Why Does the US Tax Code Penalize R&D?

Spreading deductions for research investments across five years instead of one is an innovation killer.

Spreading deductions for research investments across five years instead of one is an innovation killer.

On the heels of adopting one of the most comprehensive state tax reform packages in years, Iowa lawmakers are back in Des Moines with property tax relief in their sights. But while the issue is worthy of their attention, House File 1 (HF 1) as currently drafted misses the mark.

4 min read

Before EU policymakers rush to implement massive reforms, they should remember the goals of the Single Market, its international limitations, and the role of tax policy.

4 min read

By shifting to a flat income tax, Georgia has already made an important commitment to tax competitiveness. Although the state’s top rate threshold is already very low, a true single-rate income tax will help protect taxpayers from inflation-related tax increases and provide a buffer against rising tax rates in the future. To combine responsible rate reductions with these benefits, Georgia should create tax triggers that empower the state to keep pace with its competition.

3 min read

A combination of long-standing IRS operational deficiencies, the agency’s temporary closure due to the pandemic, and the now-expired pandemic relief produced a perfect recipe for a paper backlog.

4 min read

In a coordinated effort, lawmakers in seven states that collectively house about 60 percent of the nation’s wealth—California, Connecticut, Hawaii, Illinois, Maryland, New York, and Washington—are introducing wealth tax legislation on Thursday.

7 min read

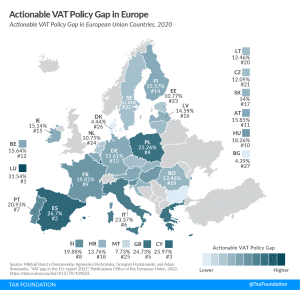

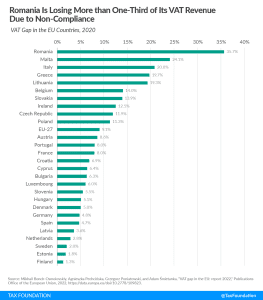

Value-added taxes (VAT) make up approximately one-fifth of total tax revenues in Europe. However, European countries differ significantly in how efficiently they raise VAT revenues. One way to measure a country’s VAT efficiency is the VAT Gap.

4 min read

Lawmakers should use the most comprehensive analytical tools available to them—like dynamic scoring—to make informed decisions about policy changes.

5 min read

The EU’s unilateral approach with carbon taxes, faster track on the global minimum tax, and threat of renewed efforts on DSTs means that U.S. policymakers face some hard choices. Policymakers on both sides of the Atlantic should keep in mind pro-growth tax and trade principles that promote a rules-based international order and increase opportunity.

7 min read

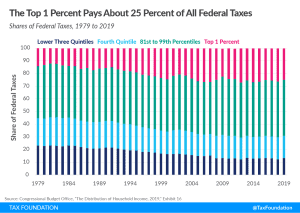

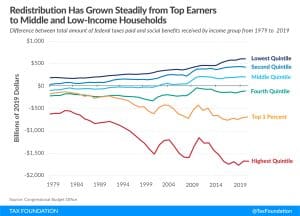

Newly published data from the CBO indicates in 2019, before the onset of the pandemic, American incomes continued to rise as part of a broad economic expansion. It also shows that, contrary to common perceptions, the federal tax system is progressive.

4 min read

Since VAT revenues are such a significant and stable contributor to overall government revenues, EU policymakers should pay particular attention to how efficiently those revenues are raised.

22 min read

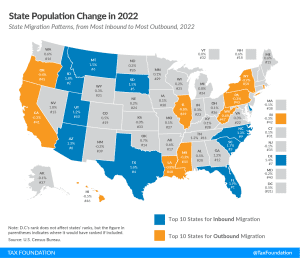

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

It’s Christmas time, and for millions of families around the country, that means revisiting some classic holiday movies. For some, that includes It’s a Wonderful Life and Home Alone. For others, that includes Die Hard.

3 min read

Most of the 2023 state tax changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

20 min read

The year-end omnibus federal spending package makes a number of reforms to retirement savings accounts.

3 min read

As it stands, Pillar One would usher in the end of many digital services taxes (though perhaps not all) at the cost of increased complexity (in an already complex and uncertain system).

4 min read

If bonus depreciation is allowed to phase out, then the tax bias against capital investments will increase, discouraging firms from making otherwise profitable investments.

14 min read

Over the long run, tax policies that grow after-tax incomes and the economy do more to boost charitable giving than policies that try to incentivize people to be charitable.

9 min read

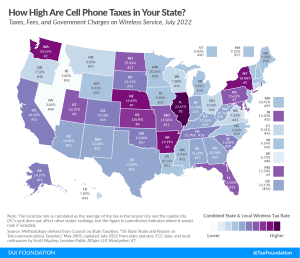

While the wireless market has become increasingly competitive in recent years, resulting in steady declines in the average price for wireless services, the price reduction for consumers has been partially offset by higher taxes.

41 min read

New CBO data shows that the current U.S. fiscal system—both taxes and direct federal benefits—is very progressive and very redistributive.

7 min read