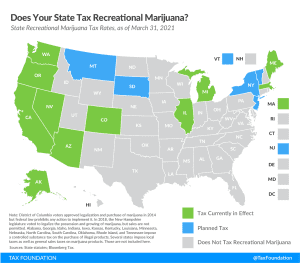

Recreational Marijuana Taxes by State, 2021

The legalization and taxation of recreational marijuana remains one of the hottest trends in state taxation.

6 min read

The legalization and taxation of recreational marijuana remains one of the hottest trends in state taxation.

6 min read

The government of Hartford County, Connecticut is in line to receive $173 million in local aid under the American Rescue Plan Act (ARPA). There’s only one problem: the government of Hartford County doesn’t exist, nor do any of Connecticut’s other counties have county-level government despite being allocated a collective $691 million under the bill.

4 min read

The ongoing pandemic has once again highlighted the importance of investment. To address the economic fallout of the pandemic, several OECD countries have temporarily accelerated depreciation schedules for various assets.

31 min read

In an effort to rein in perceived excesses in executive compensation, Sen. Bernie Sanders (I-VT) and other co-sponsors have proposed to increase a company’s corporate income tax rate progressively based on the difference between median worker pay and CEO pay.

4 min read

States which forgo income taxes have seen population and economic growth vastly outstripping their peers, and a post-pandemic culture that is friendlier to remote work will greatly enhance tax competition.

71 min read

Policymakers should be very cautious about relying too heavily on excise tax increases to pay down tax reductions elsewhere. Ideally, revenue offsets would come from more stable, broader-based revenue sources.

4 min read

Some tax hikes are more damaging than others, according to Congressional Budget Office (CBO) and new Tax Foundation economic modeling.

5 min read

We ought to be worried about the impact of corporate taxes on women, low-skilled workers, and younger workers, since they are the very workers who have been most impacted by the COVID-19 crisis. Raising the corporate tax rate would simply hurt them even more.

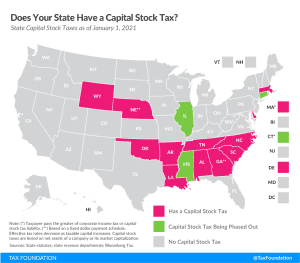

Capital stock taxes are imposed on a business’s net worth (or accumulated wealth). As such, the tax tends to penalize investment and requires businesses to pay regardless of whether they make a profit in a given year, or ever.

4 min read

The increase in expenditures associated with COVID-19 relief is another illustration of using the tax code to administer social spending.

3 min read