The Balancing Act of GILTI and FDII

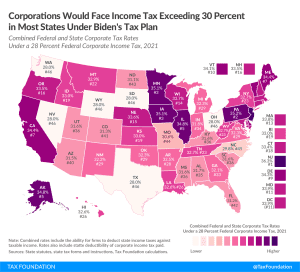

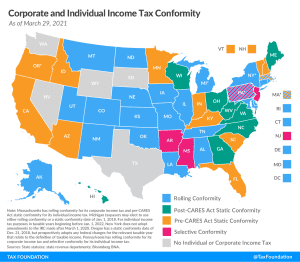

The tax treatment of intangible assets has come into the spotlight recently with the Biden administration proposing to undo a policy adopted in 2017 to encourage intellectual property (IP) to be located in the U.S.

6 min read