Inflation and Europe’s Personal Income Taxes

3 min readBy:Most countries’ personal income taxes have a progressive structure where taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates increase as individuals earn higher wages. However, if wages are pushed up by inflation, people may pay higher taxes even if their real earnings have not increased. This is known as bracket creep.

In the first quarter of 2022, labor costs in the European Union rose 4 percent over the prior year while a July report revealed a 9.8 percent annual increase in consumer inflation. With continued concerns over inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. , individuals may be wondering how their tax bills will be impacted.

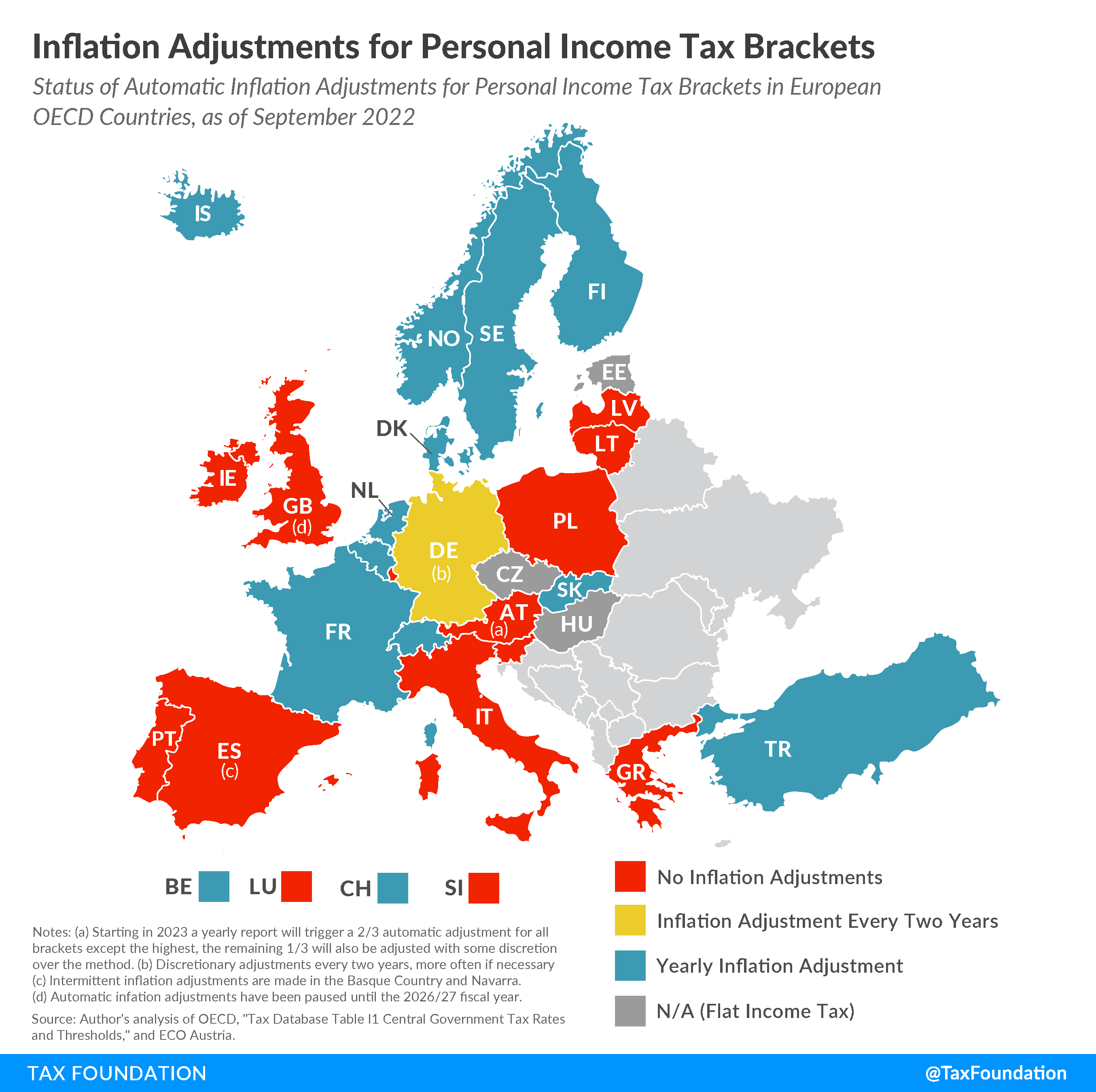

Only 11 out of 27 European OECD countries automatically adjust income tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. for inflation every year. Germany adjusts its income tax brackets every two years in response to an inflation report, but it also has the flexibility to adjust rates more regularly (as it has done in recent years). For countries with flat taxes (e.g., Czech Republic, Estonia, and Hungary), this is less problematic: there are no higher brackets into which rates can creep.

That leaves 14 European OECD countries that do not adjust their income tax brackets for inflation regularly. The United Kingdom joined this group when it paused inflation adjustments for four years, starting in 2022. Austria has recently adopted inflation adjustments that will apply beginning in 2023.

Politicians may welcome bracket creepBracket creep occurs when inflation pushes taxpayers into higher income tax brackets or reduces the value of credits, deductions, and exemptions. Bracket creep results in an increase in income taxes without an increase in real income. Many tax provisions—both at the federal and state level—are adjusted for inflation. because they can appear to cut taxes every couple of years when, in reality, they are simply bringing income tax brackets more in line with inflation. A better approach would be to automatically adjust income tax brackets for inflation. This would give taxpayers more certainty and keep politicians honest.

The German term for bracket creep—“Kalte Progression” or “cold progression”—suggests the coming of winter. As inflation remains high, more governments should help taxpayers stay warm by indexing income tax brackets to inflation.

| Country | Inflation Tax Adjustment |

|---|---|

| Austria | Starting in 2023, a yearly report will trigger a 2/3 automatic adjustment for all brackets except the highest. The remaining 1/3 will also be adjusted with some discretion over the method. |

| Belgium | Yearly |

| Czech Republic | No (Flat Income Tax) |

| Denmark | Yearly |

| Estonia | No (Flat Income Tax) |

| Finland | Yearly |

| France | Yearly |

| Germany | Adjustments every two years, more often if necessary |

| Greece | No |

| Hungary | No (Flat Income Tax) |

| Iceland | Yearly |

| Ireland | No |

| Italy | No |

| Latvia | No |

| Lithuania | No |

| Luxembourg | No |

| Netherlands | Yearly |

| Norway | Yearly |

| Poland | No |

| Portugal | No |

| Slovak Republic | Yearly |

| Slovenia | No |

| Spain | Intermittent inflation adjustments are made in the Basque Country and Navarra. |

| Sweden | Yearly |

| Switzerland | Yearly |

| Turkey | Yearly |

| United Kingdom | Automatic inflation adjustments have been paused until the 2026/27 fiscal year. |

|

Source: Author’s analysis of OECD, “Tax Database Table I.1 Central Government Personal Income Tax Rates and Thresholds,” May 24, 2022, https://stats.oecd.org/Index.aspx?DataSetCode=TABLE_I1; and ECO Austria, “Regelungen zur Anpassung der Einkommensbesteuerung an das Preisniveau im internationalen Vergleich,” 2022, https://www.datawrapper.de/_/1pYqL/. |

|

Share this article