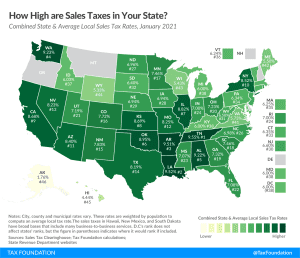

State and Local Sales Tax Rates, 2021

While many factors influence business location and investment decisions, sales taxes are something within lawmakers’ control that can have immediate impacts.

12 min read

While many factors influence business location and investment decisions, sales taxes are something within lawmakers’ control that can have immediate impacts.

12 min read

Twenty-six states and the District of Columbia had notable tax changes take effect on January 1, 2021. Because most states’ legislative sessions were cut short in 2020 due to the COVID-19 pandemic, fewer tax changes were adopted in 2020 than in a typical year.

24 min read

The world is ready to close the book on 2020 and start fresh in 2021, awaiting widespread vaccination, an end to the pandemic, and the beginning of a new chapter of economic recovery. With a fresh start in mind, and a healthy dose of optimism, here are three New Year’s resolutions for crafting better tax policy in the coming year.

2 min read

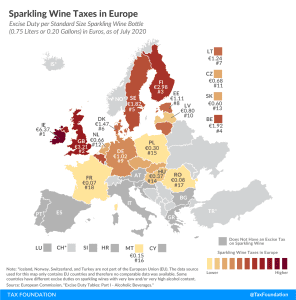

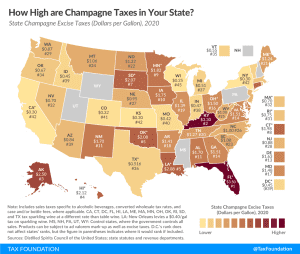

This week, people around the world will celebrate New Year’s Eve, with many opening a bottle of sparkling wine to wish farewell to—a rather consequential—2020 and offer a warm welcome to the—by many of us, long-awaited—new year 2021.

1 min read

The $900 billion coronavirus relief package provides nearly $82 billion for the Education Stabilization Fund, $14 billion for mass transit, and $10 billion for state highways,

3 min read

The latest $900 billion coronavirus relief bill extends and modifies several provisions first enacted in the CARES Act, Congress’s $2.2 trillion pandemic relief law that was passed in March. With this package, lawmakers will have responded to the coronavirus and related economic hardship with a record-setting $3 trillion of fiscal support.

14 min read

Tax extenders are no stranger to hitching a last-minute ride on year-end legislation. This year they made another last-minute appearance, finding a hold in their own division of the 5,593-page bill to fund the government through the fiscal year and provide additional coronavirus relief through March.

2 min read

The coronavirus relief package represents the second-largest recovery legislation, behind only the CARES Act, for a combined total of more than $3 trillion in support.

8 min read