All Content

State Sales Taxes in the Post-Wayfair Era

Our new report explores the choices states have made regarding sales taxes following the South Dakota v. Wayfair Supreme Court online sales tax decision heading into calendar year 2020, outlines legal pitfalls states should seek to avoid, and offers up a few best practices for designing reliable, equitable, legally-sound remote sales tax regimes.

58 min read

Corporate Tax Rates around the World, 2019

Since 1980, corporate tax rates have consistently declined on a global basis. More countries have shifted to taxing corporations at rates lower than 30 percent, with the United States following this trend with its tax changes at the end of 2017.

15 min read

Kansas Tax Modernization: A Framework for Stable, Fair, Pro-Growth Reform

Our new report outlines various policy recommendations for Kansas to consider in order to begin a robust and bipartisan conversation about modernizing the state’s tax code to suit a 21st century economy.

15 min read

Comparing Wealth Taxation and Income Taxes

A low wealth tax rate is equivalent to a high-rate income tax. The interaction between wealth taxes and the existing income taxes must be considered when analyzing a wealth tax plan.

6 min read

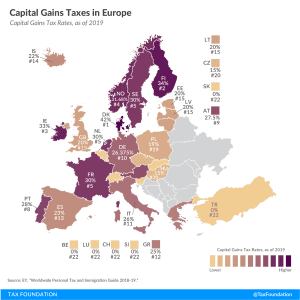

Capital Gains Taxes in Europe, 2019

2 min read

Comparing Capital Gains Tax Proposals by 2020 Presidential Candidates

Biden, Sanders, and Warren have staked out similar plans to increase capital gains taxes on the wealthiest Americans. While all three candidates have called for taxing capital gains at ordinary income rates, the phase-in levels and top marginal tax rates vary.

5 min read

Tax Foundation Response to OECD Public Consultation Document: Global Anti-Base Erosion Proposal (“GloBE”) (Pillar Two)

The tax base for the income-inclusion rule will be just as important as determining the rate, and both the base and the rate will likely impact business decisions. Additionally, policymakers need to determine how the choice for blending fits with the overarching goal of the policy. And as the example of GILTI shows, it is essential to assess how current international tax regulations would interact with a global minimum tax.

Understanding Why Full Expensing Matters

Understanding the channel through which a tax policy change is expected to affect the economy is crucial. Absent this understanding, we are likely to reach the wrong conclusions on what sound tax policy looks like and what changes would improve the tax code.

4 min read