All Content

Taxing Nicotine Products: A Primer

New nicotine products, along with a greater consciousness about the dangers of smoking, have prompted millions to give up smoking. This has contributed to federal and state excise tax collections on tobacco products declining since 2010. Our new report outlines the best way to tax nicotine products based on health outcomes and revenue stability.

49 min read

How Controlled Foreign Corporation Rules Look Around the World: France

In France, Controlled Foreign Corporation (CFC) rules were first enacted in 1980. The French tax regime operates on a strict territorial basis, where only profits generated in the country are subject to tax in France.

5 min read

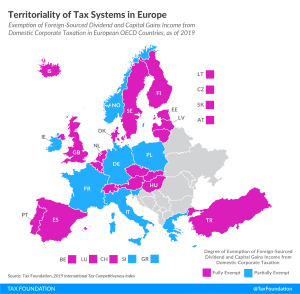

Territoriality of Tax Systems in Europe

3 min read

State and Local Sales Tax Rates, 2020

While many factors influence business location and investment decisions, sales taxes are something within lawmakers’ control that can have immediate impacts.

12 min read

How Controlled Foreign Corporation Rules Look Around the World: China

The Chinese approach to base erosion and profit shifting is more focused on the application of transfer pricing rules and not on the application of CFC rules. Even with the rules in place, the Chinese tax authorities have not enforced the rules as much as other countries have.

3 min read

Proposal to Increase New York Beer Tax

3 min read

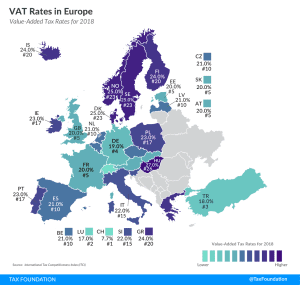

VAT Rates in Europe, 2020

4 min read

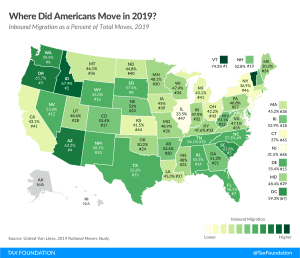

Where Did Americans Move in 2019?

2 min read

Reviewing the Tax Changes in Senator Bennet’s Real Deal

The “Real Deal” would increase the tax burden on saving, investing, and working in the United States, and reduce the global competitiveness of the U.S. economy.

3 min read

Economic and Budgetary Impact of Extending Full Expensing to Structures

Full expensing is one of the most powerful pro-growth policies in terms of revenue forgone. Given that structures comprise a large share of the private capital stock, improving their tax treatment would end a large bias against investment in the tax code.

14 min read