Update: On November 13, Louisiana voters rejected one constitutional amendment and approved the other.

Although the centralization of sales tax administration was a bipartisan effort that received overwhelming support in both the House and Senate, voters were divided and narrowly rejected Constitutional Amendment 1. Louisiana is one of only four states that lacks unified sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. administration and one of only two that also lacks a uniform sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . The voter outcome dictates that the state will continue to be an outlier in this regard.

Although sales taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. centralization proved elusive, the approval of Constitutional Amendment 2 allows the legislature’s comprehensive tax plan to be set in motion (detailed below). Repealing federal deductibility in order to pay down income tax rates will simplify the tax code and provide predictability for both taxpayers and the state. These changes have been a long time coming and represent a big step forward for tax reform in Louisiana.

Elections in Louisiana are always different than in other states due to the two-round majority vote system and, in odd-numbered years, holding the first round of elections on a Saturday in October. This year there is an additional twist, with Hurricane Ida prompting a postponement of Election Day to November 13th. Also notable this year is that in addition to municipal, school board, and a smattering of other elected offices, voters will be asked to decide the fate of constitutional amendments which would modernize the state’s tax code in significant ways.

Passage of Constitutional Amendments 1 and 2, which are aimed at the sales tax and individual and corporate income taxes, respectively, would substantially simplify Louisiana’s tax code and provide tax relief in both the short and long term.

Legislators have been working towards tax reform for years. They finally passed their combined package unanimously in both the House and the Senate this past session, but the reforms they seek to accomplish require changes to the constitution, which is where voters come in. The ballot measures do not contain many details, so it may be valuable to walk through what the actual tax plan looks like, and how these constitutional changes would fit into the larger tax picture.

Louisiana Amendment 1. “Creation of the State and Local Streamlined Sales and Use Tax Commission Measure”

If ratified by voters, Amendment 1 would give the legislature the power to create the State and Local Streamlined Sales and Use Tax Commission, with the goal of centralizing sales tax collections and administration at the state level. As Louisiana has one of the most complex sales tax systems in the country, this unification would be an important step forward.

Louisiana is one of only four states that lacks unified sales tax administration. Currently, sellers must remit taxes at the parish (county equivalent) level—a costly and burdensome undertaking, historically made still worse by the fact that each parish, and even smaller units of government below the parish level, has its own unique sales tax base. While the state has worked towards creating an online sales tax payment portal for remote sellers, and has established a unified base for these transactions, shops in the state are still stuck dealing with each jurisdiction separately. This gives out-of-state sellers an advantage and perpetuates the problems of non-neutrality and complexity in Louisiana’s sales tax.

Unified administration would allow both in-state and out-of-state sellers to remit payments to only one authority and significantly cut down on compliance costs. This change would help bring Louisiana in line with the rest of the country, instead of keeping the state an outlier for all the wrong reasons.

Louisiana Amendment 2. “Reduction of the Maximum Individual Income Tax Rate Measure”

Amendment 2 asks voters if they support lowering the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. cap, from 6 to 4.75 percent, and giving the legislature authority over the deduction for federal taxes paid.

If the amendment were ratified, it would put into motion the legislature’s tax reform plan, which includes a number of important elements.

Contingent on ratification of the amendment, already-enacted legislation would eliminate the deduction for federal taxes paid under both the individual and corporate tax, enabling rate reductions that lower burdens in a far more equitable and sensible manner than is accomplished by federal deductibility. Those planned rate changes would drop the individual top rate to 4.25 percent—below the new constitutional cap—in tax year 2022 and provide rate relief within each individual income tax bracket level.

| Current and Future Louisiana Individual Income Tax Rates & Brackets | ||||||

|---|---|---|---|---|---|---|

| Current Tax Rates | Future Tax Rates | |||||

| Rates | Brackets | Rates | Brackets | |||

| 2% | > | $0 | 1.85% | > | $0 | |

| 4% | > | $12,500 | 3.50% | > | $12,500 | |

| 6% | > | $50,000 | 4.25% | > | $50,000 | |

|

Source: Louisiana House Bill 278 |

||||||

This trade between deductions and rates allows the state’s “sticker price” to more accurately reflect real tax burdens, and it lessens the effect of federal changes on state revenue. As it stands, federal deductibility—the policy of allowing taxpayers to deduct an estimate of their federal tax liability from state taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. —causes the state code to become a “mirror” of the federal code: things that are incentivized at the federal level are penalized at the state level, and vice versa. The federal child tax credit increases Louisiana tax liability, since there is less federal tax to deduct, for instance, than a business taking a federal R&D incentive. Eliminating the deduction would put an end to this nonintuitive tax treatment.

At its core, this swap is a simplification more than a tax cut, since revenues only change modestly, but the rates chosen by the legislature also give almost all taxpayers at least minor tax reductions.

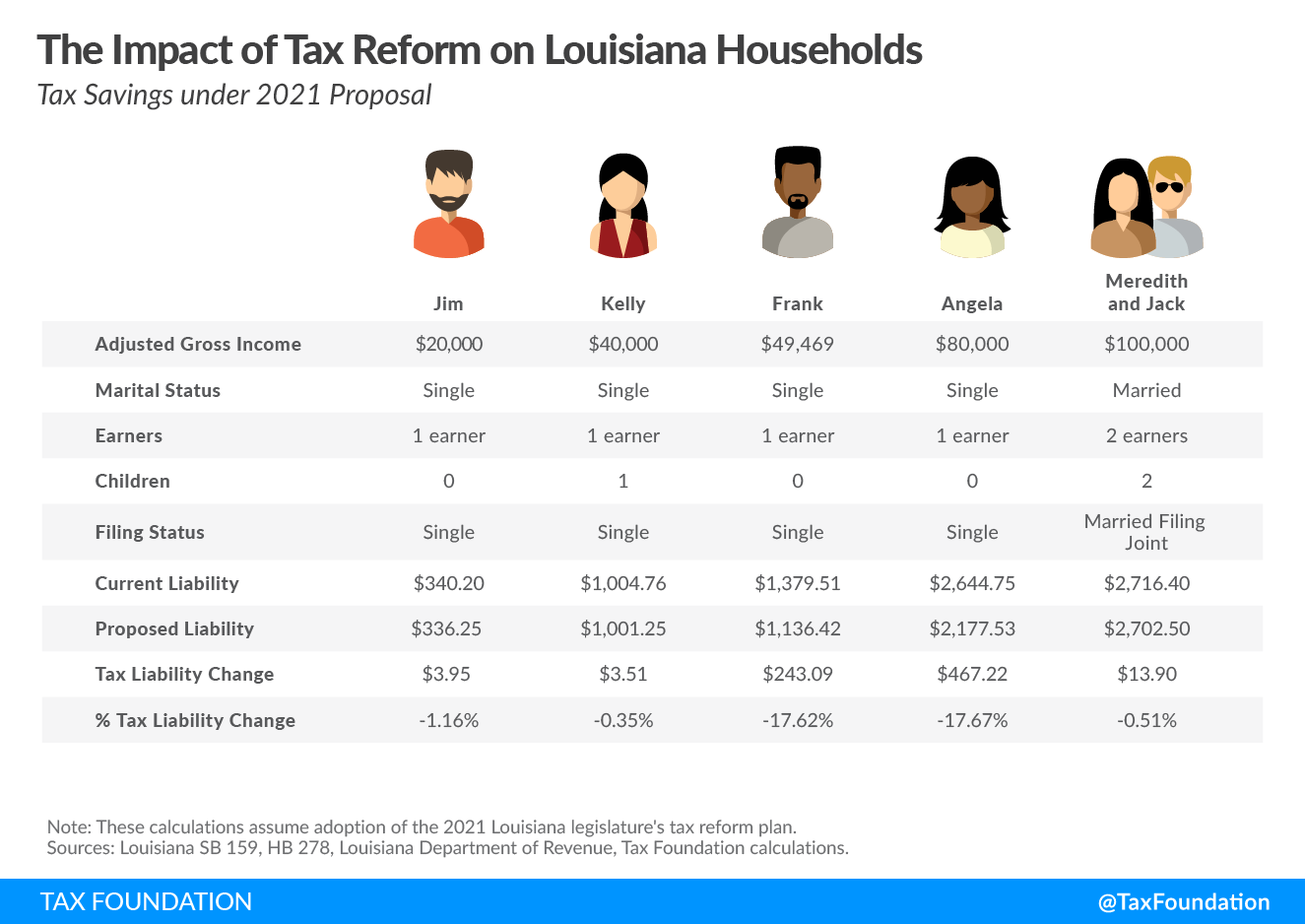

To demonstrate how this plays out, we have created five sample taxpayers of differing family sizes throughout the income spectrum—including the median household income of $49,469—to show the effect of the income tax plan as of its scheduled enactment in 2022.

As these examples show, taxpayers throughout the income spectrum see small decreases in their tax liability. Taxpayer Angela sees slightly more savings than others, as her current tax burden is higher due to some of her income falling into the top bracket, but low-income taxpayers benefit as well.

This initial round of savings may be small, since the primary focus of the first phase is structural improvement, but the approved legislation includes tax triggers that will continue to lower rates if the state reaches set goals for revenue growth and savings. While we cannot model exact future savings, as the rate reductions are also determined by the amount of growth the state sees, it is safe to say that all taxpayers would see lighter tax burdens in the future.

Corporate taxpayers also see a benefit from the repeal of federal deductibility, as the five-bracket corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. system would be consolidated into three brackets, and the top rate would drop from 8 to 7.5 percent in tax year 2022, paid for by the policy’s repeal. Additionally, businesses would no longer see their Louisiana tax liability increase when they make new investments or undertake any actions incentivized by the federal tax code.

| Current and Future Louisiana Corporate Income Tax Rates & Brackets | ||||||

|---|---|---|---|---|---|---|

| Current Tax Rates | Future Tax Rates | |||||

| Rates | Brackets | Rates | Brackets | |||

| 4% | > | $0 | 3.5% | > | $0 | |

| 5% | > | $25,000 | 5.5% | > | $50,000 | |

| 6% | > | $50,000 | 7.5% | > | $150,000 | |

| 7% | > | $100,000 | ||||

| 8% | > | $200,000 | ||||

|

Source: Louisiana House Bill 292 |

||||||

Businesses will also see some relief from the Corporation Franchise Tax, which falls on a company’s net worth and does not take profit into account. Louisiana lawmakers made temporary changes to the tax in response to the coronavirus crisis, exempting the first $300,000 of taxable capital. The tax reform plan benefits small businesses by making this exemption permanent and benefits all other businesses by lowering the rate from 0.3 percent to 0.275 percent.

The changes made by this first stage of reform are significant and will go a long way to improve Louisiana’s tax code. Louisiana has long been near the bottom of the Tax Foundation’s rankings of the competitiveness of states’ tax structures, but these proposed changes would be an important step forward. Taken together, the rate reductions, bracket consolidations, and sales tax centralization would improve the state’s tax climate and improve Louisiana’s ranking from 42nd to 38th on our State Business Tax Climate Index, finally lifting the state out of the bottom 10.

But the plan looks even farther into the future: if the state experiences sufficient revenue growth, rate reduction triggers will continue to improve the state’s rankings by responsibly lowering tax rates. Even apart from the current planned changes, giving rate-setting authority to the legislature—in addition to setting a lower rate cap—will give the state the flexibility to adjust its tax code in an increasingly mobile world where tax competitiveness is becoming more and more important.

The legislature has taken an important step with the bipartisan adoption of a package of reforms that will enhance simplicity, transparency, and neutrality in the tax code, while setting the state up for growth. Now the rest is up to voters.

Share this article