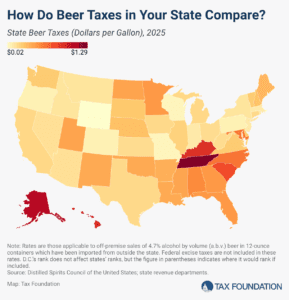

Senate Softens Blow for Pass-Throughs Using Current SALT Workarounds

The Senate’s version of the OBBB restores the benefit of avoiding the SALT deduction cap with PTETs for all pass-through businesses, while placing new limits on the extent of the workarounds.

6 min read