All Related Articles

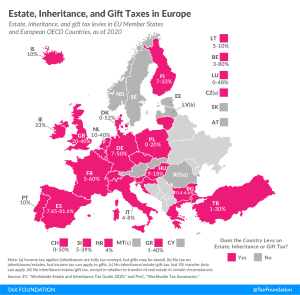

Estate, Inheritance, and Gift Taxes in Europe, 2021

Estate tax is levied on the property of the deceased and is paid by the estate itself. Inheritance taxes, in contrast, are only levied on the value of assets transferred and are paid by the heirs. Gift taxes are levied when property is transferred by a living individual. The majority of European countries covered in today’s map currently levy estate, inheritance, or gift taxes.

3 min read

OECD Report: Tax Revenue as a Percent of GDP in Latin American and Caribbean Countries Is below the OECD Average

Taxes on goods and services were on average the greatest source of tax revenue for Latin American and Caribbean countries

5 min read

Louisiana Aims at Comprehensive Tax Reform

While many of the tax proposals work in tandem, some conflicts continue to exist. If lawmakers were able to repeal federal deductibility, reduce income tax rates, finish the job on inventory taxation, and phase out the capital stock tax, this would represent a marked improvement in the state’s tax climate, eliminating several of the most uncompetitive features of the current code.

6 min read

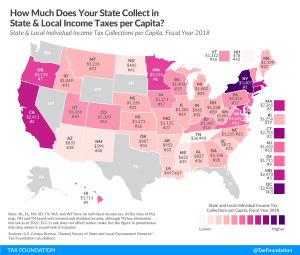

State and Local Individual Income Tax Collections Per Capita

The individual income tax is one of the most significant sources of revenue for state and local governments, generating approximately 24 percent of state and local tax collections in FY 2018.

2 min read

Effects of Proposed International Tax Changes on U.S. Multinationals

The international corporate tax changes in President Biden’s tax plan would increase tax rates on domestic income more than on foreign income, resulting in a net increase in profit shifting out of the US, according to our Multinational Tax Model.

33 min read

Providing Full Cost Recovery for Investment and Lowering Taxes on Firms Are Best Options for Boosting Growth

As policymakers consider tax options to boost the U.S. economy’s long-run economic growth, they should consider reforms that would increase growth the most while minimizing forgone tax revenue.

4 min read

Testimony: Tax Fairness, Economic Growth, and Funding Government Investments

Economic research and Tax Foundation modeling indicate there is a negative trade-off between progressive taxes on capital income—such as the wealth tax, minimum book tax on corporate income, and a higher corporate tax rate—and economic growth.