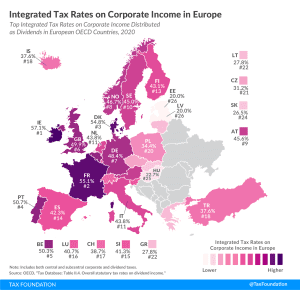

Integrated Tax Rates on Corporate Income in Europe, 2021

The integrated tax rate on corporate income reflects both the corporate income tax and the dividends or capital gains tax—the total tax levied on corporate income. For dividends, Ireland’s top integrated tax rate was highest among European OECD countries, followed by France and Denmark

4 min read