Biden Could Provide Business and Household Relief by Eliminating Trump Tariffs

Biden has not specified how he would approach the Trump tariffs, though his advisers have said he will at least review them.

5 min read

Biden has not specified how he would approach the Trump tariffs, though his advisers have said he will at least review them.

5 min read

What do election results mean for the future of the federal tax code? What role will tax policy play in curbing the economic effects of the COVID-19 pandemic? How should policymakers address the federal deficit and could a carbon tax be part of that solution? How much of President-elect Joe Biden’s pre-election tax plan will actually come to pass?

There has been an ongoing debate about how automation and the use of robots in the workplace has impacted workers’ wages and employment. Recently, MIT and Boston University economists examined whether tax policy favors certain forms of automation that puts workers at a competitive disadvantage.

7 min read

A recent Deutsche Bank analysis proposes a federal work-from-home tax (“privilege tax”), which is designed to strip away the financial benefit of remote work.

5 min read

New Jersey’s tax design adds another element to the ongoing experiment with legal recreational marijuana in the states.

3 min read

President Biden and Congress should concentrate on areas of common ground, finding incremental places to improve the tax code. A bipartisan bill recently introduced to help retirement savings is a good model for what incremental reform may look like.

4 min read

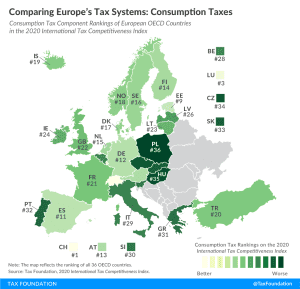

How do consumption tax codes compare among European OECD countries? Explore our new map to see how consumption tax systems in Europe compare.

2 min read