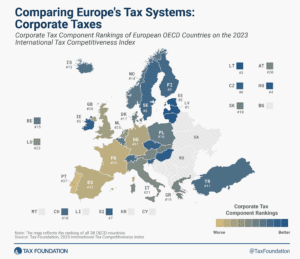

Comparing Europe’s Tax Systems: Corporate Taxes

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

2 min read

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

2 min read

What do The Rolling Stones, NFL star Tyreek Hill, and Maryland millionaires have in common? They all moved because of taxes.

4 min read

It’s been almost a year since California banned the sale of all flavored tobacco products, and the big question is: did it work?

4 min read

Policymakers on Capitol Hill should prioritize permanent pro-growth policy in the coming years as the economy struggles with inflation and the recovery from the pandemic.

4 min read

The latest tax gap report from the IRS has generated much media attention—and much misunderstanding.

6 min read

A harmonized EU tax base is a project in the making. Policymakers have a chance to put the Union on a path for increased investment and economic growth by focusing on the details of capital cost recovery.

3 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

Minimum markup policies tend to be wildly unpopular among both taxpayers and policymakers. Lawmakers should carefully evaluate whether minimum markup laws are policies that improve the well-being of their constituents.

3 min read

Indiana’s tax code is structured in a relatively sound and economically efficient manner overall, but additional improvements should be considered to make the state even more economically competitive.

If the EU is going to harmonize its tax base, it should do so in a way that increases the efficiency and competitiveness of tax policy for the EU as a whole, and not just seek out the lowest common denominator.

5 min read

Instead of adopting a highly distortive property tax assessment limit, policymakers should consider how similar goals could be met through other means.

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

88 min read

The OECD recently released a trove of new documents on a draft multilateral tax treaty. The U.S. Treasury has opened a 60-day consultation period for the proposal and is requesting public review and input.

7 min read

If tax increases are included in a package, international experience points toward raising consumption taxes, rationalizing tax expenditures, and broadening the tax base—not hiking income taxes.

6 min read

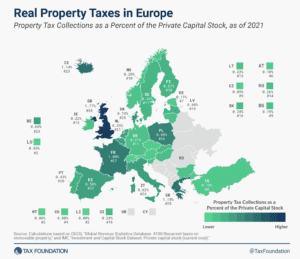

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

2 min read

The global minimum tax agreement known as Pillar Two is intended to curb profit shifting. However, OECD countries already have a variety of mechanisms in place that seek to prevent base erosion and profit shifting by multinational corporations.

40 min read

Outside of the pandemic years, this year’s federal deficit is the highest in U.S. history. While tax revenue has increased about 28 percent since the pre-pandemic year 2019, spending has increased about 46 percent. Annual deficits are headed towards $3 trillion over the next few years.

3 min read

Income taxes impose steeper economic costs, and often steeper administrative and compliance costs, than consumption taxes. Moving to a consumption tax would end the tax bias against saving and investment and provide an opportunity to greatly simplify anti-poverty programs embedded in the tax code.

45 min read