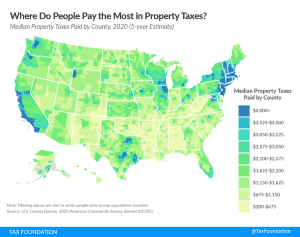

Property Taxes by State and County, 2022

Property taxes are the primary tool for financing local government and generating state-level revenue in some states as well.

5 min read

Property taxes are the primary tool for financing local government and generating state-level revenue in some states as well.

5 min read

Massachusetts’ competitive tax advantage in New England is driven primarily by its competitive individual income tax rate and its sales and use tax structure. If the Commonwealth changes its tax code in ways that narrow the base or increase the rate, it cedes greater tax competitiveness to other states, regionally and nationally.

34 min read

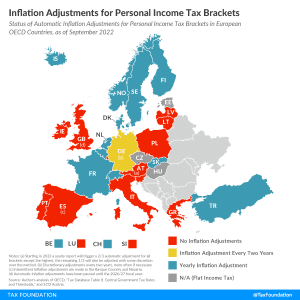

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min read

Will states consider student loan forgiveness a taxable event? In some states, the answer could be yes.

5 min read

In an already-challenging economic environment, new UK Prime Minister Liz Truss must get tax rates correct to avoid over-burdening a population and business sector facing immense uncertainty. Focusing only on rates while ignoring the base misses an opportunity for real, pro-growth reform.

4 min read

With continued concerns over inflation, individuals may be wondering how their tax bills will be impacted. Less than half of OECD countries in Europe automatically adjust income tax brackets for inflation every year.

3 min read

As Idaho attempts to further solidify its position as a growth-oriented, taxpayer-friendly state this special session, other states should look to its example and pursue similar reforms.

6 min read

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

As Missouri legislators head into a special session, they should consider making a pro-growth change that the state is already so close to achieving: creating a flat income tax.

4 min read

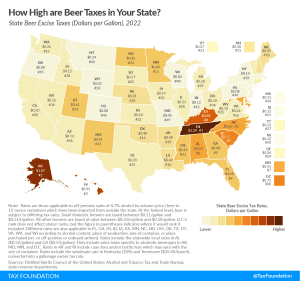

Tennessee, Alaska, Hawaii, and Kentucky levy the highest beer excise tax rates in the nation. How does your state compare?

3 min read

The phaseout of 100 percent bonus depreciation, scheduled to take place after the end of 2022, will increase the after-tax cost of investment in the U.S. Permanently extending it would increase long-run economic output by 0.4 percent and increase employment by 73,000 FTE jobs.

20 min read

The Inflation Reduction Act focused more on enforcement and hiring more auditors rather than programs that make it easier for taxpayers to comply with the code and the IRS to administer it.

6 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

In a pattern that has become all too common in recent decades, the newly enacted Inflation Reduction Act (IRA) added yet another layer of complexity to an already complex and burdensome federal tax code.

9 min read

In response to high oil prices, Sen. Wyden has proposed raising taxes on oil and gas companies in three ways. His “Taxing Big Oil Profiteers Act” would create an additional 21 percent tax on so-called excess profits earned over 10 percent of revenues of oil companies with annual revenues over $1 billion; levy a tax on stock buybacks; and remove last-in, first-out (LIFO) tax treatment of inventory accounting.

7 min read

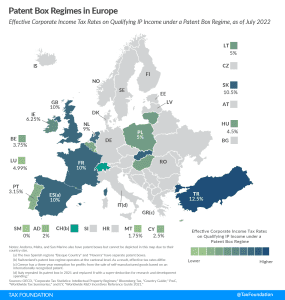

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP. Most commonly, eligible types of IP are patents and software copyrights. Currently, 13 of the 27 EU member states have a patent box regime.

4 min read

Arkansas recently became the 13th state to authorize an individual income tax rate reduction this year. This round of tax cuts accelerated reforms enacted eight months ago.

7 min read

Pillar One Amount A is meant to reallocate taxable profits of large multinationals, mitigate double taxation of profits, and avoid a harmful tax and trade war.

The Inflation Reduction Act increases the IRS’s budget by roughly $80 billion over 10 years. The money is broken into four main categories—enforcement, operations support, business system modernization, and taxpayer services—as well as a few other small items such as an exploratory study on the potential of a free-file system.

6 min read

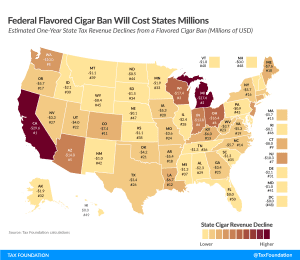

The FDA’s proposal to ban flavored cigars would carry significant revenue implications for many state governments.

7 min read