Will Mississippi Be the Next State to Phase Out its Income Tax?

Mississippi Governor Tate Reeves (R), in his budget proposal for fiscal year (FY) 2022, has announced his goal of phasing out the state’s income tax by 2030.

3 min read

Mississippi Governor Tate Reeves (R), in his budget proposal for fiscal year (FY) 2022, has announced his goal of phasing out the state’s income tax by 2030.

3 min read

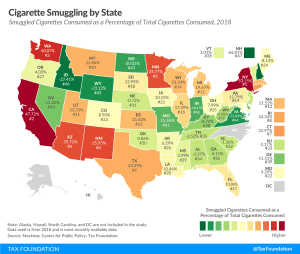

New York already suffers from significant smuggling of untaxed tobacco products—smuggled cigarettes accounted for 53 percent of cigarettes consumed in the state in 2018—and further increasing tobacco taxes is likely to make matters worse.

3 min read

Excessive tax rates on cigarettes in some states induce substantial black and gray market movement of tobacco products into high-tax states from low-tax states or foreign sources. New York has the highest inbound smuggling activity, with an estimated 53.2 percent of cigarettes consumed in the state deriving from smuggled sources.

13 min read

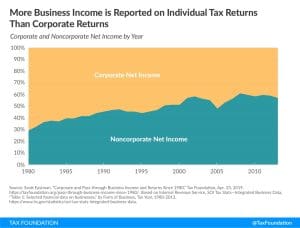

Economists have proposed taxing corporate income more uniformly through corporate integration, which can be done in a variety of ways. Biden’s plan goes in the opposite direction by making worse the double taxation of corporate income.

5 min read

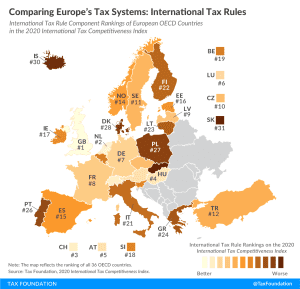

International tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of a country’s tax code.

3 min read

While there are many tax changes built into the tax code over the coming years for individuals and businesses, the recent claim that lower- and middle-income Americans may see a “stealth tax increase” in 2021 due to the Tax Cuts and Jobs Act (TCJA) is untrue.

3 min read

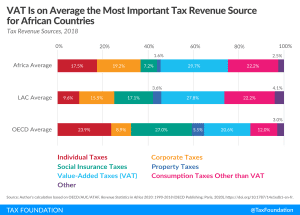

Taxes on goods and services were on average the greatest source of tax revenue for African countries, at over 50 percent of total tax revenues. VAT contributed on average 30 percent, making it the most important tax on goods and services.

6 min read

We sat down with the owners of Black Narrows Brewing Company, a family-owned craft brewery situated in a small island-town on Virginia’s scenic Eastern Shore, to discuss the challenges they face as a small business during COVID-19 and what they would like to see legislators do to reduce short- and long-term barriers for entrepreneurs.

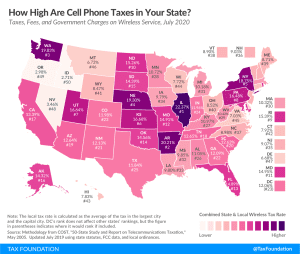

A typical American household with four phones on a “family share” wireless plan can expect to pay about $270 per year (or 22 percent of their cell phone bill) in taxes, fees, and surcharges.

36 min read