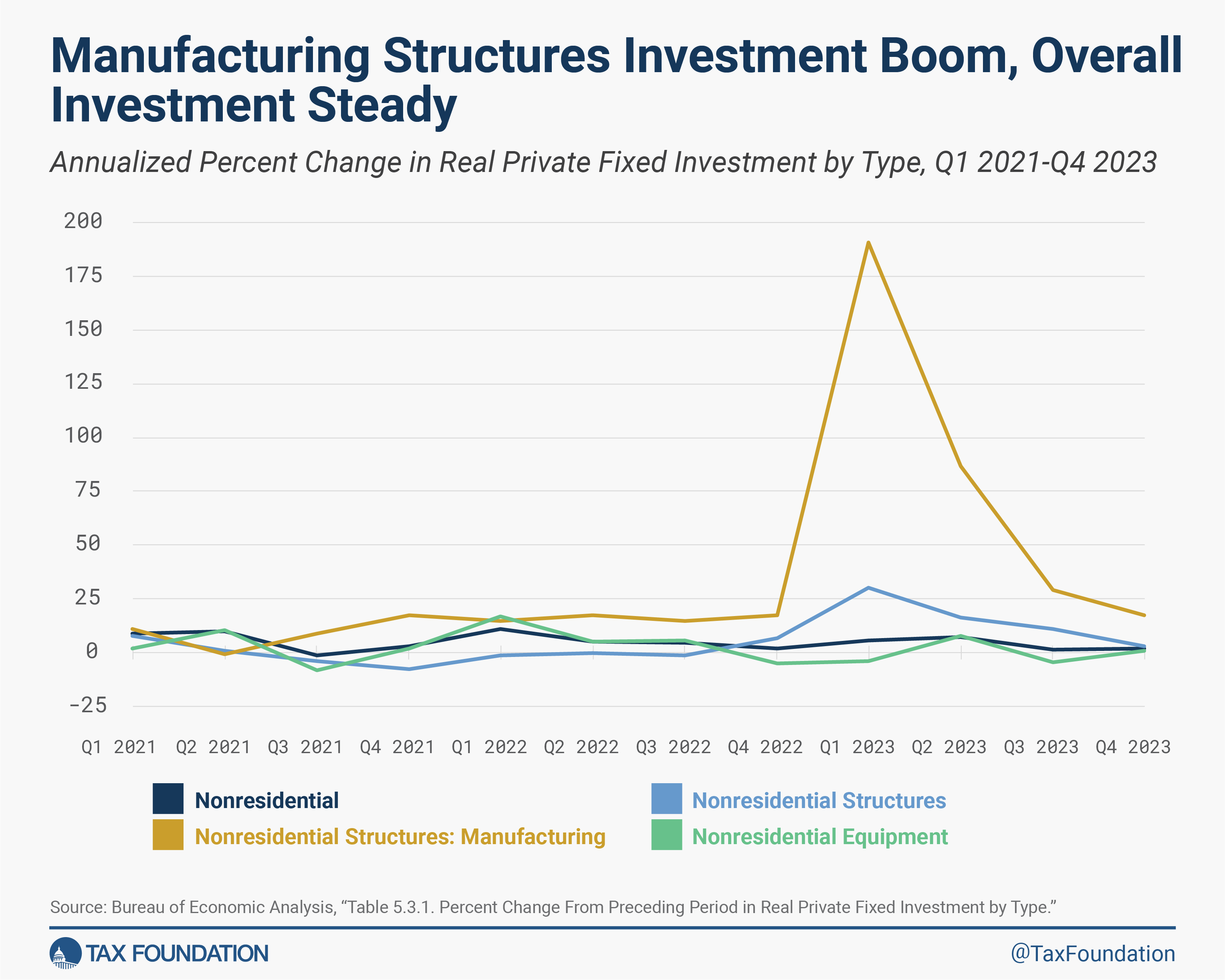

With a shorter time horizon, and more potential confounding factors, it is even harder to pinpoint the impact of the IRA and the CHIPS Act on supply-side economic growth. Advocates of the Biden administration’s approach often point to one data set as evidence for the impact of the law. Manufacturing construction spending has taken off, in real terms.[54] This boom in spending has led advocates of IRA and CHIPS to speak of a historic level of private investment—which is accurate for investment in manufacturing structures, but not true of private investment as a whole.[55]

Manufacturing structures investment grew at an annualized rate of just over 50 percent in the six quarters beginning in Q3 2022. However, manufacturing structures are a narrow share of capital investment—even with manufacturing structures investment booming in 2023, it only accounted for 4 percent of nonresidential fixed investment. And when looking at the bigger picture, the comparatively small role of manufacturing structures is clear—nonresidential structures investment has grown by 11 percent on an annualized basis since Q3 2022, and nonresidential fixed investment has grown by just under 4 percent, with investment in equipment actually slowing over this period. Four percent growth in business investment is not bad, by any means, but it is a far cry from the eye-popping numbers in manufacturing structures.

Manufacturing construction spending has grown rapidly, but that does not necessarily guarantee real construction or real productivity. California’s high-speed rail project provides an extreme example of construction spending not translating to productive activity, with over $10 billion in public money having been spent so far, yet even limited operations still several years away.[56] Meanwhile, China’s ghost cities—overbuilt planned cities without inhabitants—provide an example of completed construction ultimately proving to be unproductive.[57]

Those are extreme examples of construction spending not translating to useful outputs, but the juxtaposition between spiking manufacturing construction investment and widespread major project delays, such as the repeated delays of the TSMC plant in Arizona, suggests the boom in construction spending may not translate to a proportional increase in productive output, productivity and wages.[58] The permitting challenges associated with both the semiconductor plants and major clean energy projects are serious constraints that could keep projects in limbo.

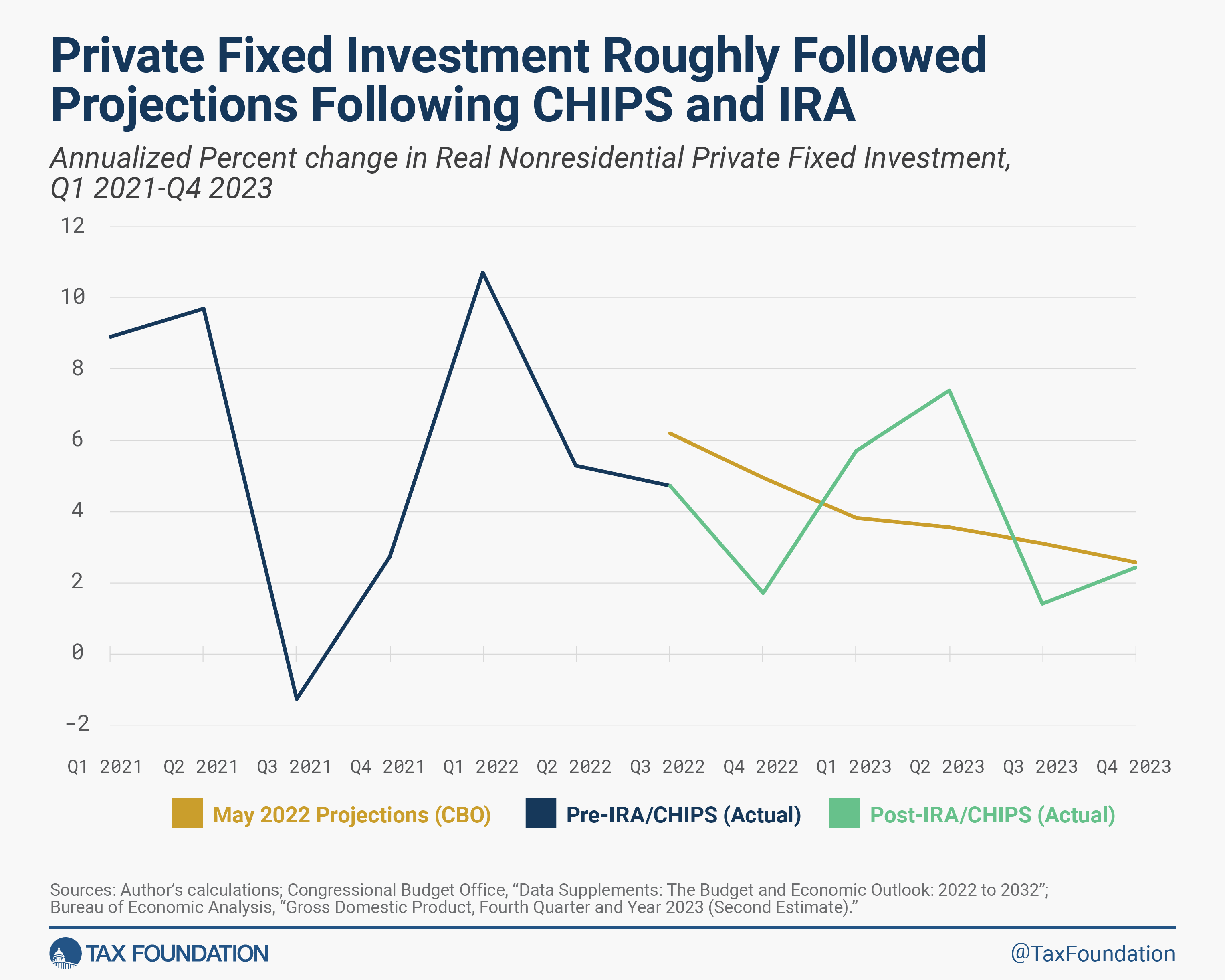

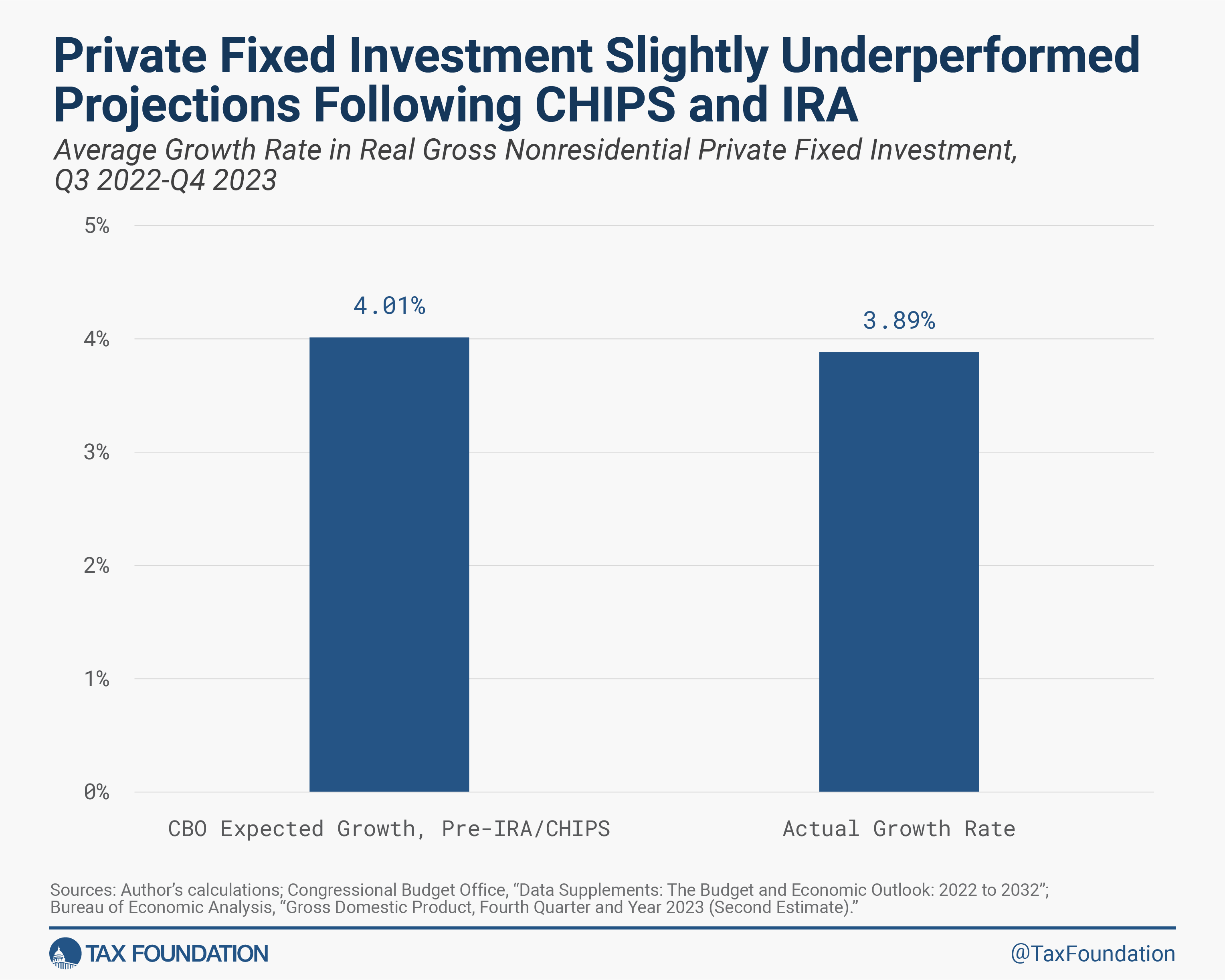

Additionally, relative to the CBO’s projections as of May 2022, nonresidential private fixed investment growth in aggregate has not outpaced projections. While growth has overperformed in a few quarters (and underperformed in others), the overall picture shows something roughly in line with projections before the laws were passed. In May 2022, CBO projected the average annualized growth rate of business investment between the start of Q3 2022 and the end of Q4 2023 would be 4.0 percent. In reality, private fixed investment grew by 3.9 percent. This rough counterfactual would suggest CHIPS and IRA have not boosted overall investment.

Like the TCJA, other unexpected changes also influenced investment, with some putting downward pressure on investment and others putting upward pressure on investment. Most notably, interest rates rose quickly—faster and more than the CBO originally projected, which raised the cost of capital and reduced investment.[59] On the other hand, oil prices rose faster than expected, too, and that put upward pressure on energy investment.[60] The net impact of these outside factors on investment is therefore uncertain.

Similarly, outside factors also influenced the specific boom in manufacturing structures. An investment boom was already in progress in some of the subsidized industries, particularly semiconductor manufacturing. The CHIPS Act was in large part a response to supply chain disruptions in the semiconductor industry in 2020 and 2021. These disruptions led policymakers to support onshoring semiconductor production.

The market agreed. While having all supply chains kept onshore is not a recipe for resiliency, diversification is valuable, and private investment was already moving in response to the situation.[61] Semiconductor industry players Intel, TSMC, and Samsung announced major investments in 2021 and early 2022.[62] Investment in computer, electronic, and electrical manufacturing structures rose from $11.3 billion in the 12 months preceding July 2021 to $41.0 billion in the 12 months preceding July 2022. Industry investment continued to grow following the CHIPS Act’s passage, but it is unclear how much of that further increase was driven by market conditions rather than the tax change.[63]

There are also some related idiosyncratic questions pertaining to clean energy investment. In the case of many renewable energy sources, costs have fallen dramatically over the past two decades, so some increased adoption and development would be expected even without policy changes.[64]

The IRA and CHIPS Act have not spurred an increase in investment across the economy, as nonresidential fixed investment is growing slightly slower than the CBO projected a few months before the two laws were enacted. So far, they have not driven the start of a supply-side boom in the more orthodox sense. However, we have seen a substantial shift in investment, as manufacturing investment (especially in structures) has grown rapidly while aggregate investment has been steady.

Other Major Policy Goals

As mentioned before, the IRA and CHIPS were not only sold as growth policies. The IRA is a climate law, and CHIPS is a national security policy, with additional goals related to geographic distribution and labor support. The IRA’s impact on carbon emissions, for instance, will take several years to come into the picture. And furthermore, some of the idiosyncratic goals might come into conflict with the broader goal of increased economic growth.

One red herring in the debate that both proponents and opponents see as a relevant metric for the programs’ success is manufacturing employment. The Biden administration (and some of its fellow travelers in the industrial policy space) sees part the manufacturing sector’s role as a stable middle-class jobs machine, and industrial policy as a means to return to a past era of broadly-available, well-paying manufacturing jobs for workers without a college degree.[65] However, manufacturing as a share of U.S. employment has not budged since the CHIPS Act and IRA were passed.[66]

Manufacturing employment share is a poor metric for evaluating how the IRA and CHIPS accelerated growth and innovation. Advanced manufacturing is highly automated, so cutting-edge industries should not be labor-intensive. In the last decade, for example, Singapore has had a manufacturing renaissance, with its manufacturing sector growing in terms of output and share of GDP, an outlier relative to other developed economies.[67] But at the same time, manufacturing employment as a share of total employment has continued to decline in Singapore.[68] While it may be a discredit to advocates of the policy packages that they see manufacturing employment as uniquely important, manufacturing employment share remaining low is not necessarily evidence the policy is failing to meet its other objectives.

Conclusion

Based on both rough counterfactuals and now a growing economic literature, the TCJA caused a substantial increase in investment, as we would expect. In contrast, the targeted subsidies of the IRA and CHIPS Act have not led to a broad increase in private investment outside of subsidized sectors. This result so far is also consistent with what we would expect, although we should caution that it is still very early to evaluate investment impacts of these laws passed in August 2022.

But one lesson consistent with these preliminary interpretations of the data is that prices matter (specifically tax prices). The TCJA broadly reduced the cost of capital, which drove increased capital investment throughout the economy. Meanwhile, the IRA and CHIPS packages changed the cost of capital in different industries, leading investment to flow to the newly subsidized activities. In both cases, the early evidence indicates investment responded to price changes.

For both policy baskets, the pass-through of investment to productivity and wage growth should take several years and will be difficult to identify precisely given the noise of confounding factors, including the pandemic and other policy developments. However, given the track record of previous industrial policy efforts, there is reason to doubt the effectiveness of the IRA and CHIP Act’s approach over the long run.

[1] Brian Deese, “Remarks on a Modern American Industrial Strategy,” White House, delivered at Economic Club of New York, Apr. 20, 2022, https://www.whitehouse.gov/briefing-room/speeches-remarks/2022/04/20/remarks-on-a-modern-american-industrial-strategy-by-nec-director-brian-deese/.

[2] Tax Cuts and Jobs Act of 2017, H.R. 1, 115th Congress (2017), https://www.congress.gov/bill/115th-congress/house-bill/1.

[3] Tax Foundation, “Preliminary Details and Analysis of the Tax Cuts and Jobs Act,” Dec. 18, 2017, https://taxfoundation.org/research/all/federal/final-tax-cuts-and-jobs-act-details-analysis/; Erica York, Garrett Watson, Alex Durante, Huaqun Li, Peter Van Ness, and William McBride, “Details and Analysis of Making the 2017 Tax Reform Permanent,” Tax Foundation, Nov. 8, 2023, https://taxfoundation.org/research/all/federal/making-2017-tax-reform-permanent/.

[4] The CHIPS and Science Act of 2022, H.R. 4346, 117th Congress (2022), https://www.commerce.senate.gov/services/files/CFC99CC6-CE84-4B1A-8BBF-8D2E84BD7965.

[5] Congressional Budget Office, “Estimated Budget Effects of H.R. 4346, as Amended by the Senate and as Posted by the Senate Committee on Commerce, Science, and Transportation on July 20, 2022,” Jul. 21, 2022, https://www.cbo.gov/system/files/2022-07/hr4346_chip.pdf.

[6] Justin Badlam, Stephen Clark, Suhrid Gajendragadkar, Adi Kumar, Sara O’Rourke, and Dale Swartz, “The CHIPS and Science Act: Here’s What’s In It,” McKinsey and Company, Oct. 4, 2022, https://www.mckinsey.com/industries/public-sector/our-insights/the-chips-and-science-act-heres-whats-in-it.

[7] Inflation Reduction Act of 2022, H.R. 5376, 117th Congress (2022), https://www.congress.gov/bill/117th-congress/house-bill/5376/text.

[8] Alex Durante, Cody Kallen, Huaqun Li, William McBride, and Garrett Watson, “Details and Analysis of the Inflation Reduction Act Tax Provisions,” Tax Foundation, Aug. 10, 2022, https://taxfoundation.org/research/all/federal/inflation-reduction-act/.

[9] Tax Foundation, “Preliminary Details and Analysis of the Tax Cuts and Jobs Act,” Taxes and Growth Model, Dec. 18, 2017, https://taxfoundation.org/research/all/federal/final-tax-cuts-and-jobs-act-details-analysis/.

[10] Joint Committee on Taxation, “Estimated Budget Effects of the Conference Agreement For H.R.1, The Tax Cuts and Jobs Act,” Dec. 18, 2017, https://www.jct.gov/publications/2017/jcx-67-17/. The $594 billion includes the impacts of the 20 percent pass-through deduction and the limitation on pass-through loss deductions, which JCT categorized as individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. changes.

[11] Erica York, “Inflation Reduction Act’s Price Controls Are Deterring New Drug Development,” Tax Foundation, Apr. 26, 2023, https://taxfoundation.org/blog/inflation-reduction-act-medicare-prescription-drug-price-controls/.

[12] Alex Durante, Cody Kallen, Huaqun Li, William McBride, and Garrett Watson, “Details and Analysis of the Inflation Reduction Act Tax Provisions,” Tax Foundation, Aug. 10, 2022, https://taxfoundation.org/research/all/federal/inflation-reduction-act/.

[13] Congressional Budget Office, “Estimated Budgetary Effects of H.R. 4346, as Amended by the Senate and as Posted by the Senate Committee on Commerce, Science, and Transportation on July 20, 2022,” Jul. 21, 2022, https://www.cbo.gov/system/files/2022-07/hr4346_chip.pdf.

[14] Congressional Budget Office, “The Budget and Economic Outlook: 2024 to 2034,” February 2024, https://www.cbo.gov/publication/59710.

[15] John Bistline, Neil Mehrotra, and Catherine Wolfram, “Economic Implications of the Climate Provisions of the Inflation Reduction Act,” Brookings Institution Papers on Economic Activity, Spring 2023, https://www.brookings.edu/articles/economic-implications-of-the-climate-provisions-of-the-inflation-reduction-act/.

[16] Réka Juhász, Nathan Lane, and Dani Rodrik, “The New Economics of Industrial Policy,” National Bureau of Economic Research Working Paper No. 31538, August 2023, https://www.nber.org/papers/w31538.

[17] Ibid.

[18] See for instance, Scott Lincicome and Huan Zhu, “Questioning Industrial Policy: Why Government Manufacturing Plans Are Ineffective and Unnecessary,” Cato Institute, Sep. 28, 2021, https://www.cato.org/white-paper/questioning-industrial-policy.

[19] See Garrett Watson, “Testimony: Tax Policy’s Role in Expanding Affordable Housing,” Tax Foundation, Mar. 7, 2023, https://taxfoundation.org/research/all/federal/expanding-affordable-housing/; Alex Muresianu, “1980s Tax Reform, Cost Recovery, and the Real Estate Industry,” Tax Foundation, Jul. 23, 2020, https://taxfoundation.org/research/all/federal/1980s-tax-reform-cost-recovery-and-the-real-estate-industry-lessons-for-today/.

[20] See for instance, Sean Bray, Daniel Bunn, and Joost Haddinga, “The Role of Pro-Growth Tax Policy and Private Investment in the European Union’s Green Transition,” Tax Foundation, May 4, 2023, https://taxfoundation.org/research/all/eu/eu-green-transition-tax-policy/; Alex Muresianu, “How Expensing for Capital Investment Can Accelerate the Transition to a Cleaner Economy,” Tax Foundation, Jan. 12, 2021, https://taxfoundation.org/research/all/federal/energy-efficiency-climate-change-tax-policy/.

[21] The White House, “ICYMI: Experts Agree: Chips Manufacturing and National Security Bolstered by Childcare,” Mar. 8, 2023, https://www.whitehouse.gov/briefing-room/statements-releases/2023/03/08/icymi-experts-agree-chips-manufacturing-and-national-security-bolstered-by-childcare/.

[22] National Institute of Standards and Technology, “Biden-Harris Administration Announces Final National Security Guardrails for CHIPS for America Incentives Program,” Sep. 22, 2023, https://www.nist.gov/news-events/news/2023/09/biden-harris-administration-announces-final-national-security-guardrails.

[23] Dominic Pino, “Why Defense is Different,” National Review, Dec. 14, 2023, https://www.nationalreview.com/2023/12/why-defense-is-different/; see also Scott Lincicome, “Manufactured Crisis: Deindustrialization, Free Markets, and National Security,” Cato Institute Policy Analysis No. 907, Jan. 27, 2021, https://www.cato.org/publications/policy-analysis/manufactured-crisis-deindustrialization-free-markets-national-security.

[24] The maritime industry provides examples for both cases. The Jones Act has a plausible national security justification (ensuring domestic sailing and shipbuilding capacity) but has ultimately harmed those security goals. Conversely, in World War II, the Liberty Ship program was extremely successful in rapidly expanding U.S. maritime transportation capacity to aid the war effort, but it did not form the basis for post-war growth in domestic shipbuilding, nor did the Liberty Ships prove particularly useful in peacetime commercial applications.

[25] See, for instance, Douglas Holtz-Eakin, “Solow and the States: Capital Accumulation, Productivity, and Economic Growth,” National Tax Journal 46:4 (December 1993), https://www.journals.uchicago.edu/doi/epdf/10.1086/NTJ41789037.

[26] Oren Cass, “America Should Adopt an Industrial Policy,” Law and Liberty, Jul. 23, 2019, https://manhattan.institute/article/america-should-adopt-an-industrial-policy.

[27] Jake Sullivan, “Remarks on Renewing American Economic Leadership,” Brookings Institution, Apr. 27, 2023, https://www.whitehouse.gov/briefing-room/speeches-remarks/2023/04/27/remarks-by-national-security-advisor-jake-sullivan-on-renewing-american-economic-leadership-at-the-brookings-institution/.

[28] Kyle Pomerleau and Huaqun Li, “Measuring Marginal Effective Tax Rates on Capital Income Under Current Law,” Tax Foundation, Jan. 15, 2020, https://taxfoundation.org/research/all/federal/measuring-marginal-effective-tax-rates-on-capital-income-under-current-law/.

[29] Ibid.

[30] Alex Muresianu, Alex Durante, and Erica York, “Taxes, Tariffs, and Industrial Policy: How the U.S. Tax Code Fails Manufacturing,” Tax Foundation, Mar. 17, 2022, https://taxfoundation.org/research/all/federal/us-manufacturing-tax-industrial-policy/.

[31] Réka Juhász, Nathan Lane, and Dani Rodrik, “The New Economics of Industrial Policy.”

[32] F. A. Hayek, “The Use of Knowledge in Society,” The American Economic Review 35:4 (September 1945).

[33] Réka Juhász, Nathan Lane, and Dani Rodrik, “The New Economics of Industrial Policy.”

[34] See, for instance, Gordon Tullock, “The Welfare Costs of Tariffs, Monopolies, and Theft,” Western Economic Journal 5:3 (June 1967), https://cameroneconomics.com/tullock%201967.pdf.

[35] See, for instance, Eduardo Luzio and Shane Greenstein, “Measuring the Performance of a Protected Infant Industry: The Case of Brazilian Microcomputers,” The Review of Economics and Statistics 77:4 (November 1995), https://www.jstor.org/stable/2109811; Marta Czarnecka-Gallas, “The Efficiency of Industrial Policy in the 21st Century? The Case of Brazil,” The Polish Journal of Economics.

[36] Joe Studwell, How Asia Works (Grove Press: New York, 2014); see also Arvind Panagariya, “Debunking Protectionist Myths: Free Trade, the Developing World, and Prosperity,” Cato Institute, Jul. 18, 2019, https://www.cato.org/economic-development-bulletin/debunking-protectionist-myths-free-trade-developing-world-prosperity.

[37] Ibid.

[38] Alex Muresianu, Alex Durante, and Erica York, “Taxes, Tariffs, and Industrial Policy: How the U.S. Tax Code Fails Manufacturing”; see also Jeffrey Birnbaum and Alan Murray, Showdown at Gucci Gulch: Lawmakers, Lobbyists, and the Unlikely Triumph of Tax Reform (New York: Random House, 1988).

[39] Alex Durante, “How the Section 232 Tariffs on Steel and Aluminum Harmed the Economy,” Tax Foundation, Sep. 20, 2022, https://taxfoundation.org/research/all/federal/section-232-tariffs-steel-aluminum/; Erica York, “Trump-Biden Tariffs Hurt Domestic Manufacturing,” Tax Foundation, Dec. 1, 2021, https://taxfoundation.org/blog/trump-biden-tariffs-manufacturing/; Brian Potter, “’No Inventions, No Innovations,’ a History of US Steel,” Construction Physics, Dec. 29, 2023, https://www.construction-physics.com/p/no-inventions-no-innovations-a-history.

[40] Alex Muresianu, Alex Durante, and Erica York, “Taxes, Tariffs, and Industrial Policy: How the U.S. Tax Code Fails Manufacturing,” Everett Stamm, “An Overview of the Low-Income Housing Tax Credit,” Tax Foundation, Aug. 11, 2020, https://taxfoundation.org/research/all/federal/low-income-housing-tax-credit-lihtc/.

[41] Brian Murray, Maureen Cropper, Francisco C. De La Chesnaye, and John Reilly, “How Effective are US Renewable Energy Subsidies in Cutting Greenhouse Gases?,” American Economic Review: Papers and Proceedings 104:5 (2014), https://pubs.aeaweb.org/doi/pdfplus/10.1257/aer.104.5.569; see also Gary Clyde Hufbauer and Euijin Jung, “Scoring 50 Years of US Industrial Policy,” Peterson Institute for International Economics, Nov. 29, 2021, https://www.piie.com/publications/piie-briefings/2021/scoring-50-years-us-industrial-policy-1970-2020.

[42] Ibid.

[43] Chris Miller, Chip War: The Fight for the World’s Most Critical Technology (Scribner: New York, 2022); see also Chris Miller, “History Offers a Guide to Winning Our Growing ‘Chip War’ with China,” The Washington Post, Oct. 4, 2022, https://www.washingtonpost.com/made-by-history/2022/10/04/history-offers-guide-winning-our-growing-chip-war-with-china/.

[44] Ibid.; see also Brink Lindsey, “DRAM Scam,” Reason, February 1992, https://reason.com/1992/02/01/dram-scam/.

[45] Nathan Lane, “The New Empirics of Industrial Policy,” Journal of Industry, Competition, and Trade 20 (2020), https://osf.io/preprints/socarxiv/tnxg6.

[46] Bureau of Economic Analysis, “Table 5.3.1. Percent Change From Preceding Period in Real Private Fixed Investment by Type,” Jan. 25, 2024, https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&categories=survey#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDNdLCJkYXRhIjpbWyJjYXRlZ29yaWVzIiwiU3VydmV5Il0sWyJOSVBBX1RhYmxlX0xpc3QiLCIxNDEiXV19; Congressional Budget Office, “Data Supplements: An Update to the Budget and Economic Outlook: 2017 to 2027,” June 2017, https://www.cbo.gov/system/files/115th-congress-2017-2018/reports/52801-june2017outlook.pdf. Additionally, considering only those eight quarters may understate the TCJA’s impact on investment, as the bonus depreciation provisions were made available retroactively as of September 27, 2017, which incentivized companies to book investment in Q4 2017 in order to deduct the costs against the old 35 percent tax rate.

[47] Congressional Budget Office, “An Update to the Budget and Economic Outlook: 2019 to 2029,” Aug 21, 2019, https://www.cbo.gov/system/files/2019-08/55551-CBO-outlook-update_0.pdf.

[48] David Altig, Nick Bloom, Steven J. Davis, Brent Meyer, and Nick Parker, “TariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers that raise prices, reduce available quantities of goods and services for US businesses and consumers, and create an economic burden on foreign exporters. Worries and U.S. Business Investment, Take Two,” Federal Reserve Bank of Atlanta, Feb. 25, 2019, https://www.atlantafed.org/blogs/macroblog/2019/02/25/tariff-worries-and-us-business-investment-take-two.

[49] Board of Governors of the Federal Reserve System, “Open Market Operations,” accessed Jan. 4, 2024, https://www.federalreserve.gov/monetarypolicy/openmarket.htm.

[50] Gabriel Chodorow-Reich, Matthew Smith, Eric Zwick, and Owen Zidar, “Tax Policy and Investment in a Global Economy,” Becker-Friedman Institute Working Paper 2023-141, November 2023, https://bfi.uchicago.edu/wp-content/uploads/2023/11/BFI_WP_2023-141.pdf.

[51] John Bitzan, Yongtao Hong, and Fariz Huzeynov, “Did the Tax Cuts and Jobs Act Stimulate Capital Expenditures? A Firm-Level Approach,” Applied Economics (2023), https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4608729.

[52] Patrick Kennedy, Christine Dobridge, Paul Landefeld, and Jacob Mortenson, “The Efficiency-Equity Tradeoff of the Corporate Income TaxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. : Evidence from the Tax Cuts and Jobs Act,” Nov. 14, 2023, https://patrick-kennedy.github.io/files/TCJA_KDLM_2023.pdf; see also Alex Durante, “Don’t Ignore the Long Run When Evaluating Corporate Tax Cuts,” Tax Foundation, Jan. 11, 2024, https://taxfoundation.org/blog/corporate-tax-cuts-worker-wages/.

[53] John Robertson, “Fastest Wage Growth for the Lowest-Paid Workers,” Federal Reserve Bank of Atlanta, Dec. 16, 2019, https://www.atlantafed.org/blogs/macroblog/2019/12/16/faster-wage-growth-for-the-lowest-paid-workers.

[54] Joseph Politano, “America’s Industrial Transition,” Apricitas Economics, Apr. 26, 2023, https://www.apricitas.io/p/americas-industrial-transition.

[55] President Joe Biden, “Investing In America,” updated Dec. 22, 2023, https://www.whitehouse.gov/invest/.

[56] Jeniece Pettitt, “California’s High-Speed Rail is Running Out of Money, but Progress Has Been Made,” CNBC, May 17, 2023, https://www.cnbc.com/2023/05/17/why-californias-high-speed-rail-is-taking-so-long-to-complete.html.

[57] See, for instance, Shihe Fu, Xiaocong Xu, and Junfu Zhang, “Land Conversion Across Cities in China,” Regional Science and Urban Economics 87 (March 2021), https://www.sciencedirect.com/science/article/abs/pii/S016604622100003X.

[58] Yang Jie and Yuka Hayashi, “One of Biden’s Favorite Chip Projects is Facing New Delays,” The Wall Street Journal, Jan. 18, 2024, https://www.wsj.com/tech/chip-giant-tsmc-foresees-delay-at-second-arizona-plant-22fe1e41.

[59] Board of Governors of the Federal Reserve System, “Open Market Operations”; see also Congressional Budget Office, “Data Supplements: The Budget and Economic Outlook: 2022 to 2032.”

[60] Congressional Budget Office, “Data Supplements: The Budget and Economic Outlook: 2022 to 2032”; see also International Energy Agency, “World Energy Investment: 2023,” May 2023, https://www.iea.org/reports/world-energy-investment-2023.

[61] Barthelemy Bonadio, Zhen Huo, Andrei Levchenko, and Nitya Pandalai-Nayar, “Global Supply Chains in the Pandemic,” Journal of International Economics 133 (November 2021), https://www.sciencedirect.com/science/article/pii/S0022199621001148.

[62] See, for instance, David Shepherdson and Jane Lee, “Intel’s $20B Ohio Factory Could Become World’s Largest Chip Plant,” Reuters, Jan. 21, 2022, https://www.reuters.com/technology/intel-plans-new-chip-manufacturing-site-ohio-report-2022-01-21/; Samsung Newsroom, “Samsung Electronics Announces New Advanced Semiconductor Fab Site in Taylor, Texas,” Nov. 24, 2021, https://news.samsung.com/global/samsung-electronics-announces-new-advanced-semiconductor-fab-site-in-taylor-texas; Stephen Nellis, “TSMC Says Has Begun Construction at its Arizona Chip Factory Site,” Reuters, Jun. 1, 2021, https://www.reuters.com/technology/tsmc-says-construction-has-started-arizona-chip-factory-2021-06-01/.

[63] U.S. Census Bureau, “Construction Spending: Value of Private Construction Put in Place,” accessed Feb. 20, 2024, https://www.census.gov/construction/c30/historical_data.html; see also Joseph Politano, “America’s Industrial Transition.”

[64] Max Roser, “Why did Renewables Become So Cheap So Fast?,” Our World in Data, Dec. 1, 2020, https://ourworldindata.org/cheap-renewables-growth.

[65] See, for instance, Aurelia Glass and Karla Walter, “How Biden’s American-Style Industrial Policy Will Create Quality Jobs,” Center for American Progress, Oct. 27, 2022, https://www.americanprogress.org/article/how-bidens-american-style-industrial-policy-will-create-quality-jobs/.

[66] Bureau of Labor Statistics, “All Employees, Manufacturing [MANEMP],” retrieved from FRED, Jan. 23, 2024, https://fred.stlouisfed.org/graph/?g=cAYh.

[67] Jon Emont, “How Singapore Got Its Manufacturing Mojo Back,” The Wall Street Journal, Jun. 22, 2022, https://www.wsj.com/articles/singapore-manufacturing-factory-automation-11655488002; see also Scott Lincicome, “Manufactured Crisis: Deindustrialization, Free Markets, and National Security.”

[68] Ibid.

Share this article