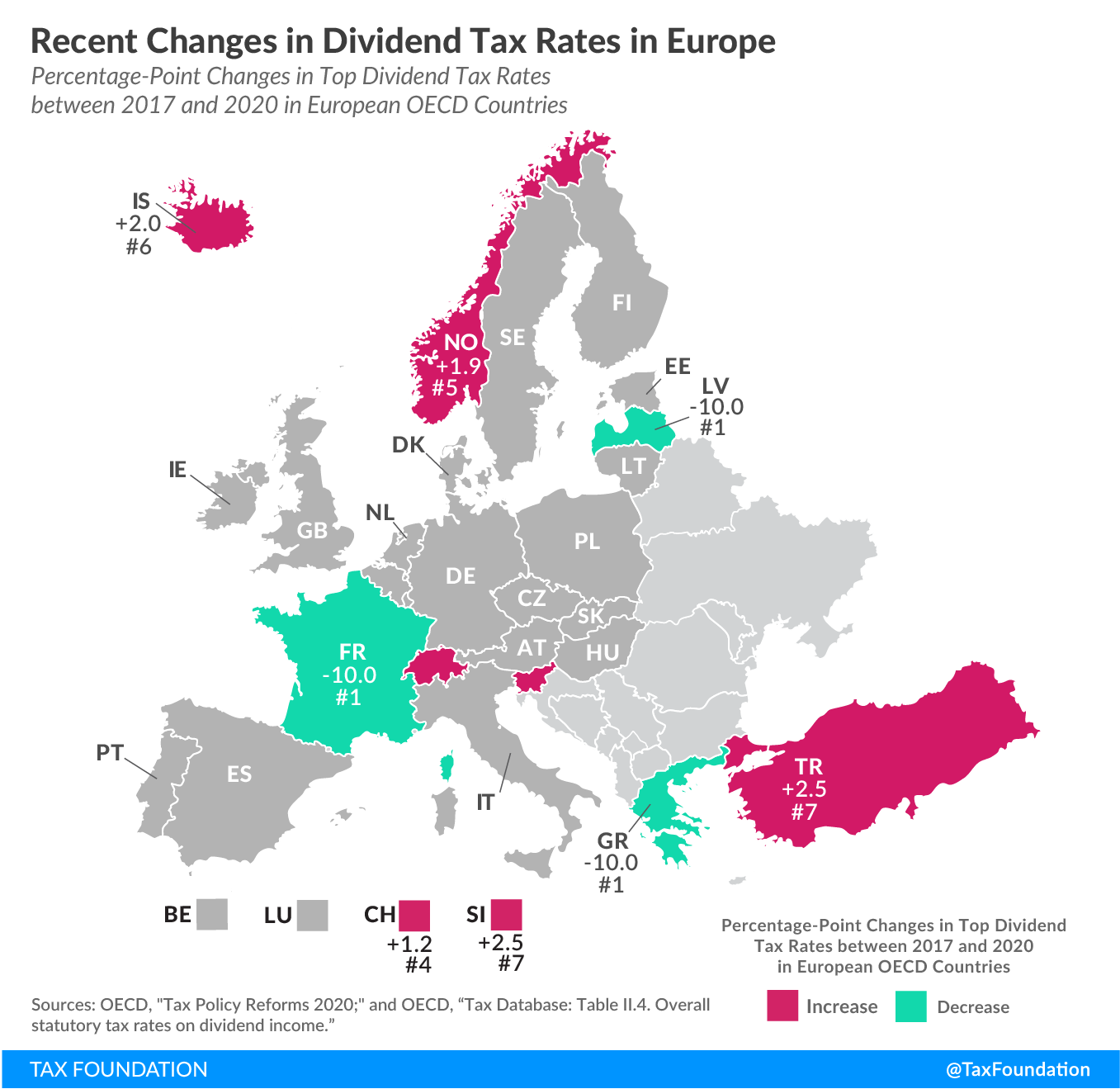

Recent Changes in Dividend Tax Rates in Europe

2 min readBy:With the exception of Estonia and Latvia, all European countries covered in today’s map levy a dividend tax, with the top rates varying significantly. Greece levies a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. of only 5 percent on dividend income, while Ireland taxes dividends at 51 percent.

Over the last three years, eight European OECD countries have made changes to their dividend tax rates. Iceland, Norway, Slovenia, Switzerland, and Turkey increased their rates, each between roughly one and three percentage points. France, Greece, and Latvia cut their rates by 10 percentage points.

France

In 2018, France implemented a single 30 percent flat-rate tax on capital income. Adding the 4 percent high income exceptional contributions for taxpayers earning above €500,000 (US $590,000), the current top dividend tax rate is 34 percent. Prior to the reform, dividends earned by individuals were included as taxable income at the shareholder level, with a top rate of 44 percent.

Greece

Greece reduced its dividends tax rate first from 15 to 10 percent in 2019, and then from 10 to 5 percent in 2020 to encourage investment.

Iceland

In 2018, Iceland increased its tax rate on dividends from 20 percent to 22 percent.

Latvia

Latvia adopted a cash-flow tax model in 2018, replacing its business income tax. Under the new model, a 20 percent corporate income tax is levied when profits are distributed to shareholders. There is no additional dividend tax on individuals. Prior to the reform, Latvia levied a 10 percent dividend tax.

Norway

Norway levies its ordinary income tax on dividends, multiplied by an adjustment factor. In 2019 and 2020, a 22 percent ordinary income tax and an adjustment factor of 1.44 applies to dividend income, resulting in an effective dividend tax rate of 31.7 percent. In 2017 and 2018, the tax rate and adjustment factor were different, translating to tax rates of 29.8 percent and 30.6 percent, respectively.

Slovenia

In 2020, Slovenia’s top dividend tax rate was increased to 27.5 percent from 25 percent.

Switzerland

Switzerland’s top dividend tax rate was increased to 22.29 percent from 21.14 percent this year. The dividend rate increase is a result of a 2020 tax reform, which moved Switzerland closer to EU and OECD tax standards for multinational businesses.

Turkey

This year, Turkey increased its tax rate on dividends from 17.5 percent to 20 percent.

| Country | 2017 Tax Rate | 2018 Tax Rate | 2019 Tax Rate | 2020 Tax Rate |

|---|---|---|---|---|

| 44.00% | 34.00% | 34.00% | 34.00% | |

| 15.00% | 15.00% | 10.00% | 5.00% | |

| 20.00% | 22.00% | 22.00% | 22.00% | |

| 10.00% | 0% | 0% | 0% | |

| 29.76% | 30.59% | 31.68% | 31.68% | |

| 25.00% | 25.00% | 25.00% | 27.50% | |

| 21.14% | 21.14% | 21.14% | 22.29% | |

| 17.50% | 17.50% | 17.50% | 20.00% | |

|

Sources: OECD, “Tax Policy Reforms 2020,” Sept. 3, 2020, https://www.oecd.org/tax/tax-policy-reforms-26173433.htm; and OECD, “Tax Database: Table II.4. Overall statutory tax rates on dividend income,” last updated Sept. 7, 2020, https://stats.oecd.org/Index.aspx?QueryId=59615. |

||||