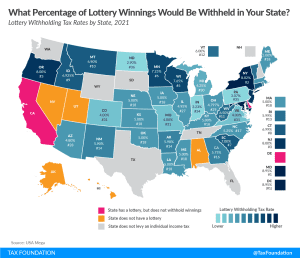

What Are the Chances Your State Withholds Much of Your Lottery Winnings?

Krispy Kreme may have started the vaccine incentive ball rolling, but many states are putting big money into the effort with vaccine lotteries. Unlike a normal lottery, no one is paying for tickets—but the tax collector still gets paid when someone wins.

3 min read