Reviewing Joe Biden’s Tax Vision

Biden’s tax vision is twofold: higher taxes on high-income earners and businesses paired with more generous provisions for specific activities and households.

4 min read

Biden’s tax vision is twofold: higher taxes on high-income earners and businesses paired with more generous provisions for specific activities and households.

4 min read

One under-discussed part of the CARES Act, passed in March to provide economic relief during the COVID-19 epidemic, is a correction to a drafting error in the Tax Cuts and Jobs Act of 2017, often known as the “retail glitch.”

3 min read

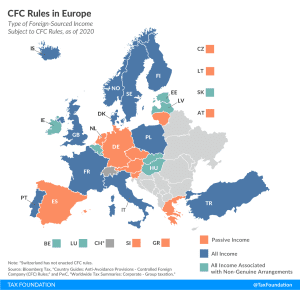

To prevent businesses from minimizing their tax liability by taking advantage of cross-country differences in taxation, countries have implemented various anti-tax avoidance measures, one known as Controlled Foreign Corporation (CFC) rules.

5 min read

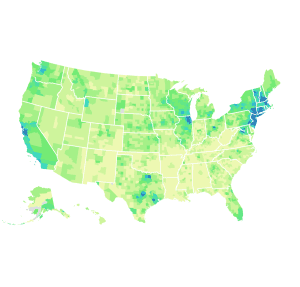

The five counties with the highest median property tax payments are all located near New York City and have bills exceeding $10,000.

3 min read

In recent months, several countries have introduced accelerated depreciation as a measure to incentivize private investment, including Australia, Austria, Germany, and New Zealand. There are various ways of how this policy has been implemented in the respective countries, largely depending on the existing standard depreciation schedules.

5 min read

Value-added taxes (VAT) are traditionally considered regressive, meaning they place a disproportionate burden on low-income taxpayers. However, a recent OECD study used household expenditures micro-data from 27 OECD countries to reassess this conclusion.

5 min read

Tax credits like the ones approved in the Nebraska bill may help legislators buy some time to work toward a more permanent solution, but they are not, in and of themselves, an effective means of providing lasting relief or generating long-term economic growth.

7 min readTax treatment can affect investment decisions. Extending expensing treatment (full and immediate deductions) to all forms of capital investment, human and physical, would help facilitate sustainable long-run economic growth.

2 min read

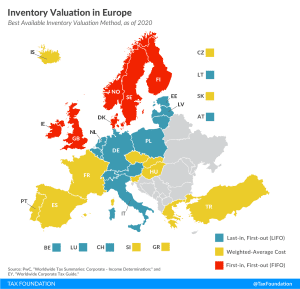

The method by which a country allows businesses to account for inventories can significantly impact a business’s taxable income. When prices are rising, as is usually the case due to factors like inflation, LIFO is the preferred method because it allows inventory costs to be closer to true costs at the time of sale.

2 min read