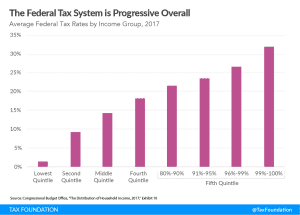

Congressional Budget Office Releases 2017 Data on Household Income and Tax Burdens

Contrary to the perceptions of some, new data indicate that (1) income earned after taxes and transfers has increased over the past several decades for all income groups; (2) the federal tax system is increasingly progressive; and (3) that system relies heavily on higher earners to raise revenue for government services and means-tested transfers.

3 min read