What Is GDP and Why Should I Care About It?

GDP stands for gross domestic product and is calculated by measuring a country’s total consumption, government spending, investments, and net exports.

2 min read

GDP stands for gross domestic product and is calculated by measuring a country’s total consumption, government spending, investments, and net exports.

2 min read

Canada is planning to join the club of countries that, in the past 3 years, introduced a digital services tax (DST) despite U.S. opposition and concerns expressed by Canadian businesses.

4 min read

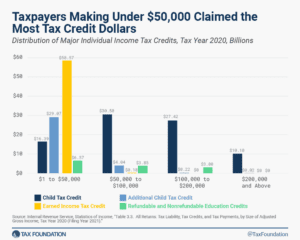

In tax year 2020, taxpayers claimed more than 159 million tax credits on their individual income tax returns worth a total of more than $277 billion. That was an increase of $35.3 billion from tax year 2019, largely due to an influx of pandemic relief administered through the tax code in 2020.

6 min read

Congress should reconsider key elements of the IRA, including the book minimum tax and the green energy credits, with an eye towards simplification and fiscal responsibility.

46 min read

As the TCJA expiration nears, lawmakers face difficult choices in reforming the CTC. While revenue, distributional and economic effects are important, lawmakers should also focus on simplifying the rules and reducing the administrative challenges.

9 min read

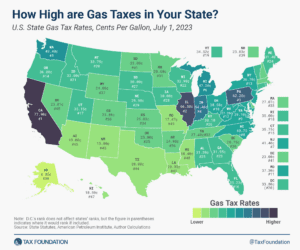

California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg).

2 min read

A bill introduced in the Massachusetts House, (H. 74) would expand funding for community media programming by imposing a new tax on the gross revenues of digital streaming service providers. The sentiment is understandable, but the proposed solution leaves much to be desired.

6 min read

Taylor Swift’s Eras Tour highlights that taxes impact everyone, artists and fans alike.

3 min read

Taxation plays a key role in driving illicit trade. People respond to incentives, and sizable price markups for legal cigarettes create incentives for tax avoidance.

4 min read

Starting on September 1st, federal student loan payments will resume after a three-and-a-half-year pause on payments and accrued interest following the onset of the COVID-19 pandemic.

6 min read

Montana Policymakers should pursue principled property tax reform that benefits all property owners without creating market distortions or unfairly shifting the tax burden.

5 min read

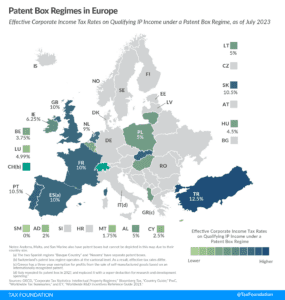

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read

Our newly enhanced website will improve accessibility to the very data, research, and experts that make us the world’s leading independent tax policy organization.

3 min read

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

4 min read

For policymakers in Germany, corporate taxation stands out as a promising area for reform. See Germany tax reform and Germany tax proposals.

5 min read

Details and analysis of the latest House GOP tax plan, the American Families and Jobs Act. Learn more about the House Republican tax plan.

7 min read

The technical rules that were once solely the province of tax wonks in D.C. and Paris are being brought out into the public sphere.

5 min read

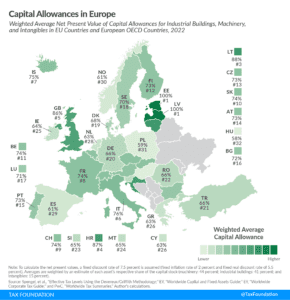

Capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read

In Greta Gerwig’s new Barbie movie, Barbie’s venture outside of Barbieland introduces her to new experiences. But what about Barbie and taxes?

3 min read

Simplifying international tax rules will not solve all the challenges that stand in the way of healthy cross-border investment, but eliminating unnecessary provisions would be a positive pivot relative to the trajectory of recent years. It’s high time that policymakers stopped pursuing ever more complex rules and started the hard work of simplification.

6 min read