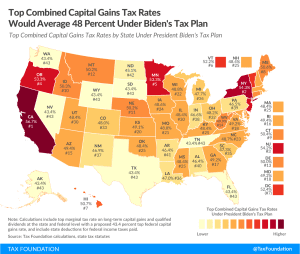

Biden’s Proposed Capital Gains Tax Rate Would be Highest for Many in a Century

The Biden administration is proposing to tax long-term capital gains at ordinary income rates for high earners, which will bring the top federal rate to highs not seen since the 1920s.

2 min read