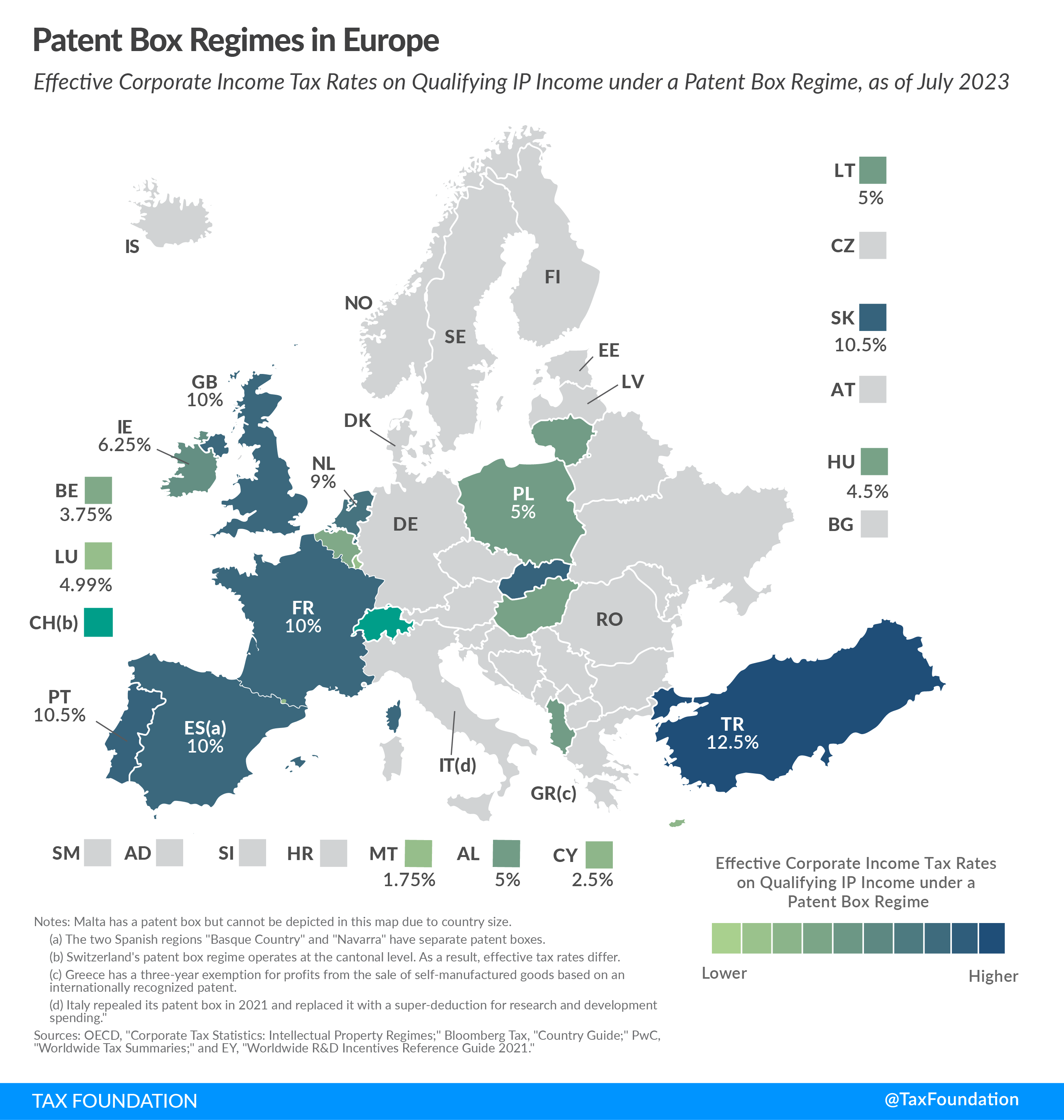

Patent Box Regimes in Europe, 2023

3 min readBy:Patent boxA patent box—also referred to as intellectual property (IP) regime—taxes business income earned from IP at a rate below the statutory corporate income tax rate, aiming to encourage local research and development. Many patent boxes around the world have undergone substantial reforms due to profit shifting concerns. regimes (also referred to as intellectual property [IP] regimes) provide lower effective taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates on income derived from IP. Most commonly, eligible types of IP are patents and software copyrights. Depending on the patent box regime, income derived from IP can include royalties, licensing fees, gains on the sale of IP, sales of goods and services incorporating IP, and patent infringement damage awards.

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

As today’s map shows, patent box regimes are relatively widespread in Europe. Most have been implemented within the last two decades.

Currently, 13 of the 27 EU Member States have a patent box regime in place. These are Belgium, Cyprus, France, Hungary, Ireland, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Slovakia, and Spain (federal, Basque Country, and Navarra). Non-EU countries Albania, Serbia Switzerland, Turkey, and the United Kingdom have also implemented patent boxes.

The reduced tax rates provided under patent box regimes range from 1.75 percent in Malta to 10.5 percent in Slovakia.

Italy repealed its patent box in 2021 and instead introduced a deduction for 230 percent of costs related to R&D. This represents a transition away from a benefit based on income (the patent box) to a benefit focused on investment or expenditure (the super-deduction). San Marino is the most recent country in Europe to repeal both of its IP regimes in 2022.

In 2022, Portugal increased its corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. exemption for patent income from 50 to 85 percent and extended the exemption to income from software copyrights.

Patent Box Regimes in Europe, as of July 2023

| Qualifying IP Assets | Tax Rate Under Patent Box Regime | Statutory Corporate Income Tax Rate | |||

|---|---|---|---|---|---|

| Patents | Software | Other (a) | |||

| Albania | ✔ | 5% | 15% | ||

| Belgium | ✔ | ✔ | 3.75% | 25% | |

| Cyprus | ✔ | ✔ | ✔ | 2.5% | 12.5% |

| France | ✔ | ✔ | 10% | 25.83% | |

| Hungary | ✔ | ✔ | 4.5% | 9% | |

| Ireland | ✔ | ✔ | ✔ | 6.25% | 12.5% |

| Lithuania | ✔ | ✔ | 5% | 15% | |

| Luxembourg | ✔ | ✔ | 4.99% | 24.94% | |

| Malta | ✔ | ✔ | 1.75% | 35% | |

| Netherlands | ✔ | ✔ | ✔ | 9% | 25.8% |

| Poland | ✔ | ✔ | 5% | 19% | |

| Portugal | ✔ | ✔ | 4.73% | 31.5% | |

| Serbia | ✔ | ✔ | ✔ | 3% | 15% |

| Slovakia | ✔ | ✔ | 10.5% | 21% | |

| Spain - federal (b) | ✔ | ✔ | 10% | 25% | |

| Spain - Basque Country | ✔ | ✔ | 7.2% | 24% | |

| Spain - Navarra | ✔ | ✔ | 8.4% | 28% | |

| Switzerland (c) | ✔ | Varies from canton to canton, up to a 90% exemption from corporate tax | Varies from canton to canton; 11.9% to 21.6% | ||

| Turkey (d) | ✔ | 10.0% | 20% | ||

| United Kingdom | ✔ | 10% | 25% | ||

(a) ”Other” refers to IP assets that are non-obvious, useful, and novel. These can only be applied to small and medium-size businesses.

(b) The Spanish regions “Basque Country” and “Navarra” have separate corporate tax and therefore separate IP regimes.

(c) In 2020, Switzerland introduced a patent box regime at the cantonal level, which provides a maximum tax base reduction of 90 percent on income from patents and similar rights developed in Switzerland. Cantons can opt for a lower reduction.

(d) Turkey has a second IP regime which allows for a full tax deduction (0 percent effective tax rate) of qualified IP income resulting from R&D activities that were undertaken in Turkish Technology Development Zones.

Sources: OECD, Dataset Intellectual Property Regimes; Bloomberg Tax, "Country Guide;" PwC, "Tax Summaries;" EY, "Worldwide R&D Incentives Reference Guide 2022;" and OECD, “Tax Database: Table II.1. Statutory corporate income tax rate,” https://stats.oecd.org/Index.aspx?DataSetCode=TABLE_II1.

In 2015, OECD countries agreed on a so-called Modified Nexus Approach for IP regimes as part of Action 5 of the OECD’s Base Erosion and Profit Shifting (BEPS) Action Plan. This Modified Nexus Approach limits the scope of qualifying IP assets and requires a geographic link among R&D expenditures, IP assets, and IP income. To be in line with this approach, previously noncompliant countries have either abolished or amended their patent box regimes in the last few years.

Many European countries offer additional R&D incentives, such as direct government support, R&D tax credits, or accelerated depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment.

on R&D assets. The effective tax rates on IP income can therefore be lower than the ones stated in the respective patent box regimes.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe