All Content

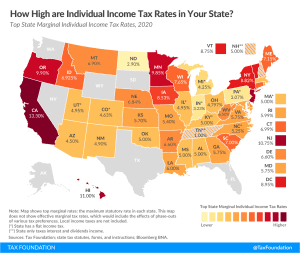

State Individual Income Tax Rates and Brackets, 2020

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

9 min read

How Controlled Foreign Corporation Rules Look Around the World: Spain

The CFC legislation in Spain is not as complicated as it is in some other countries, and it is aligned with the standards recommended by the OECD. The Spanish rules have evolved in a way that the rules are designed to comply with the EU principles not to interrupt the functioning of the Union and its single market.

4 min read

Profit Shifting: Evaluating the Evidence and Policies to Address It

The OECD has been working to assess the impact of their program of work, and it will be critical for this assessment to take into account impacts not only on revenues, but also on growth and investment.

7 min read

FAQ on Digital Services Taxes and the OECD’s BEPS Project

What is a digital services tax (DST)? What countries have announced, proposed, or implemented a DST? What are some of the criticisms of a DST? What are alternatives to a DST? What is the OECD BEPS project and what is its main objective? What is the main objective of OECD Pillar 1? What is the main objective of OECD Pillar 2?

8 min read

Navigating Alaska’s Fiscal Crisis

4 min read

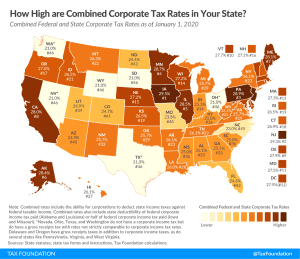

State Corporate Income Tax Rates and Brackets, 2020

Forty-four states currently levy a corporate income tax. Rates range from 2.5 percent in North Carolina to 12 percent in Iowa. Over the past year, several states, including Florida, Georgia, Indiana, Mississippi, Missouri, and New Jersey, implemented notable corporate income tax changes.

7 min read

Analysis of Sen. Warren and Sen. Sanders’ Wealth Tax Plans

New modeling finds that the wealth taxes proposed by Sen. Warren and Sen. Sanders would raise significantly less revenue than promised, face serious administrative and compliance challenges, and would increase foreign ownership of U.S. capital.

38 min read

The Davos Digital (Tax) Détente?

The past week has been nearly nonstop with news on various fronts of a dispute over taxation of digital businesses. The main characters have been the U.S., France, and the UK, although the EU and the OECD have also played roles. Though the dust is still settling, it is worth trying to tie the various events and arguments together.

7 min read

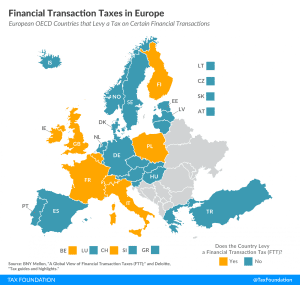

The Impact of a Financial Transaction Tax

Policymakers should exercise caution in deciding whether to enact an FTT given the uncertainty regarding the FTT’s ability to raise revenue and the significant damage it could cause to the U.S. financial system

39 min read

Financial Transaction Taxes in Europe

2 min read

Looking Back on Taxation of Capital Gains

When considering options to eliminate the deferral advantage of capital gains taxation, a lookback charge provides a reasonable solution for taxing hard-to-value assets. However, policymakers need to understand the limitations of a lookback charge compared to both mark-to-market taxation and the current system.

16 min read